In 2022 Are Employee Business Expenses Deductible

In 2022 Are Employee Business Expenses Deductible

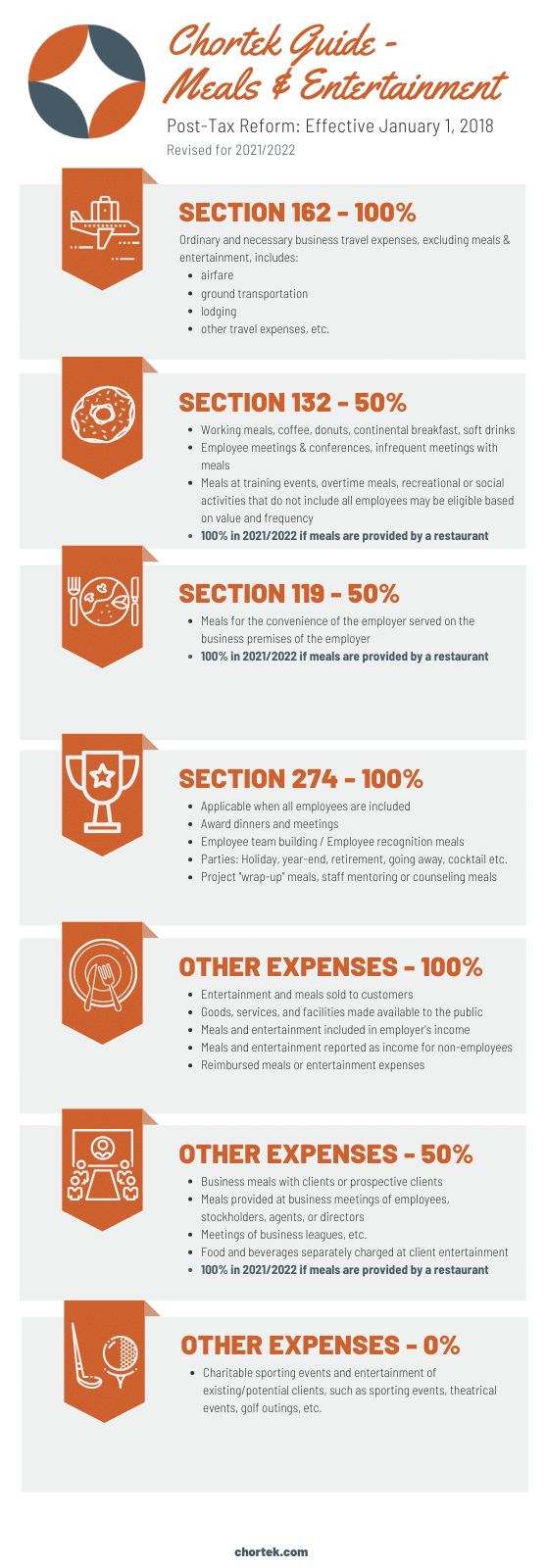

Deduct 100 Percent of Your Business Meals under New Rules 9 Deduct 100 Percent of Your Employee Recreation and Parties 15 Helicopter View of Meals and Entertainment 2021-2022 19. Meal expenses by an employee during a business trip and reimbursed to that employee are still only deductible at 50 percent even though the employee was reimbursed 100 percent for the cost of the meals. Meals during business travel 50 deductible 100 deductible in 202122. However if you are reimbursing an independent contractor it will be added to their 1099 income.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

100 Amount Deductible for Tax Years 2021-2022.

In 2022 Are Employee Business Expenses Deductible. These regs were written before the CAA change that allows 100 deductions for business-related restaurant meals provided in 2021 and 2022. In general if a company has an arrangement that meets the criteria for an accountable plan the ordinary and necessary food and beverage expenses of operating your business are deductible. 1- Restaurant meals with clients and prospects.

2022 Property Tax Bills. However the deduction is limited to 50 percent of the otherwise allowable expense. This relief enacted as part of the Consolidated Appropriations Act 2021 comes in the form of an increase in the deductibility of business meal expenses from 50 percent to 100 percent if purchased from a restaurant during calendar years 2021 and 2022.

Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. A meal with a client where work is discussed that isnt lavish Employee meals at a conference above and beyond the ticket price. Generally deductible business expenses are those wholly and exclusively incurred in the production of income.

