Form, Standard Deduction, 2022, Business, Mileage

Form, Standard Deduction, 2022, Business, Mileage

IRS Mileage Rates 2021. Figure out the standard mileage deduction using the rates. The agency usually releases the new mileage rates before the new year starts. 565 cents per mile for business miles driven down 5 cents from 2020 rates.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

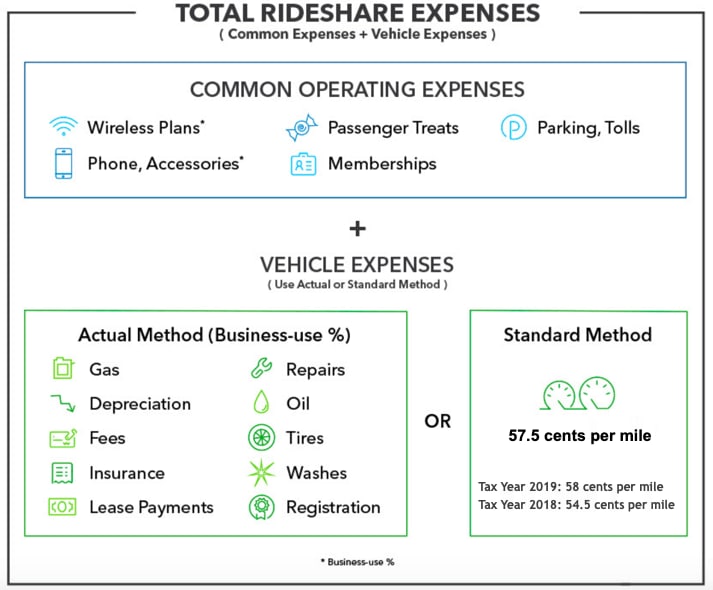

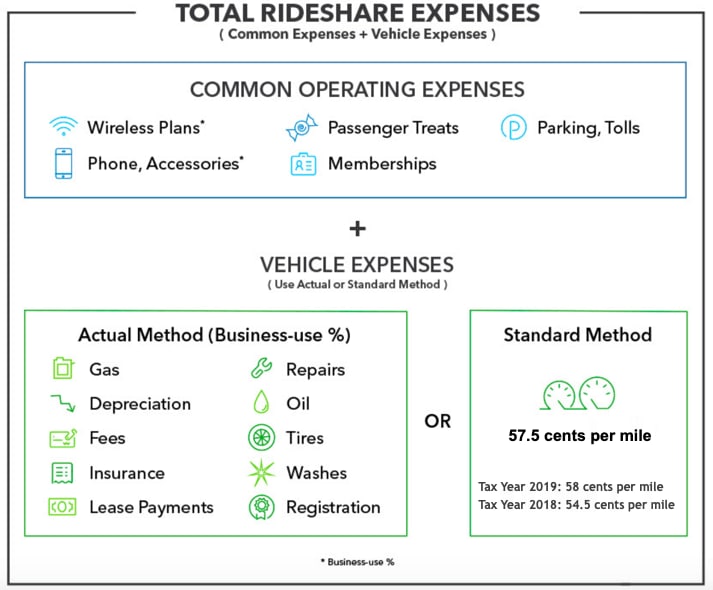

The most commonly claimed deductions are for gas fees repairs.

Form, Standard Deduction, 2022, Business, Mileage. IRS Business Mileage Rate is updated by the Internal Revenue Service. The tax forms for adjustments and deductions must be filed if you want to reduce taxable income. Form W9 Mailing Address 2022.

On the other hand there are qualifying expenses you can claim a deduction for. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The number of miles driven for business must be multiplied by the business mileage rate.

The Federal Mileage Reimbursement Rate 2022 may be specifically beneficial for small-scale businesses or self-employed people to compute their car costs and to deduct tax. The reason why it is published early on is so the employer can reimburse their employees. IRS Data Retrieval Tool for FAFSA.

