Irs Extension For Business 2022

Irs Extension For Business 2022

2022 Tax Returns are due on April 15 2023. Connecticut budget-implementing legislation enacted on June 23 extends the 10 corporation business tax surcharge through 2022 delays the phase-out of the capital base tax by four years increases the research and development tax credit allowance to over two years but limits the carryforward of nonincremental research and development tax credits to 15 years and provides a tax. A business of all tax classifications can request an extension to get more time to file returns. This page is being updated for Tax Year 2022.

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

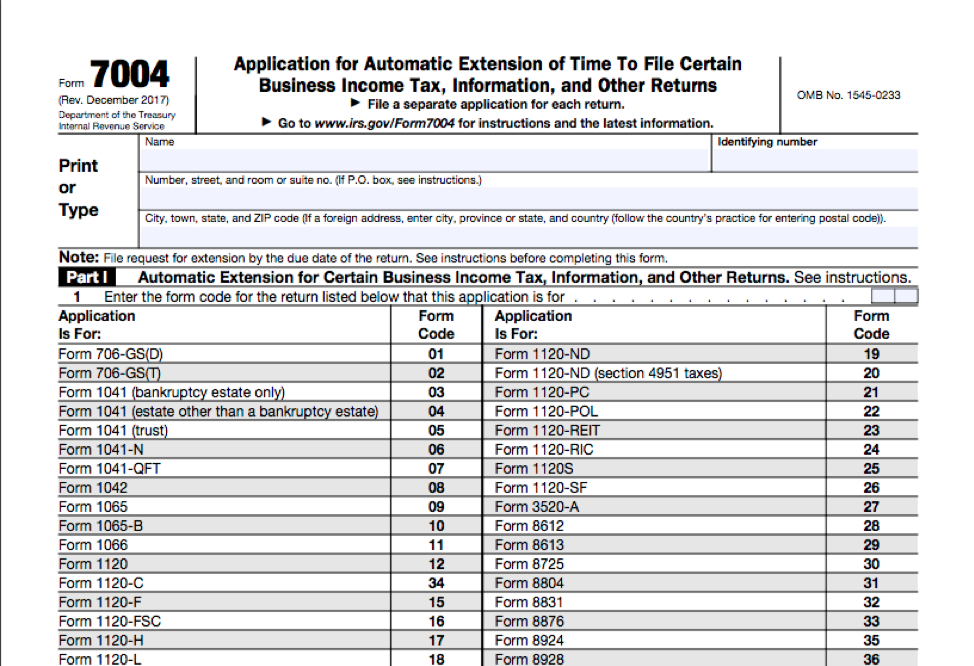

Business Tax Extension 7004 Form 2021.

Irs Extension For Business 2022. In this article well provide you with the instructions to file Form 7004 for the 2020 2021 taxes so you can get more time to prepare to file the return for your business. For corporate taxpayers and individual taxpayers liable to tax audit the due to date of filing return for AY 2021-22 has been extended to February 15 2022 instead of November 30. The IRS has also provided relief to Ida victims in Louisiana Mississippi New Jersey and New York.

Use the 2022 Tax Calculator. Given the number of government payments to reconcile in 2021 returns like the expanded CTC and third stimulus checks EIP I expect there to a keen interest in the upcoming tax seasonEspecially for those expecting a large refund see expected tax refund. Hotel operators in Malaysia propose extension of SST exemption until Dec 2022 Monday 18 Oct 2021 0947 PM MYT KUALA LUMPUR Oct 18 The Malaysia Budget and Business Hotel Association MyBHA has proposed that the government extend the sales and service tax SST exemption period until December next year in the Budget 2022 scheduled to be tabled on.

Oct 13 2021 originally due on may 17 filers have until october 15 2021 to submit their extended 2020 tax year. If you are an individual freelancer sole proprietor or business owner operating under another entity type in New York and New Jersey you may have until January 3 2022 to file individual and business tax returns. Business Tax Extension Deadline 2021 Aicpa Irs Extends Income Tax Day To May 17 But Small Businesses Still Could Be Held To April 15 Repairer Driven Newsrepairer Driven News.

