New Car Tax Deduction 2022 Business

New Car Tax Deduction 2022 Business

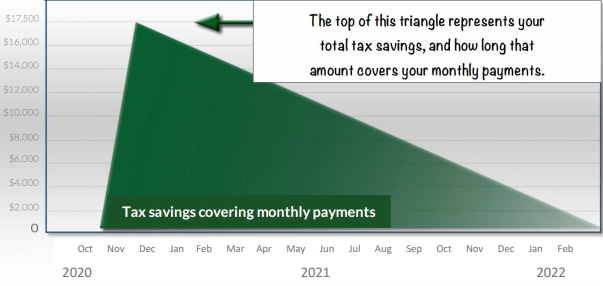

For example lets say you spent 20000 on a new car for your business in June 2021. Accelerated depreciation basically allows you to fast forward your expected losses faster which can be helpful to do during a year where you made a lot of income. You then multiply the total of your actual expenses by this percentage to arrive at your actual expenses deduction. For 202122 the maximum GST credit you can claim is 5521 that is 111 60733.

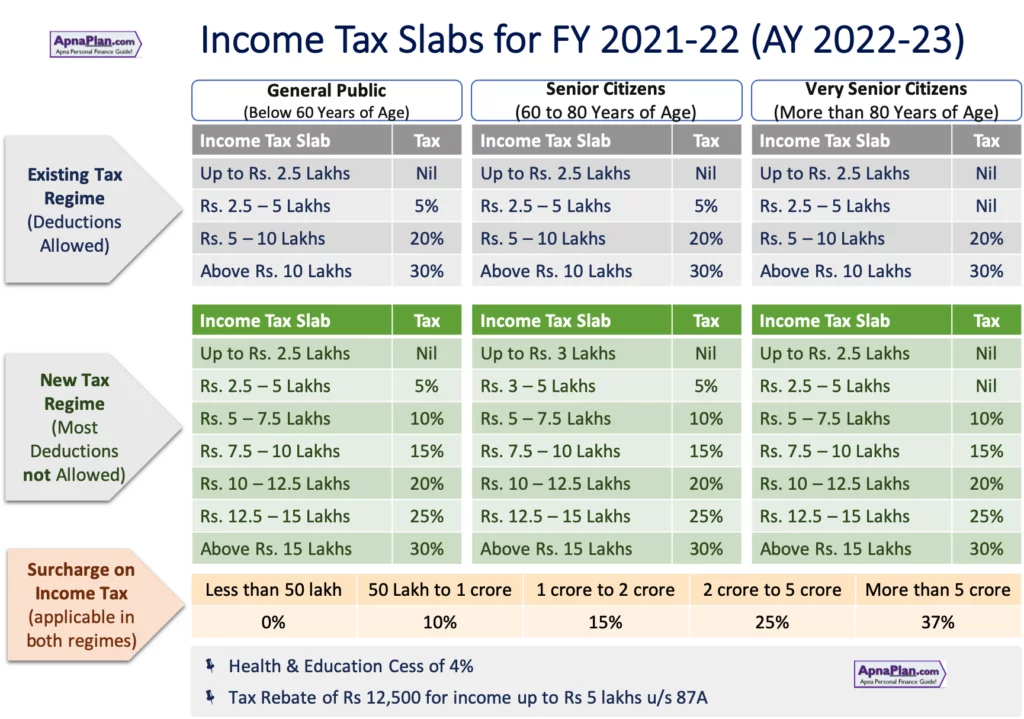

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

The list of vehicles that can get a Section 179 Tax Write-Off include.

New Car Tax Deduction 2022 Business. According to the IRS the maximum tax break that you will receive for placing a heavy vehicle in use will be 25000. You cant deduct more than the cost of the vehicle as a business expense. You need to continue to use 1 method for as long as you own the vehicle.

You can deduct vehicle expenses without itemizing deductions. If you were to claim the Section 179 deduction you could take a 15000 deduction 20000 075 on your 2021 tax return which youd file in early 2022. Your deduction would be 4750 9500 x 50 4750.

Write Off Car With Section 179 Vehicle Tax Deduction Now if youre trying to get a vehicle for free then you want to take advantage of accelerated depreciation through the tax code section 179. Capital expenditure incurred within 3 years before commencement of business is allowed as deduction in the year of commencement of business. You can keep a logbook to find out how much you usually use the vehicle for business.

2022 Income Taxes Deductions For Self Employed Business Vehicles Tax Practice Advisor

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

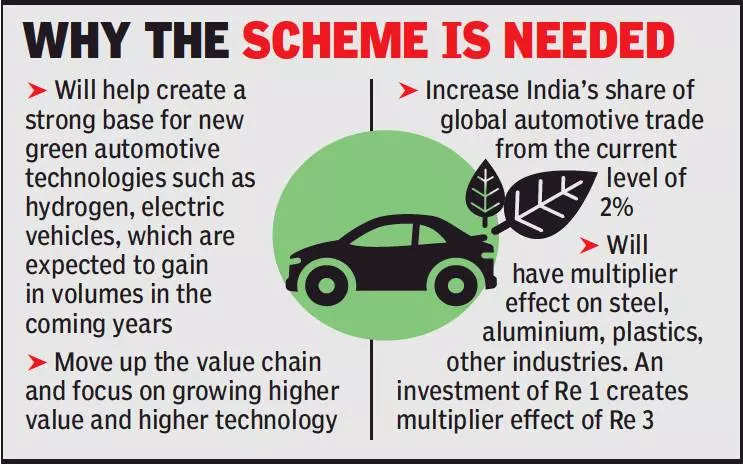

Govt To Limit Incentive Plan For Auto To Green Vehicles Times Of India

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

Section 80eeb Electric Vehicle Tax Deduction Indiafilings

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Vehicle Scrapping Policy Registration Fee Waiver For New Cars 25 Rebate On Road Tax Gadkari Unveils Vehicle Scrapping Policy The Economic Times