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Deductions List Fy 2019 20 How To Save Tax For Ay 20 21

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

2021 Irs Mileage Rates For Business

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

How To Calculate Mileage Deductions On Your Tax Return

2021 Standard Irs Mileage Rates For Automobile Operation

27 Common Small Business Tax Deductions And Write Offs

How To Obtain Small Business Tax Deductions

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

Is Rs 40000 Standard Deduction From Fy 2018 19 Really Beneficial

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

Rs 50000 Standard Deduction From Fy 2019 20 Ay 2020 21 Impact

2021 Standard Irs Mileage Rates For Automobile Operation

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Everything You Need To Know About Filing 2020 Taxes For 2021

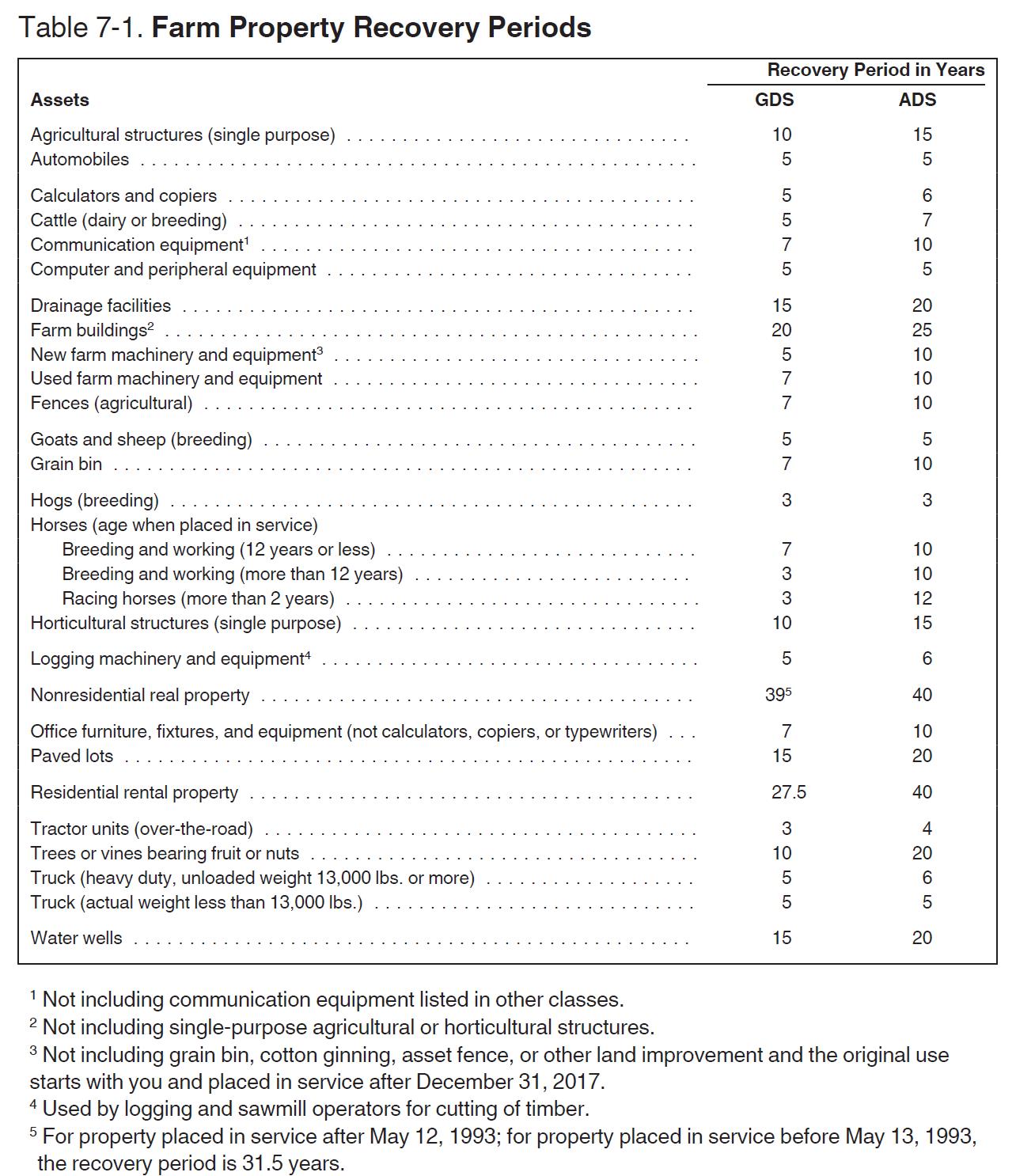

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Post a Comment for "Form, Standard Deduction, 2022, Business, Mileage"