/ScreenShot2021-02-11at4.25.46PM-efc1304fa898450db5381a052fb0fcfe.png)

Form 4868 Application For Extension Definition

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Prepping For Tax Season 2022 Accounting Today

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Irs Extension 2022 Form 4868 Irs Forms Taxuni

2021 Federal Tax Deadlines For Your Small Business

When Are Taxes Due 2021 Filing Extension Deadlines Bench Accounting

Fiducial 2021 Small Business Tax Calendar

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

When Is The Earliest You Can File Your Tax Return

2021 Tax Calendar For Small Business Owners Non Profits And Individuals Applied Financial Services Inc

How To File For A Business Tax Extension Federal Bench Accounting

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Us Tax Deadlines For Expats Businesses 2021 Updated Online Taxman

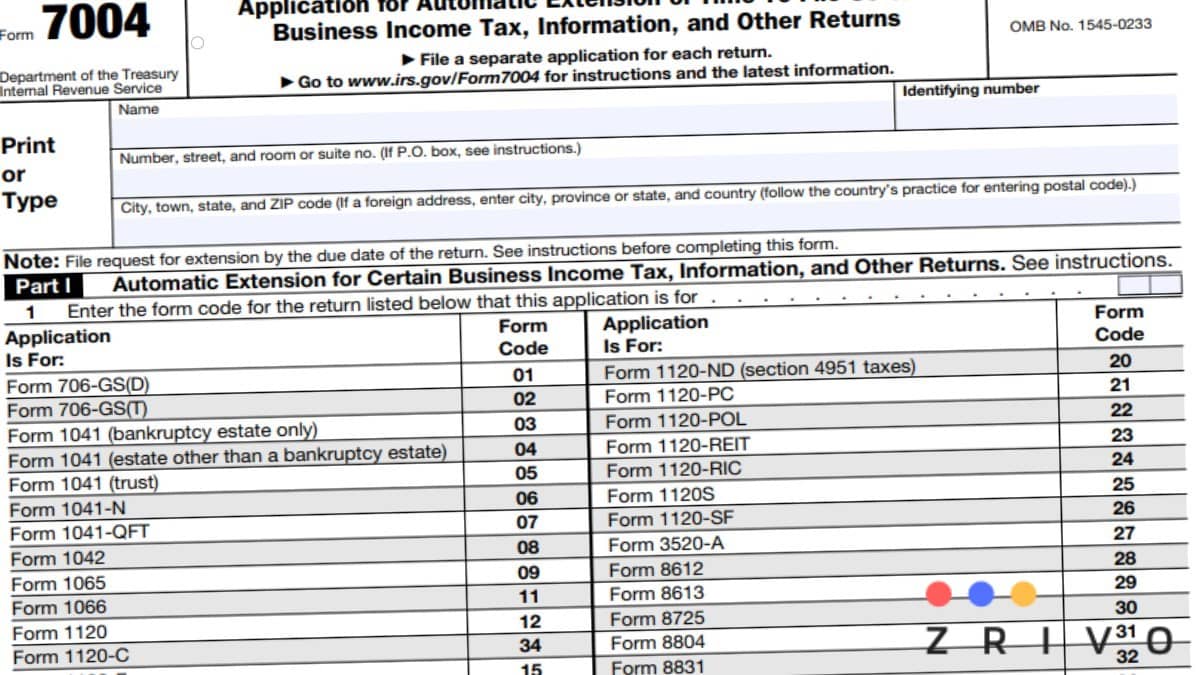

7004 Form 2021 Irs Forms Zrivo

:max_bytes(150000):strip_icc()/Screenshot64-177a60f2f4d6482eb80dfbc1be971169.png)

Post a Comment for "Irs Extension For Business 2022"