2022 Can I Deduct Employee Business Expense For Using My Own Vehicle

2022 Can I Deduct Employee Business Expense For Using My Own Vehicle

You need not include the cost in your employee income. Use a logbook How to use a logbook to calculate the amount you can claim for business use of a vehicle. However if you use the car for both business and personal purposes you may deduct only the cost of its business use. If you finance a car or buy one you cannot deduct your monthly expenses on your taxes.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

The federal law doesnt require employers to reimburse employees for their out-of-pocket business expenses.

2022 Can I Deduct Employee Business Expense For Using My Own Vehicle. Your small business can deduct all business driving expenses for all types of vehicles driven by business owners and employees. You can and should deduct the operating expense of your vehicle if you use it for your business. You cant deduct commuting miles the distance you.

A car your own lease or hire under a hire-purchase arrangement someone elses car. Kilometre rates 2017-2018 Use these rates to work out your vehicle expenses for the 2017-2018 income year. For all other types of vehicle claim them as.

If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to earning business income. If you dont use it you cant get the deduction so make sure you can prove the vehicle was used in your business by the end of December in case of a tax audit. You may be able to claim a deduction for motor vehicle expenses if you use the vehicle in performing your work-related duties.

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

New Tax Regime Complete List Of Exemptions And Deductions Disallowed Basunivesh

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

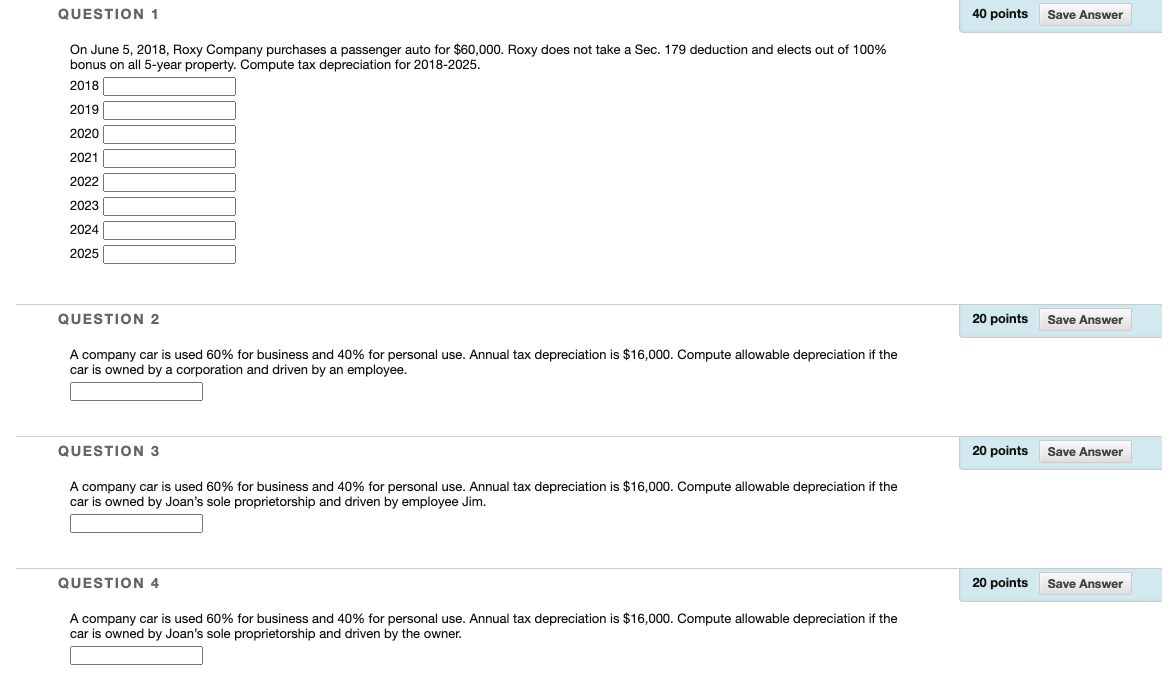

Question 1 40 Points Save Answer On June 5 2018 Chegg Com

Business Use Of Vehicles Turbotax Tax Tips Videos

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Top 10 List Of Income Tax Deductions For Ay 2021 22 For Salaried Employees Tax Benefits On Payments Investments And Incomes The Financial Express

