Unreimbursed Employee Business Expenses For 2022

Unreimbursed Employee Business Expenses For 2022

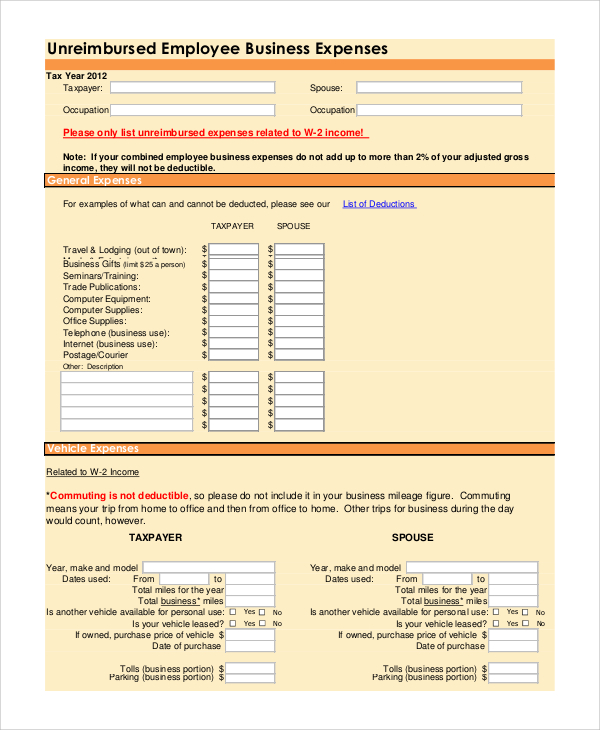

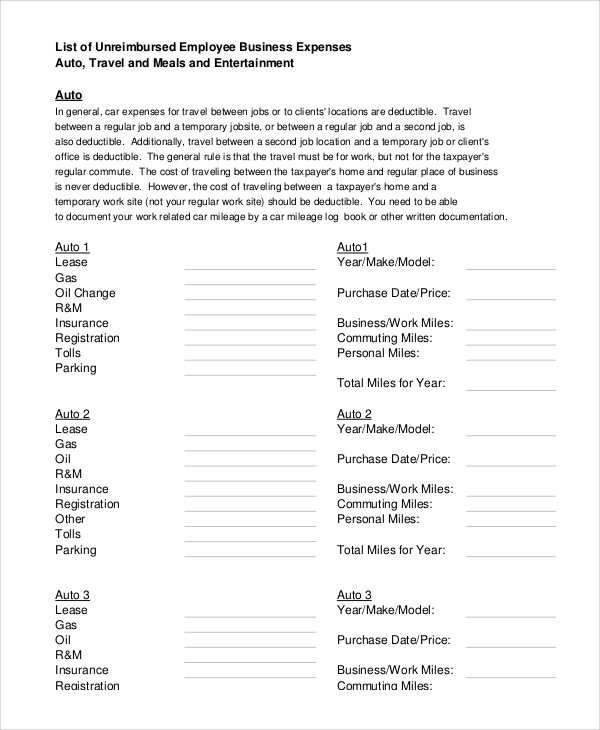

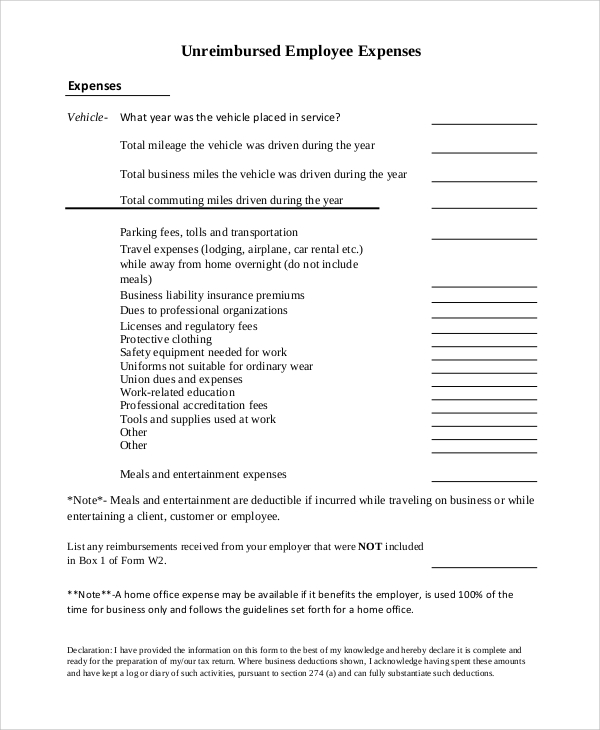

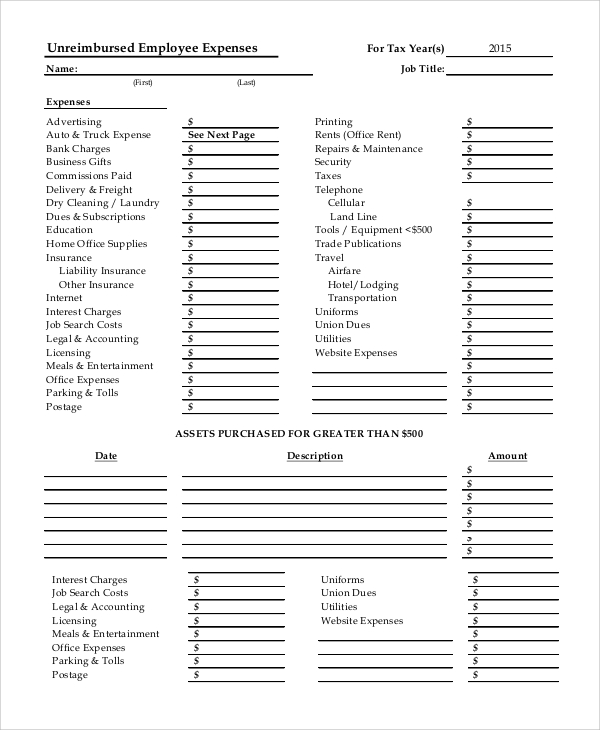

Form 2106-EZ - Unreimbursed Employee Business Expenses 2015 free download and preview download free printable template samples in PDF Word and Excel formats. Premiums paid by an employee for insurance against personal liability for wrongful acts on the job. Self-employed taxpayers may continue to deduct ordinary and. The total home office expenses for half the year is 800 with a PA personal income tax savings of 25 800 x 307 Use tax is 12 2000 x 10 x 6.

Free 6 Sample Unreimbursed Employee Expense In Pdf

The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020.

/GettyImages-929044192-5c34aef046e0fb000116263a.jpg)

Unreimbursed Employee Business Expenses For 2022. On Forms there is a Miscellaneous Itemized Deductions Worksheet which has certain fields. Keep Detailed Business Expense Records Detailed contemporaneous expense records are a must-have when using this small business tax planning strategy in case the IRS questions your heavy vehicles claimed business-use percentage or your home office. The deduction for unreimbursed employee business expenses was one of those that were affected.

The Tax Cuts and Jobs Act TCJA sounded at least a temporary death knell for a good many itemized deductions when it was signed into law in December 2017. If you incurred vehicle expenses for more than one vehicle complete a separate Part 2 of Schedule M1UE for. Damages paid to a former employer for breach of an employment contract.

