Business Expense Deduction 2022

Business Expense Deduction 2022

Net operating loss deduction under Sec. At that time a company will only be able to deduct interest expenses up to 30 of earnings before interest and taxes but after depreciation and amortization expenses. Since business travelers have a lot of expenses to log hotels meals etc the IRS allows employers to pay employees per diem rates or daily allowances to compensate for meals lodging and incidental expenses includes fees and tips paid to porters baggage carriers hotel staff and ship staff. As there is no definite answer to whether or not you should itemize deductions in 2022 you need to see it for yourself.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

100 Deduction for Business Meal Expenses 2021-2022 Restaurant meals get a 100 business deduction but not prepackaged grocery meals The Consolidated Appropriations Act 2021 increased the business-meal deduction for the cost of food and beverages provided by a restaurant from 50 percent to 100 percent in 2021 and 2022 if certain conditions are met.

Business Expense Deduction 2022. However the deduction is limited to 50 percent of the otherwise allowable expense. The use of the word by shows that the new rule isnt limited. Previously there was a 50 first-year bonus depreciation deduction on the purchase of new assets or property.

Increased business meal deductions for 2021 and 2022 allowed under these circumstances. For example if you buy a laptop and you only use it for your business you can claim a deduction for the full purchase price. The Act under CAA 2021 further amends section 274n to allow a 100 deduction for business-related expenses for food and beverages provided by a restaurant and that are paid or incurred in calendar years 2021 and 2022.

Business owners can find some relief in a temporary change to a commonly used deduction. 199A for qualified business income. This relief enacted as part of the Consolidated Appropriations Act 2021 comes in the form of an increase in the deductibility of business meal expenses from 50 percent to 100 percent if purchased from a restaurant during calendar years.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

