Qualified Trade Or Business Definition Irs 2022

Qualified Trade Or Business Definition Irs 2022

Property used in a trade or business with FPFI is not qualified property under Sec. A QBU is any separate and clearly identified unit of a trade or business of a taxpayer provided that separate books and records are maintained. A qualified trade or business is any trade or business that is not a specified service trade or business or the trade or business of performing services as an employee Sec. The significance of this issue will increase as tax practitioners attempt to apply new Secs.

Specified Service Trade Or Business Sstb Definitions Wcg Cpas

Generally this includes but is not limited to the deductible part of self-employment tax self-employed health insurance and.

Qualified Trade Or Business Definition Irs 2022. I used to finance the acquisition of motor vehicles held for sale or lease. B Definition of a qualified business unit - 1 In general. 3 Qualified trade or business For purposes of this subsection the term qualified trade or business means any trade or business other than A any trade or business involving the performance of services in the fields of health law engineering architecture accounting actuarial science performing arts consulting athletics financial services brokerage services or any.

NW IR-6526 Washington DC 20224. A QTB is further defined to include any trade or business except for a specified service trade or business SSTB. Except property used in connection with the production of income subject to the tax on unrelated trade or.

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. A Specified Service Trade or Business SSTB the trade or business of performing services as an employee. A qualified trade or business is any section 162 trade or business with three exceptions.

Defining A Trade Or Business For Purposes Of Sec 199a Journal Of Accountancy

Instructions For Form 8990 05 2020 Internal Revenue Service

Irs Releases Final Qualified Business Income Deduction Regs

Publication 54 2020 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Sec 199a Regulations Shed Light On Qbi Deduction Journal Of Accountancy

Instructions For Form 8990 05 2020 Internal Revenue Service

Mechanics Of The New Sec 199a Deduction For Qualified Business Income Journal Of Accountancy

Section 199a Flowchart Example Afsg Consulting

Irs Issues Final Proposed Guidance On Qualified Business Income Deduction Bkd Llp

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

The Section 179 And Section 168 K Expensing Allowances Current Law And Economic Effects Everycrsreport Com

Doing Business In The United States Federal Tax Issues Pwc

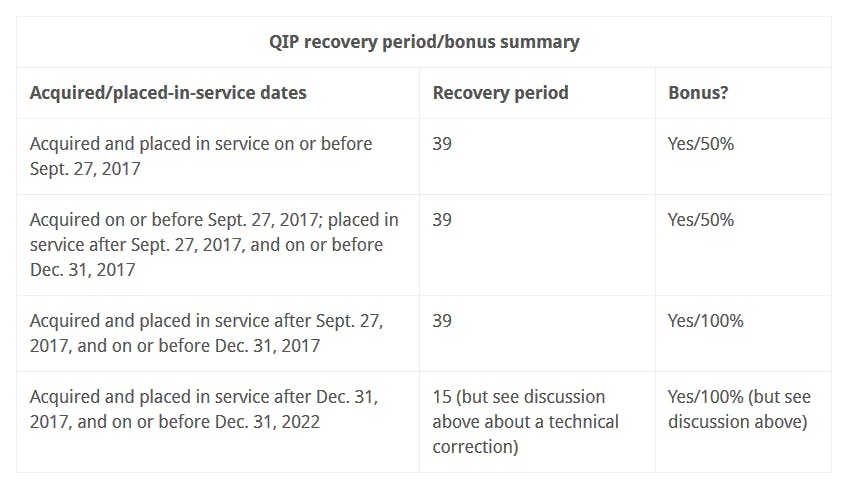

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Post a Comment for "Qualified Trade Or Business Definition Irs 2022"