Heloc Tax Deduction 2022 And Using The Proceeds For Business

Heloc Tax Deduction 2022 And Using The Proceeds For Business

Returns and Forms Applicable to Individual having Income from Business Profession for AY 2021-2022. Deductions include deduction Against Salaries Against income from house properties Against profits and gains of business or profession Against capital gains and Against income from. Home equity loan. Learn about the benefits and risks along with alternatives.

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

Using a HELOC for business can get you funds at a lower interest rate than other options.

:max_bytes(150000):strip_icc()/GettyImages-1148171551-a60119b7ac2c4653b12c48b4e40b2b81.jpg)

Heloc Tax Deduction 2022 And Using The Proceeds For Business. 12550 for single or married filing separately. You can treat a home under construction as a qualified home for a period of up to 24 months but only if it becomes your qualified home at the time it is ready for occupancy. Small business owners can sometimes use a HELOC to finance commercial needs and create some tax benefits.

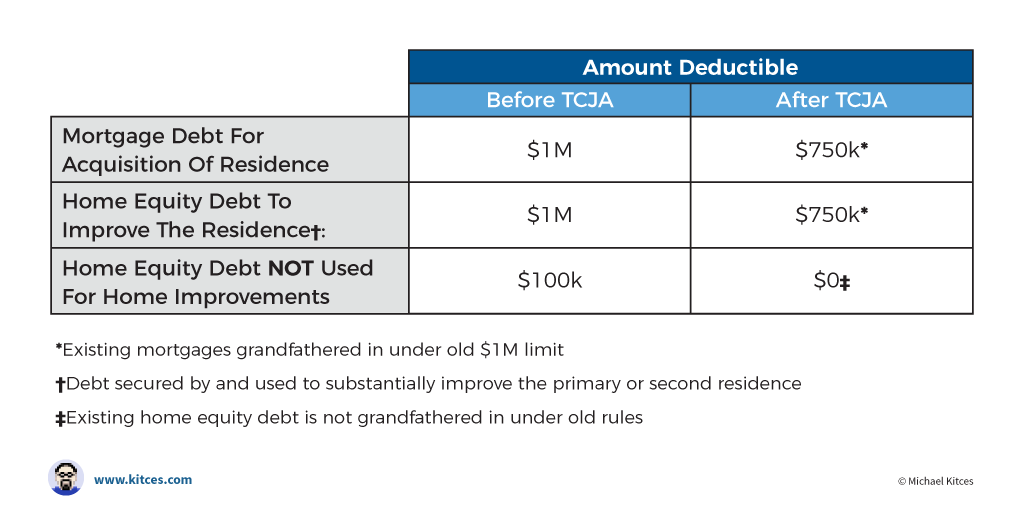

For example should a homeowner have a home office that qualifies. Please enter a minimum of three characters. Despite new provisions in the Tax Cut and Jobs Act the IRS in a 2018 advisory memo stated that home equity loan interest may still be deductible along with interest on HELOCs and second mortgages.

A home equity line of credit or HELOC is a line of credit secured by your clients residence. Business purposes you may be eligible for this. The TCJA roughly doubled the available standard deduction for each filing status and as a result fewer taxpayers now benefit from itemizing.

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

How The Mortgage Interest Tax Deduction Works

Should You Finance Your Business With Your Home S Equity Nav

:max_bytes(150000):strip_icc()/shutterstock_557631214.home.equity.heloc.cropped-5bfc30ff46e0fb00511aac29.jpg)

Is Interest On A Home Equity Line Of Credit Heloc Tax Deductible

:max_bytes(150000):strip_icc()/GettyImages-1148171551-a60119b7ac2c4653b12c48b4e40b2b81.jpg)

Is Interest On A Home Equity Line Of Credit Heloc Tax Deductible

Home Loan Tax Deduction Benefits 2021 22 All You Need To Know Finmedium

Use Your Heloc Wisely In 2020 Herlife Magazine

Tax Deductions For Home Mortgage Interest Under Tcja

What Suspension Of Heloc Tax Deduction Means For Banks American Banker

Are Home Equity Loans Tax Deductible Millionacres

Can I Still Get A Tax Deduction For My Heloc M0rtgage

What Suspension Of Heloc Tax Deduction Means For Banks American Banker

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

Can You Still Deduct Your Home Equity Line Of Credit

Home Loan Tax Deduction Benefits 2021 22 All You Need To Know Finmedium

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat The New York Times

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

How The Mortgage Interest Tax Deduction Works

Complete Guide Home Equity Loans And Tax Deductions Bankrate

Can I Deduct Heloc Interest On My Income Taxes Bank Of Hawaii

Post a Comment for "Heloc Tax Deduction 2022 And Using The Proceeds For Business"