Business Vehicle Depreciation 2022 Over 6000lbs Vs Standard Mileage Deduction

Business Vehicle Depreciation 2022 Over 6000lbs Vs Standard Mileage Deduction

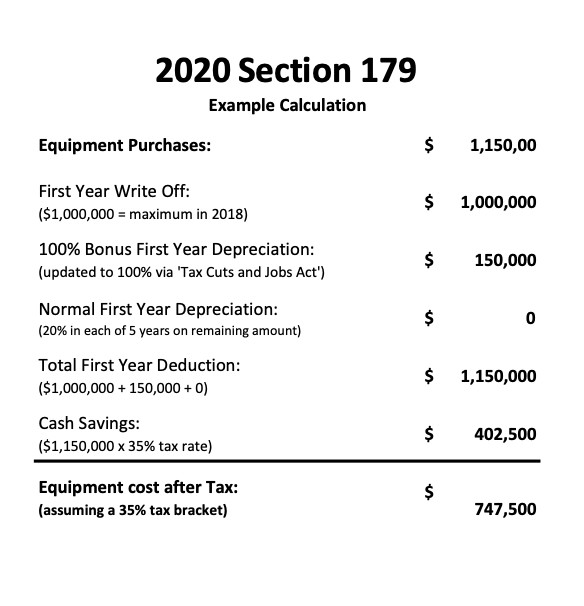

But a section 179 deduction allows you to take more of the expense of the. Normally depreciation is deducted as an expense to the business over the life of the equipment or vehicle. Charity 14 cents a mile. You can calculate the actual costs of using your vehicle for business or either opt to claim a standard mileage deduction.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

New and pre-owned heavy SUVs pickups and vans acquired and put to business use in 2021 are eligible for 100 first-year bonus depreciation.

Business Vehicle Depreciation 2022 Over 6000lbs Vs Standard Mileage Deduction. With normal depreciation you would take about a 10000 deduction each year over 5 years. Anyone have any experience with this particular Section 179 depreciation deduction. What Vehicles Qualify for the Section 179 Deduction in 2021.

3160 2 3160 Truck or vanGVW loaded up to 6000 lbs. Up to 25000 of the cost of vehicles rated between 6000 lbs GVWR and 14000 lbs GVWR can be deducted using a section 179 deduction. Deduction Limits for Vehicles Placed in Service in 2015 Description 280F Depreciation Limit1 Maximum 179 Deduction CarGVW unloaded up to 6000 lbs.

In other words you must take the same deduction year after year over the vehicles useful life. Your business car declines in value over time due to wear and tear. If you cant or dont want to deduct based on mileage you can deduct based on cost of operating the vehicle.

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

Buy A Truck Or Suv Before Year End Get A Tax Break Small Business Trends

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

2020 Section 179 Commercial Vehicle Tax Deduction

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

Deducting Automobile Business Costs Strategic Finance

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

The Best Auto Deduction Strategies For Your Suv Or Truck Mark J Kohler

Tax Deductions For Vehicles Over 6 000lbs Taxhub

2020 Section 179 Commercial Vehicle Tax Deduction

Vehicle Tax Deduction 8 Cars You Can Get Free Section 179 Youtube

Tax Deductions For Vehicles Over 6 000lbs Taxhub

Depreciation Guidelines For Vehicles And When To Report Them As Listed Property

Section 179 Tax Deduction Explained Alpharetta Ga Near Sandy Springs Cumming Gwinnett Duluth

Best Vehicle Tax Deduction 2021 It S Not Section 179 Deduction Youtube

Vehicle Tax Deductions For 2019 Lakeland Ford

2020 Tax Code 179 For Business Owners The Self Employed

Vehicle Tax Deduction 8 Cars You Can Get Free Section 179 Youtube

Post a Comment for "Business Vehicle Depreciation 2022 Over 6000lbs Vs Standard Mileage Deduction"