Is Business Use Of Home Deductible In 2022?

Is Business Use Of Home Deductible In 2022?

Who can claim 1 2 3 Against salaries. Can employees deduct business use of home. If your business turnover is less than 85000 for 20212022 youll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. The space must only be used for business purposes.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

The simplified option has a rate of 5 a square foot for business use of the home.

Is Business Use Of Home Deductible In 2022?. This generous tax break is available for qualifying vehicles that are acquired and placed in service between September 28 2017 and December 31 2022. Deduction will not be allowed in year in. However your deduction is limited to the percentage of your home that is dedicated exclusively to your business.

Exclusive use means you use a specific area of your home only for trade or business purposes. You cant claim a deduction for the private use of your homes facilities. Against profits and gains of business or profession A.

To deduct expenses for business use of the home you must use part of your home as one of the following. View 67 Reading Certain Business Meals 100 Deductible in Tax Years 2021 and 2022docx from AUDIT 405 at University of Phoenix. For tax years 2018 through 2025 tax reform has eliminated the itemized deduction for employee business expenses.

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Tanya Clark Esq Powerhouse Bosses Business Owners Are You Keeping Your Receipts And Documenting Your Expenses For Meals You Will Get A 100 Deduction For 2021 And 2022 Facebook

2021 2022 Home Office Tax Deductions Cpa Practice Advisor

Deducting Home Office Expenses Journal Of Accountancy

Union Budget 2021 Additional Deduction Of 1 5 Lakh On Home Loan Interest Extended Till March 2022 The Hindu

Budget 2021 Home Loan Interest Deduction Extended Till March 2022 Nirmala Sitharaman Announcement Business News India Tv

Section 16 Ia Standard Deduction For Ay 2022 23 New Tax Route

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

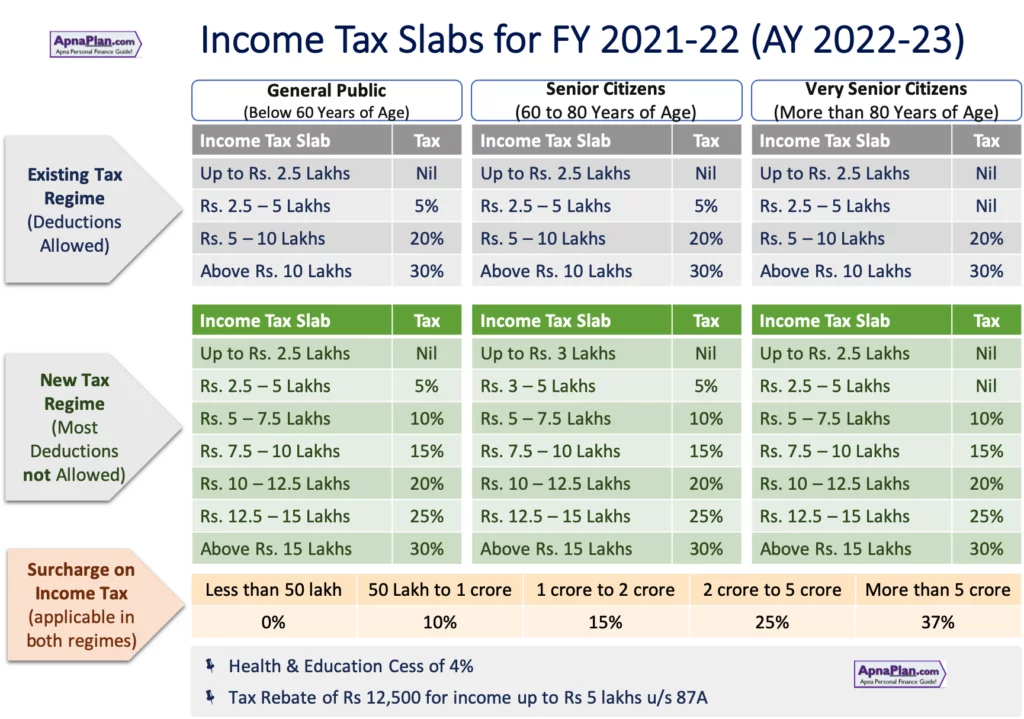

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Due Dates For E Filing Of Tds Tcs Return Ay 2022 23 Fy 2021 22

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22

Union Budget 2021 Govt May Provide Work From Home Tax Relief Know How Can It Be Beneficial For Employees

