2022 Business Expense Per Mile To Drive

2022 Business Expense Per Mile To Drive

First 10000 business miles in the tax year. Automatic estimates are provided for local gas prices and vehicle fuel efficiency in miles per gallon mpg or liters per 100 kilometers L100 km based on the. 59 per kilometre for the first 5000 kilometres driven. You can enter airports cities states countries or zip codes to compute the cost of driving between locations.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

You just need to multiply the miles you travelled by the specific mileage rate for your vehicle.

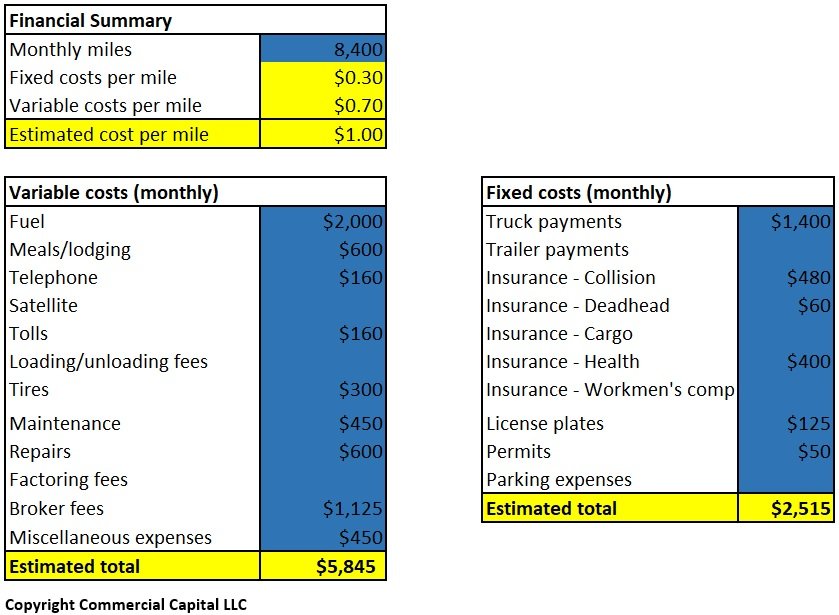

2022 Business Expense Per Mile To Drive. For prior-year rates see Automobile allowance rates. You can calculate the actual costs of using your vehicle for business or either opt to claim a standard mileage deduction. The final 069 per mile cost for 130000 miles represents a vehicle cost of 89000 and a Driver Income of 38422.

Now that might not sound like a lot to some people but it sums up very quickly when you consider how much someone who commutes like me drives. 16 cents per mile for medical or moving expenses this is a decrease of 1 cent from 2020 14 cents per mile driven in service of charitable organizationsthis rate is set by law and hasnt changed from previous years. By increasing the number of loaded miles per day your drivers.

Heres how to calculate the amount of mileage that can be claimed as. Keeping Your Car in Shape. Driving distances are calculated using actual driving directions if they are available or a GPS-accurate method for the straight line distance.

/GettyImages-556453499-57a9e7013df78cf4592e6f58.jpg)

Irs Standard Mileage Rate Including 2020

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

What Is Total Cost Per Mile For Truckload Carriers Freightwaves

Medical Cost Trend Behind The Numbers 2022 Pwc

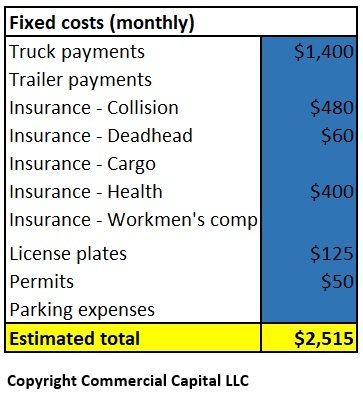

Calculate Your Cost Per Mile Truckers Owner Operators

Irs Mileage Rate 2022 Irs Taxuni

2021 Standard Irs Mileage Rates For Automobile Operation

The Cost Of A Mile Micromobility Industries

Corporate Tax Rates Around The World Tax Foundation

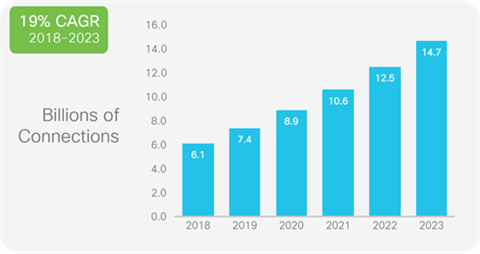

Cisco Annual Internet Report Cisco Annual Internet Report 2018 2023 White Paper Cisco