Scrappage Policy Centre To Ask States For Up To 25 Road Tax Rebate Under National Automobile Scrappage Policy Auto News Et Auto

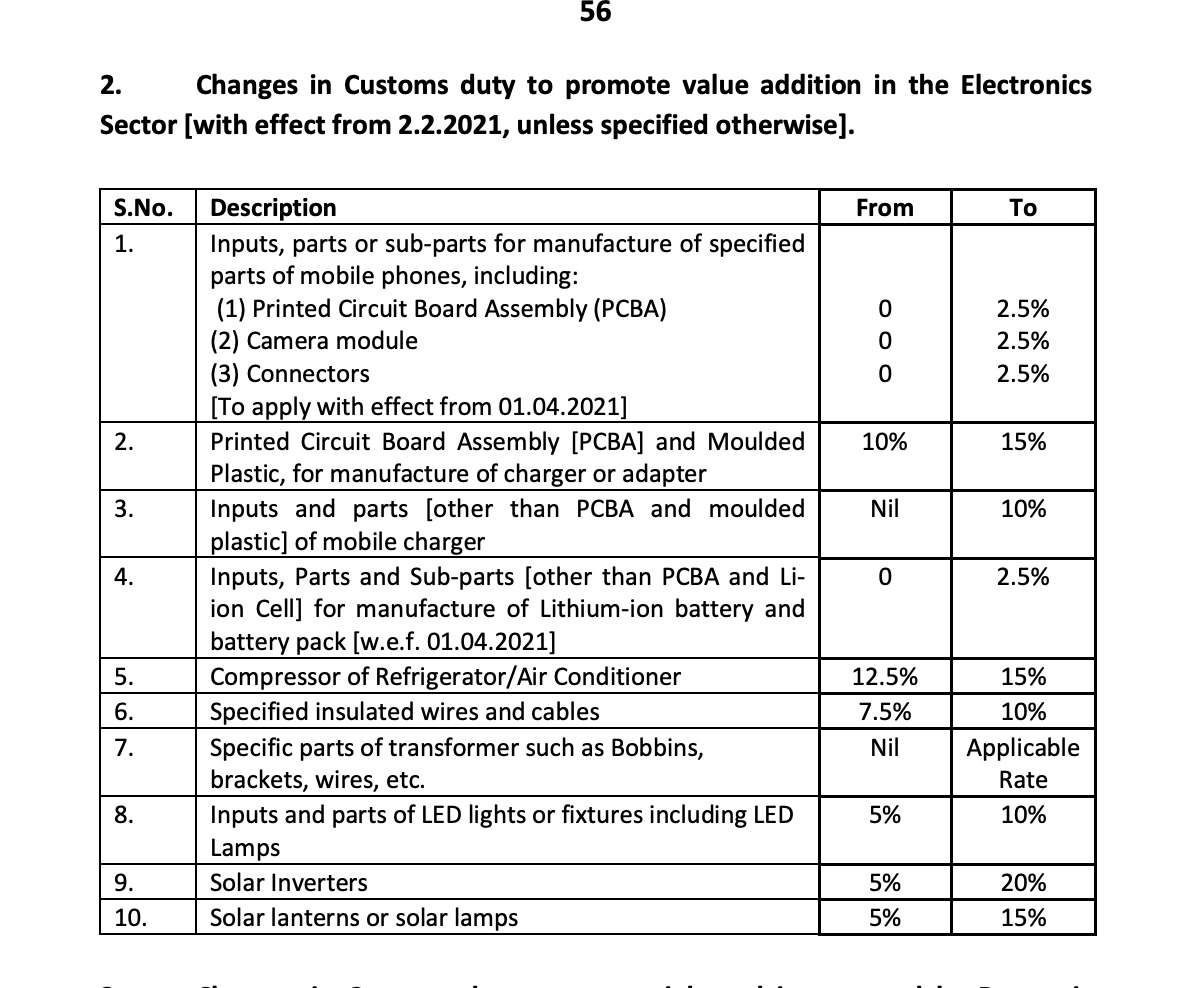

Budget For Auto Sector Auto In Budget 2021 Top 5 Hits And Misses Auto News Et Auto

Government Approves Green Tax Proposal And Scrappage Policy Effective April 2022 Overdrive

House Democrats Tax On Corporate Income Third Highest In Oecd

2018 Tax Guidelines Tri State Ford

Post a Comment for "New Car Tax Deduction 2022 Business"