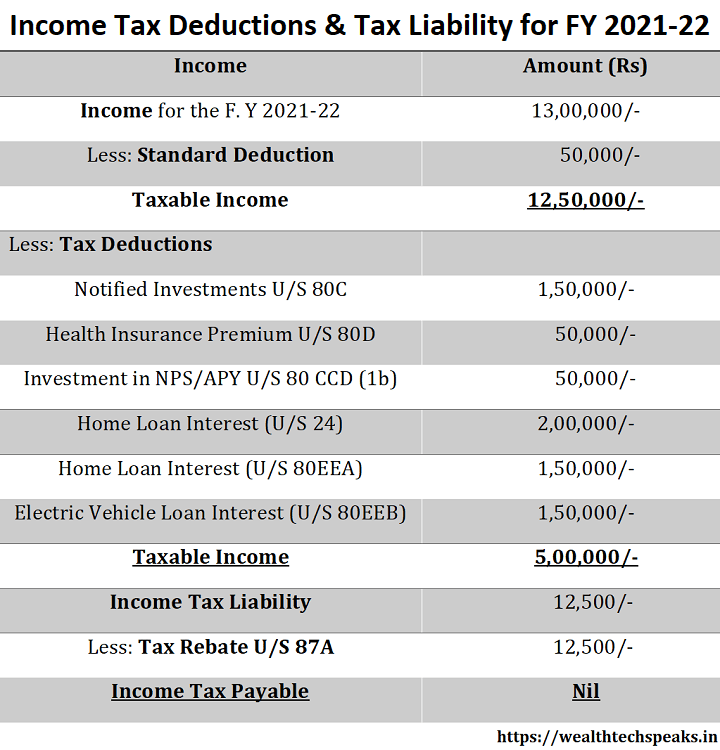

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Meals And Entertainment Deduction 2021 Updated Information Chortek

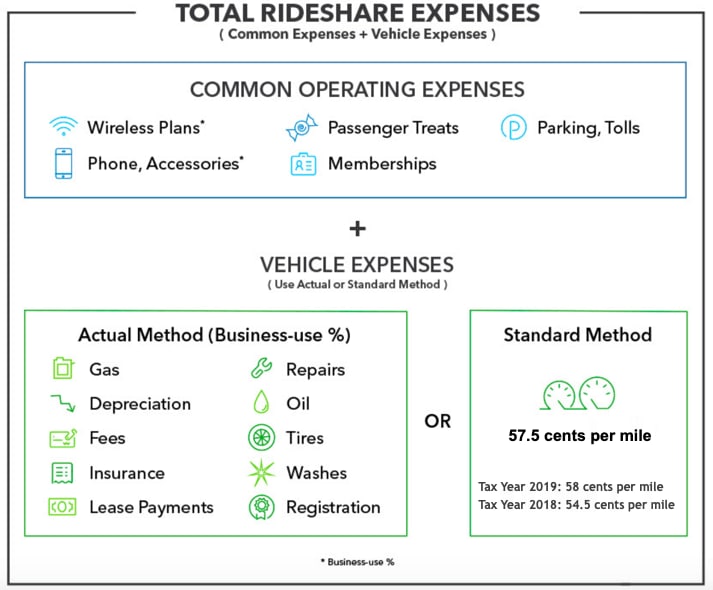

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Oregon Business Meals And Entertainment Expenses Under The Consolidated Appropriations Act

New Tax Deduction Business Meals Are 100 Deductible In 2021

What Are Business Expenses Deductible Non Deductible Costs

What Is Employee Expense Reimbursement And How Does It Work Justworks

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Tax Reform Impact On Insurance Companies

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Business Meals Mean Tax Break Now But Watch For Future Changes

Top 10 Tax Deductions And Expenses For Small Businesses To Claim Wave Year End Wave Blog

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

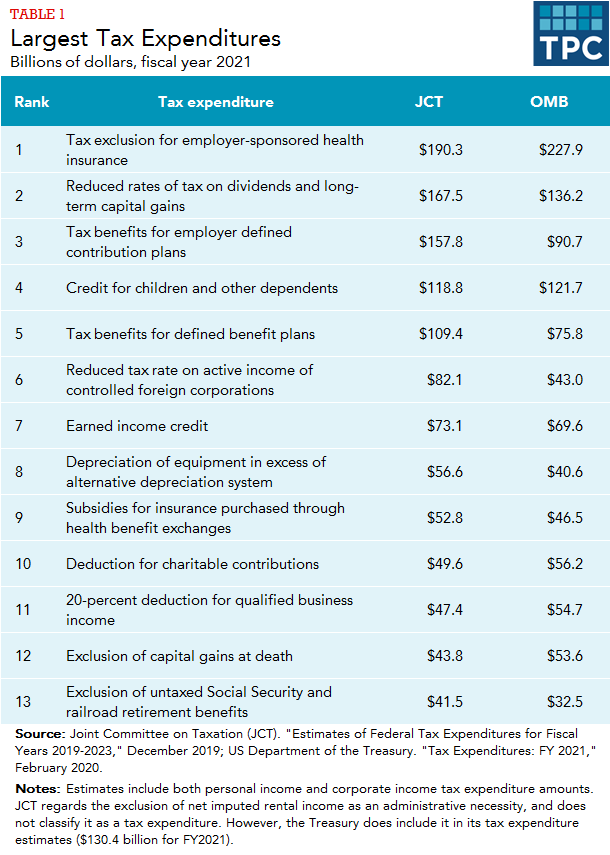

What Are The Largest Tax Expenditures Tax Policy Center

Publication 463 2020 Travel Gift And Car Expenses Internal Revenue Service

Post a Comment for "In 2022 Are Employee Business Expenses Deductible"