2022 Ordinary And Necessary Business Expenses

2022 Ordinary And Necessary Business Expenses

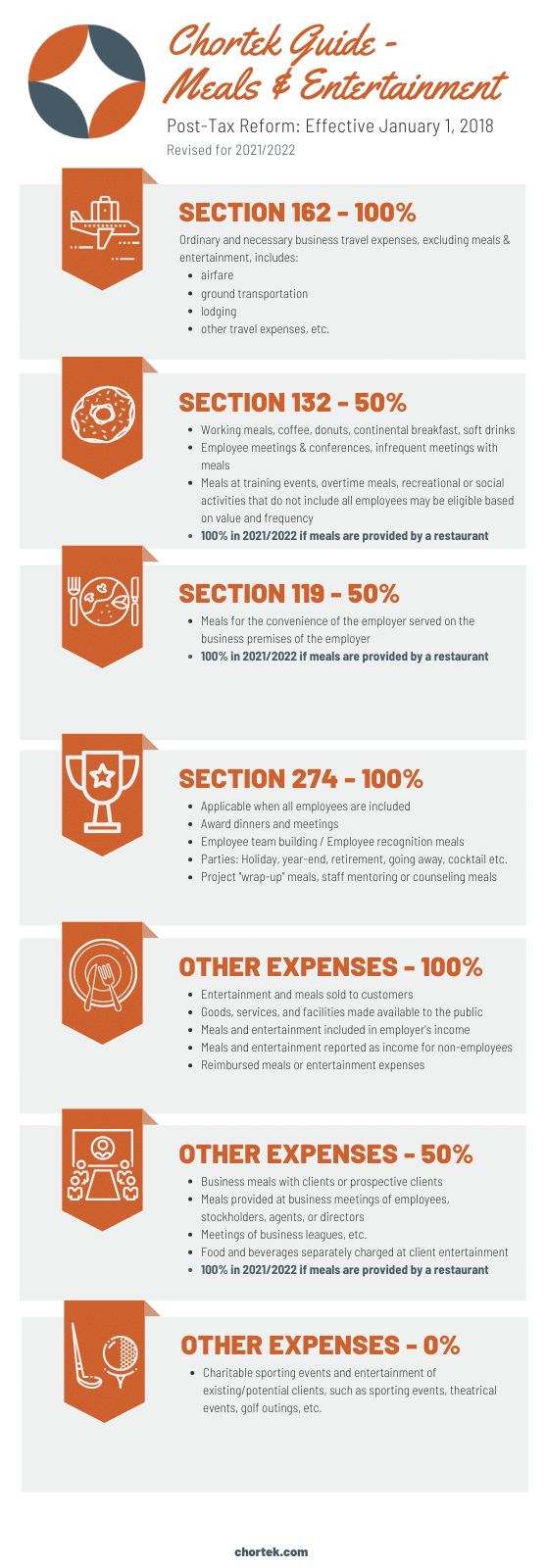

Increased Business Meal Deductions for 2021 and 2022. Special transportation industry meal and incidental expenses MIE rates increase. Section 162 100. Up to 5000 of otherwise deductible expenses that are incurred before your business commences can generally be deducted in the year business commences.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

Restaurant takeout and delivered meals are also fully deductible.

2022 Ordinary And Necessary Business Expenses. However it did retain a deduction for business meals when the expense is ordinary and necessary for carrying on the trade or business and is not lavish or extravagant. The food or beverages must be provided by a restaurant. The expense is an ordinary and necessary expense paid or incurred during the taxable year in carrying on any trade or business The expense is not lavish or extravagant under the circumstances The taxpayer or their employee is present at the furnishing of the food or beverages.

The IRS issued its annual update Friday of special per-diem rates for substantiating ordinary and necessary business expenses incurred while traveling away from home Notice 2021-52. Logan cannot deduct any of the costs associated with the horse ranch because the horse ranch would be classified as a hobby not a business Logan can deduct the full salary paid to Luke because Luke works in Logans horse ranch business Logan can deduct the full salary paid to Lucy because the amount of the expense is reasonable Logan can deduct the full salary paid to Lucy because grocery shopping is. Increased business meal deductions for 2021 and 2022 allowed under these circumstances.

Also the meal must have an ordinary and necessary business purpose which means that business is being discussed during the meal. It is important to separate business expenses from the following expenses. This annual notice provides the 2021- 2022 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home specifically 1 the special transportation industry meal and incidental expenses MIE rates 2 the rate for the incidental expenses only.

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Meals And Entertainment Deduction 2021 Updated Information Chortek

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

What Are Business Expenses Deductible Non Deductible Costs

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

What Are Ordinary And Necessary Business Expenses Potter Lamarca

Amazon In Buy Tax Year Diary 2021 2022 Record Income And Expense For Small Business And Self Employed In One Daily Monthly Log 2021 22 April To April 6 X 9 Inches Book

What Is Employee Expense Reimbursement And How Does It Work Justworks

What Is An Ordinary And Necessary Business Expense On Taxes

Amazon In Buy Tax Year Diary 2021 2022 For Small Businesses Tax Year Diary For Small Business Self Employed Business Diary And Balance Sheet In One April 2021 To April 2022 Book

Amazon In Buy Tax Year Diary 2021 2022 For Small Business Accounts Book Self Employed Record Income And Expense For Small Home Businesses 7 X 10 Inch Book Online At Low Prices In India Tax

Bach Yen Vu Cpa Llc Posts Facebook

.jpg)

Gate Exam 2022 Exam Dates Admit Card Subjects Scorecard Result Cutoff Counselling

Accounting What Are Ordinary Necessary Business Expenses

Business Meals Mean Tax Break Now But Watch For Future Changes

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Post a Comment for "2022 Ordinary And Necessary Business Expenses"