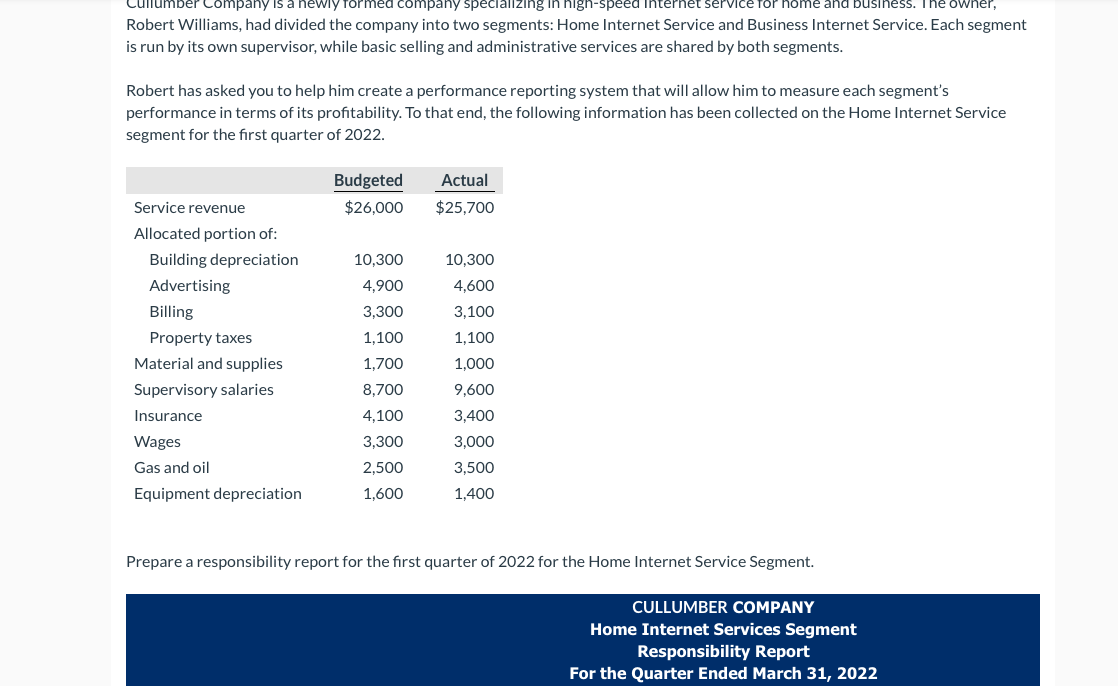

Curlumber Company Is A Newly Formed Company Chegg Com

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

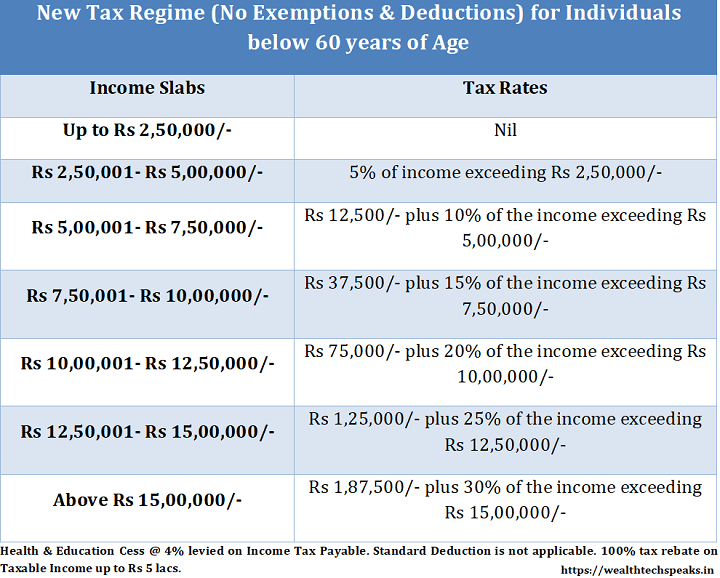

Income Tax Slabs Rates Financial Year 2021 22 Wealthtech Speaks

Section 80eea Deduction For Interest Paid On Home Loan For Affordable Housing

There S A Tax Deduction For People Working From Home But It Won T Apply To Most Remote Workers During The Pandemic Business Insider India

Home Loan Tax Deduction Benefits 2021 22 All You Need To Know Finmedium

Post a Comment for "Is Business Use Of Home Deductible In 2022?"