Small Business Write Off 2022

Small Business Write Off 2022

Find out how the program works and how you could benefit. So if your adjusted gross income is between 23000 and 25000 you can get a write-off of 30. Consult with your tax advisor or CPA before claiming a deduction on your tax return. Consider this a checklist of small business tax write-offs.

Tax Write Offs 2022 Small Business Tax Deductions

Finally theres a dollar limit to this write-off as well Its 3000 for the care of one person and 6000 for two or more individuals.

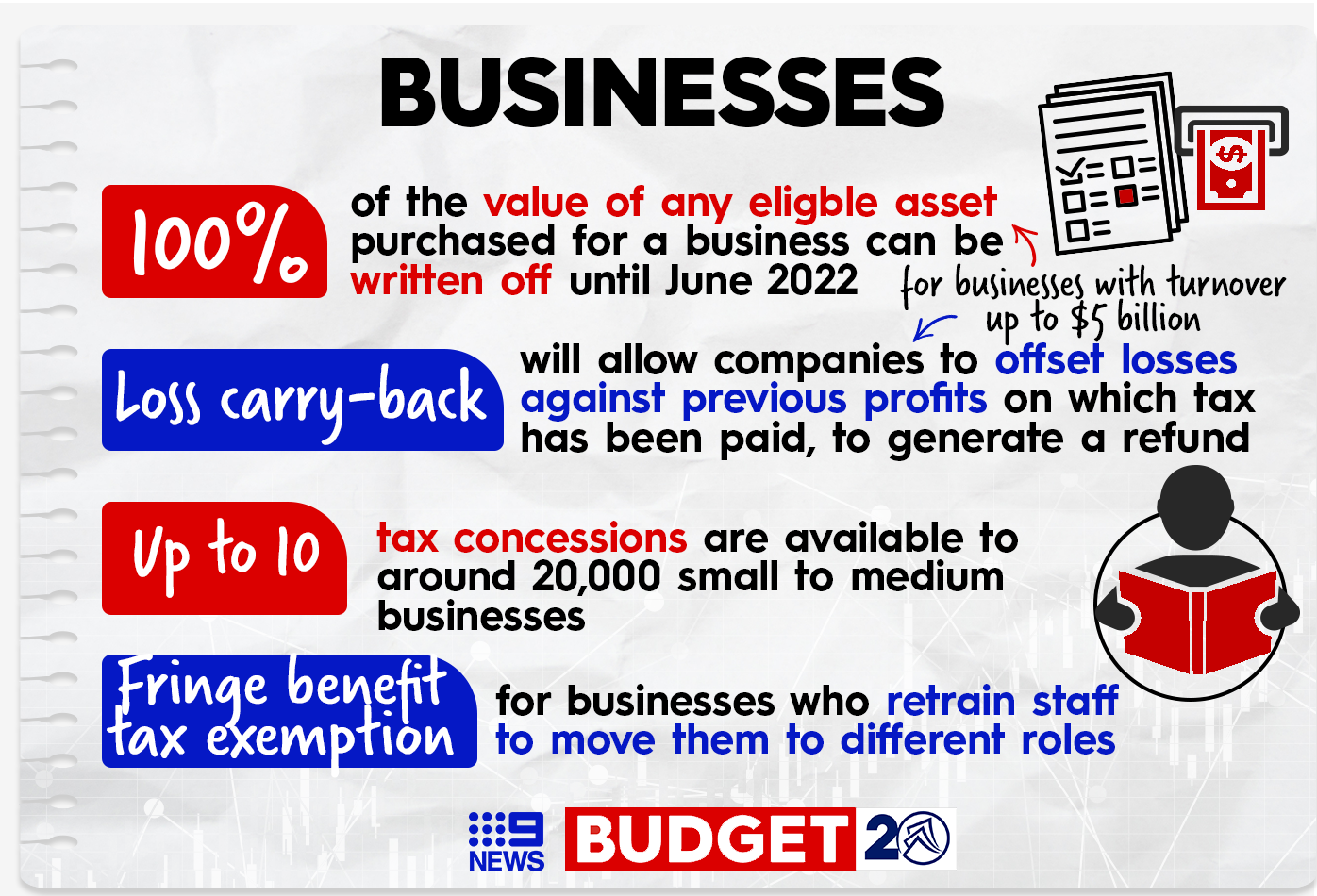

Small Business Write Off 2022. Here are estimated small business tax deadlines for 2022. Thus the Federal Government has directed the IRS to allow for a 100 dining write-off for business owners when ordering food from restaurants for tax years 2021 and 2022. Deductions can lower your tax bill considerably.

Instant asset write-off limit to be lifted. 2022 Tax Deadlines for Small Businesses. And remember some of the deductions in this list may not be available to your small business.

COVID-19 has transformed business dynamics which we all have to adapt to survive. From 730pm AEST 12 May 2015 to 30 June 2022 the lock out rules are suspended to allow small businesses that choose to stop using the simplified depreciation rules to take advantage of temporary full expensing and the instant asset write-off. But if your adjusted gross income is 43000 or more the credit is limited to 20.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

The Master List Of Small Business Tax Write Offs For 2022

The Master List Of Small Business Tax Write Offs For 2022

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

Ato Depreciation Atotaxrates Info

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Hiring Credits Complete Asset Write Offs For Businesses Australian News Breaking News Today

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Putin Supported The Idea Of Extending The Moratorium On Small Business Inspections In 2022 Time News Time News

2020 Budget Will Help Lift Small Businesses Out Of Covid Crisis Says Ombudsman Image Magazine

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

Instant Asset Write Off Increased Southern Accounting Services

Businesses To Write Off Full Value Of Assets Purchased Before June 2022

How To Deduct Meals And Entertainment In 2021 Bench Accounting

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

The Tax Rules For Deducting The Computer Software Costs Of Your Business Sensiba San Filippo

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Post a Comment for "Small Business Write Off 2022"