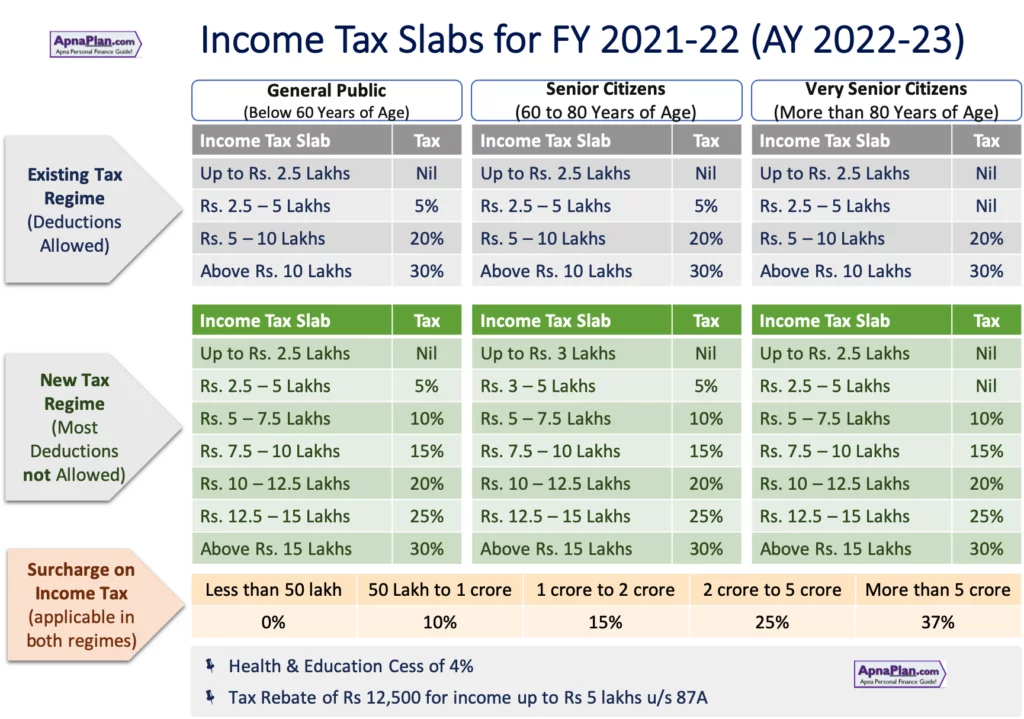

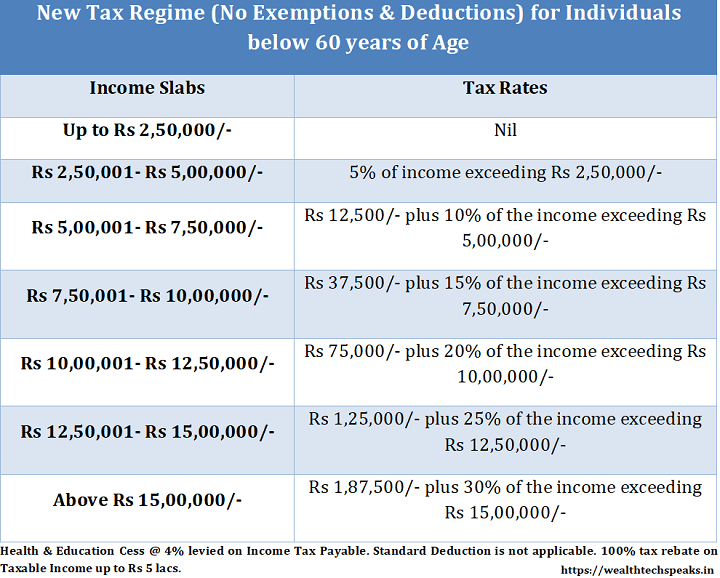

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

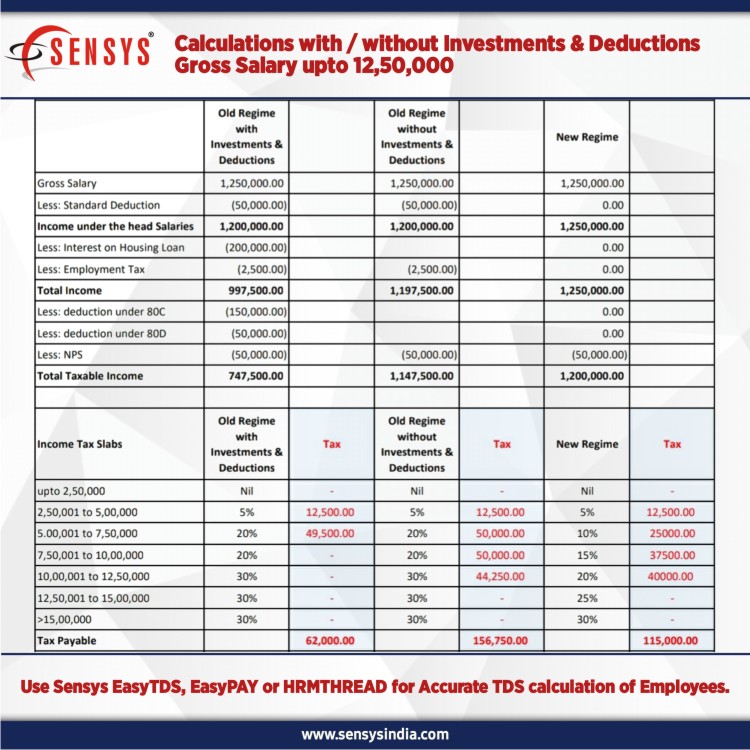

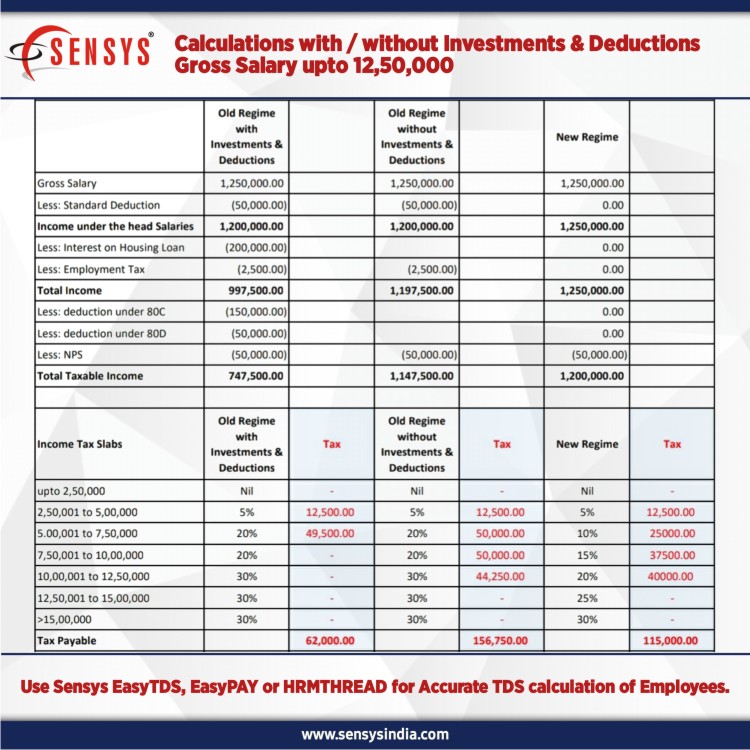

Income Tax Slabs Fy 2020 2021 Ay 2021 2022 Sensys Blog

All In One Guide To Important Budget 2021 22 Proposals

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

What Are The Largest Tax Expenditures Tax Policy Center

Income Tax Slabs Fy 2020 2021 Ay 2021 2022 Sensys Blog

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Oregon Business Meals And Entertainment Expenses Under The Consolidated Appropriations Act

Income Tax Slabs Rates Financial Year 2021 22 Wealthtech Speaks

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22

Calculating Deductions For Business Interest Expense Mitchell Wiggins

Tax Deduction Of Mba Tuition 2021 2022 Studychacha

Interest Expense Limitation Gross Receipts Test Lancaster Cpa Firm

Irs Guidance Clarifies Business Meal Deductions For 2021 And 2022

Post a Comment for "Business Expense Deduction 2022"