2022 Can I Deduct Small Business Expenses

2022 Can I Deduct Small Business Expenses

While you can still deduct a portion of your meals entertainment expenses such as tickets to a sporting event are no longer considered a deductible business expense. Ways your small business can. The eligible assets must be first held and first used or installed ready for use for a taxable purpose between 730pm AEDT on 6 October 2020 and 30 June 2022. Previously fully deductible now a company can only deduct interest expenses up to 30 of its Adjusted Taxable Income ATI.

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

On your 2022 income tax return you could then deduct the balance of 200 for the part of the prepaid lease that applies to 2022.

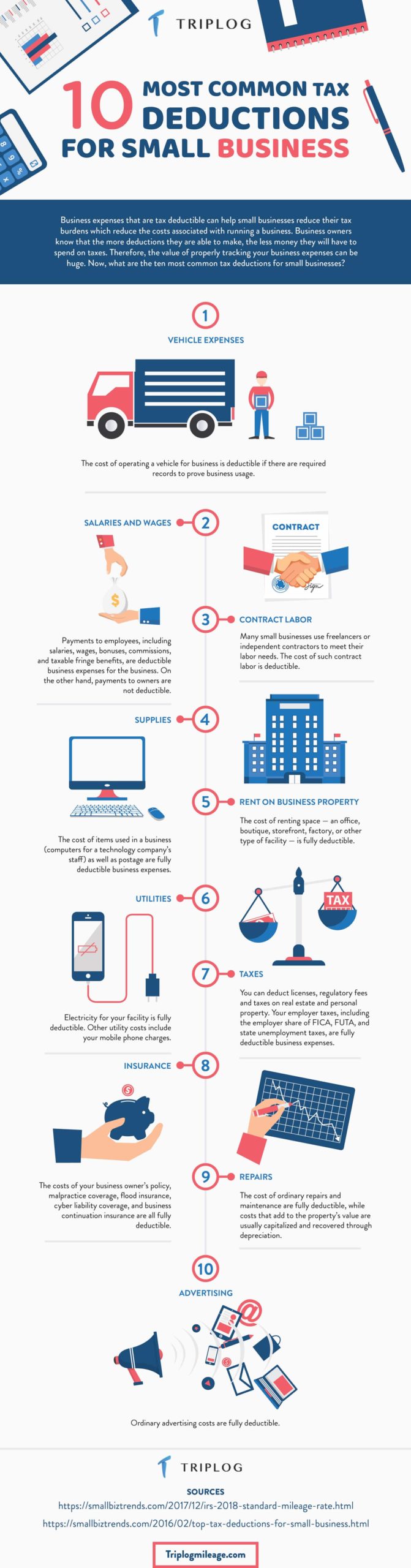

2022 Can I Deduct Small Business Expenses. In order to use this deduction the business must value inventory at the beginning as well as at the end of each tax year to determine the cost of goods sold. Small businesses can elect to expense assets that cost less than 2500 per item in the year they are purchased. There are several expenses you can write off if youre paying taxes on your small business.

Under temporary full expensing you can immediately deduct the business portion of the cost of eligible new or second-hand depreciating assets. Small business owners can deduct the cost of equipment used in the operation of the business. The Section 179 deduction allows business owners to deduct up to 1040000 of property placed in service during the tax year.

Many are now able to write off most depreciable assets in the year they are placed into service. At that time a company will only be able to deduct interest expenses up to 30 of earnings before interest and taxes but after depreciation and amortization expenses. If a small business manufactures or purchases and stores products for resale ie inventory the cost may be deductible.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

What Are Business Expenses Deductible Non Deductible Costs

What Are The Largest Tax Expenditures Tax Policy Center

10 Most Important Tax Deductions For Small Business Icraftopia

2021 2022 Home Office Tax Deductions Cpa Practice Advisor

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Top 10 Tax Deductions And Expenses For Small Businesses To Claim Wave Year End Wave Blog

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GigEconomy-6b18081cdaa34796a0f187801e945ea4.jpeg)

10 Common Small Business Tax Deductions

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

Deducting Home Office Expenses Journal Of Accountancy

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Deduct Meals And Entertainment In 2021 Bench Accounting

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Post a Comment for "2022 Can I Deduct Small Business Expenses"