/GigEconomy-6b18081cdaa34796a0f187801e945ea4.jpeg)

10 Common Small Business Tax Deductions

Costs Related To Car Used For Business Can Be Reduced From Your Taxable Business Income

Need A New Business Vehicle Consider A Heavy Suv Fmd

All In One Guide To Important Budget 2021 22 Proposals

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

All In One Guide To Important Budget 2021 22 Proposals

What Is Employee Expense Reimbursement And How Does It Work Justworks

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

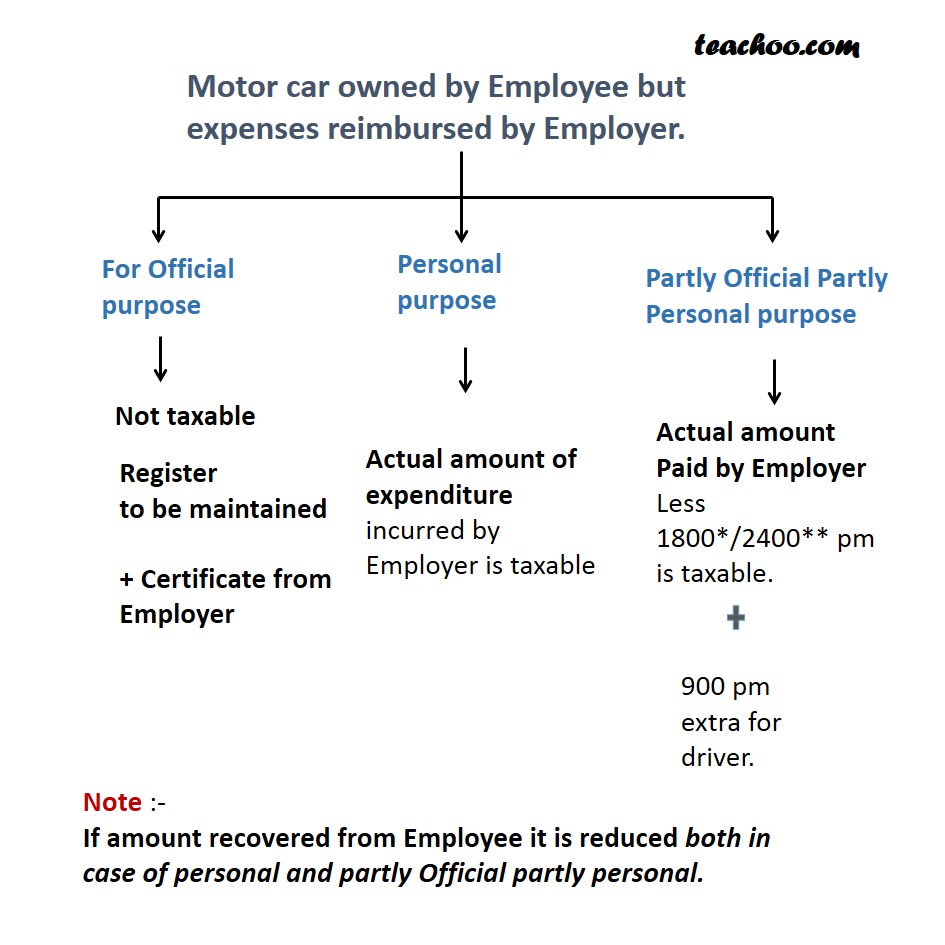

Motor Car Owned By Employee But Expenses Reimbursed By Employer

Post a Comment for "2022 Can I Deduct Employee Business Expense For Using My Own Vehicle"