Calculate Your Cost Per Mile Truckers Owner Operators

The Cents Per Mile Rate For Business Miles Decreases Again For 2021 Mlr

Hero Gogoro Product Launch Taiwan S Gogoro Hero Motocorp Likely To Launch Ev Product In India In Q4 2022 Auto News Et Auto

Corporate Tax Rates Around The World Tax Foundation

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

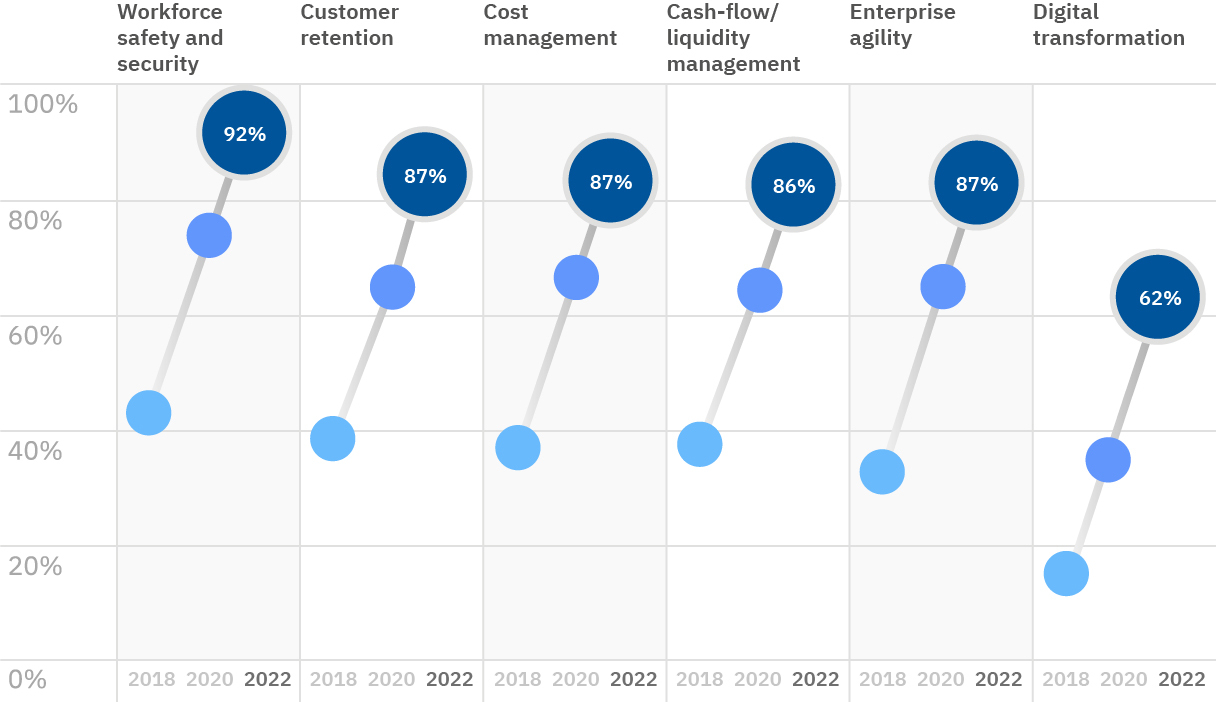

Covid 19 And The Future Of Business Ibm

Biden Corporate Tax Increase Details Analysis Tax Foundation

Coronavirus Business Impact Evolving Perspective Mckinsey

Post a Comment for "2022 Business Expense Per Mile To Drive"