An expense is ordinary if it is common and accepted in your trade business or profession. Examples of pre-2018 unreimbursed business expenses claimed. Expenses such as union dues work-related business travel or professional organization dues are no longer deductible even if the employee can itemize deductions.

Free 6 Sample Unreimbursed Employee Expense In Pdf

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Free 6 Sample Unreimbursed Employee Expense In Pdf

Free 6 Sample Unreimbursed Employee Expense In Pdf

Free 6 Sample Unreimbursed Employee Expense In Pdf

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Free 6 Sample Unreimbursed Employee Expense In Pdf

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-929044192-5c34aef046e0fb000116263a.jpg)

How To Deduct Unreimbursed Employee Expenses

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Employee Business Expenses Commuting Doesn T Count Alloy Silverstein

What Is Employee Expense Reimbursement And How Does It Work Justworks

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Employee Employee Expenses Business Expenses H R Block

Deducting Home Office Expenses Journal Of Accountancy

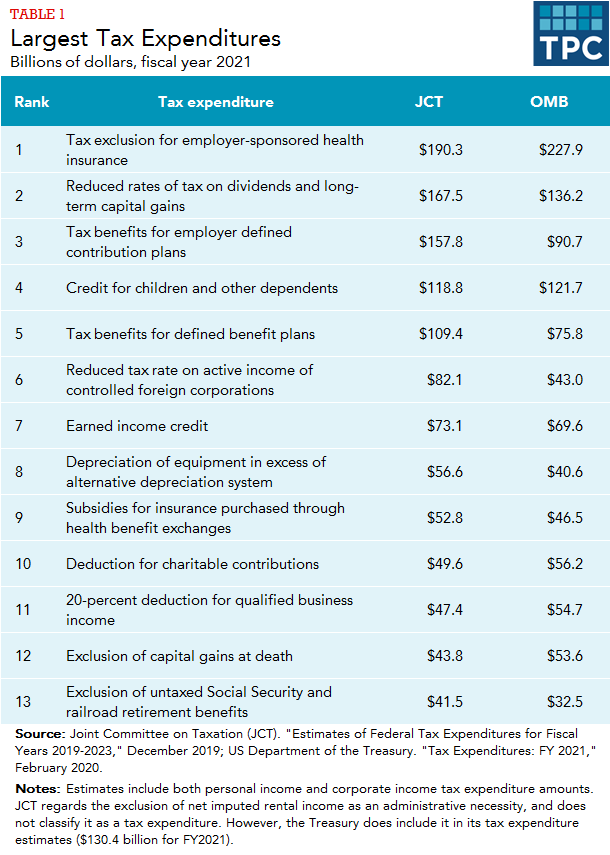

What Are The Largest Tax Expenditures Tax Policy Center

/GettyImages-929044192-5c34aef046e0fb000116263a.jpg)

How To Deduct Unreimbursed Employee Expenses

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

:max_bytes(150000):strip_icc()/Screenshot60-c292ba5857354bc2a6954431d654a9bb.png)

Post a Comment for "Unreimbursed Employee Business Expenses For 2022"