Business Charitable Deductions 2022

Business Charitable Deductions 2022

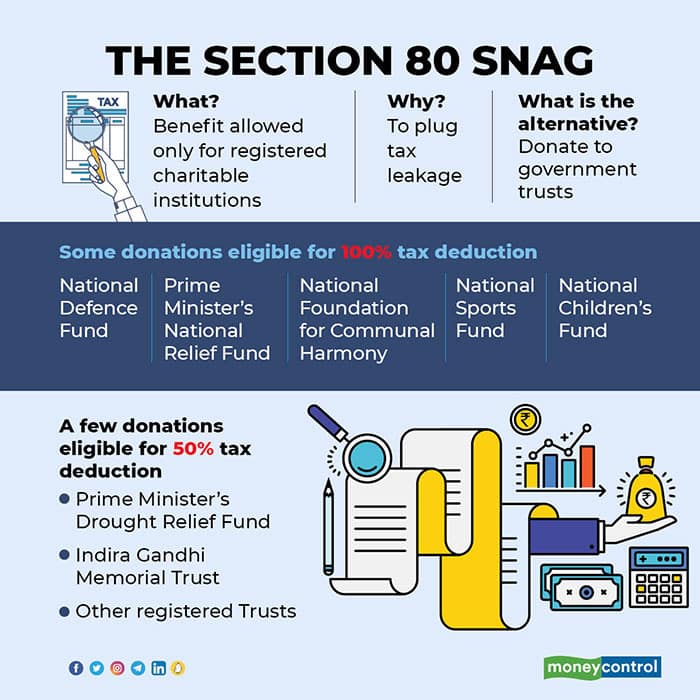

And limited other itemized deductions reducing the share of taxpayers with a charitable contributions deduction from an estimated 21 to 9. Also the increased AGI limitation on the charitable income deduction from the CARES Act was extended for a year for corporations and taxpayers who itemize. As a means to stimulate charitable contributions during the COVID crisis Congress made two notable changes to the charitable contributions deduction for 2021 and 2020one allowing taxpayers that dont itemize their deductions an above-the-line deduction for cash contributions of up to 300 and another for those itemizing their deductions to increase the maximum deduction for cash. Donations to certain approved funds trusts charitable institutionsdonations for renovation or repairs of notified temples etc.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

The limits for 2021 is 25 percent of taxable income for corporations and there is an optional election that can be made for cash gifts to public charities from individuals to allow them to deduct up to 100 of their AGI.

Business Charitable Deductions 2022. Limit may be carried over for up to five tax years. As there is no definite answer to whether or not you should itemize deductions in 2022 you need to see it for yourself. In addition the annual deduction limit.

Food and beverages will be 100 deductible if purchased from a restaurant in 2021 and 2022. In previous years you could only claim deductions in a given year for charitable gifts worth up to 50 of your adjusted gross income AGI. The limitation on qualifying disaster relief charitable contributions is suspended through 2021.

100 per cent of qualifying donations to National Defence Fund Prime Ministers National Relief Fund Prime Ministers Citizen Assistance and Relief in Emergency Situations Fund PM CARES FUND Prime Ministers. 274n1 generally limits the deduction for business-related food or beverages expenses to 50 percent of the amount otherwise deductible. The extension of various energy-related tax credits.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

New Tax Regime Complete List Of Exemptions And Deductions Disallowed Basunivesh

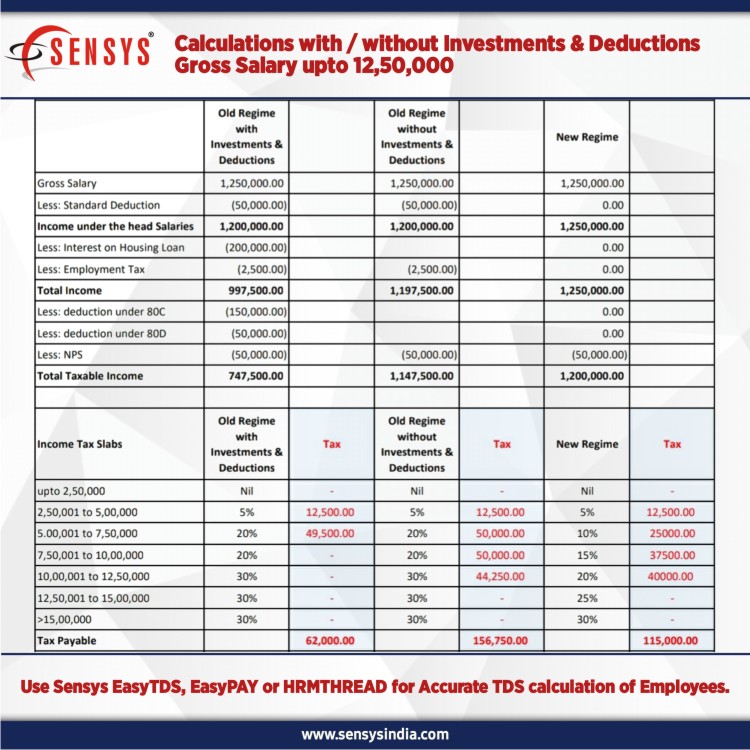

Income Tax Slabs Fy 2020 2021 Ay 2021 2022 Sensys Blog

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

The Messy Income Tax Portal Has Made Giving Donations Tougher This Year But There Is A Way Out

Income Tax Slabs Fy 2020 2021 Ay 2021 2022 Sensys Blog

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Budget 2021 New Income Tax Slabs For 2022

Tax Slabs For Domestic Company For Ay 2021 22

Section 16 Ia Standard Deduction For Ay 2022 23 New Tax Route

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Businesses Can Temporarily Deduct 100 Of Meals Beginning Jan 1 2021 Dec 31 2022 Afsg Consulting

Income Tax Slabs For The Ay 2021 2022 Fy 2020 2021 Ca Firms In Delhi Casanchar

Why To Avoid 100 Of Agi Qualified Charitable Contributions

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Post a Comment for "Business Charitable Deductions 2022"