2022 Massachusetts Employee Business Expense Deduction

2022 Massachusetts Employee Business Expense Deduction

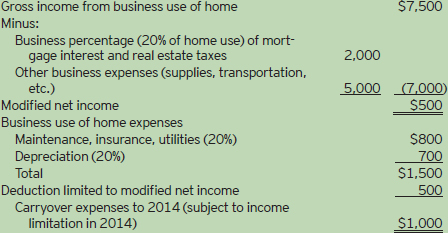

The ME deduction in 2021 and 2022 is great for small businesses but the CAA wasnt perfectly clear on how to apply the law. The mileage reimbursement is the most common type of reimbursement for business expenses. Prior to the enactment of the CAA the US. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators.

To qualify for the Massachusetts employee business expense deduction the following 3 conditions must be met.

2022 Massachusetts Employee Business Expense Deduction. The 2018 Tax Cuts and Jobs Act TCJA eliminated deductions for most business-related entertainment expenses. If the expense is for a mix of business and private use you can only claim the portion that is used for your business. Understanding business meal and entertainment deduction rules.

Maximizing the 100 Meal Deduction. If you take out a loan or use a credit card to cover business expenses you can deduct the interest paid to your lender or credit card company as long as you meet the following. 1099-INT Form 2022 Instructions.

1 2019 Illinois employers will have to reimburse employees for certain business expenses. If an employee operates his or her personal vehicle for the. You can also deduct 50 of the cost of providing meals to employees such as buying pizza for dinner when your team is working late.

State Conformity To Cares Act American Rescue Plan Tax Foundation

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

Increased Business Meal Deductions For 2021 And 2022 Tax Mam Inc

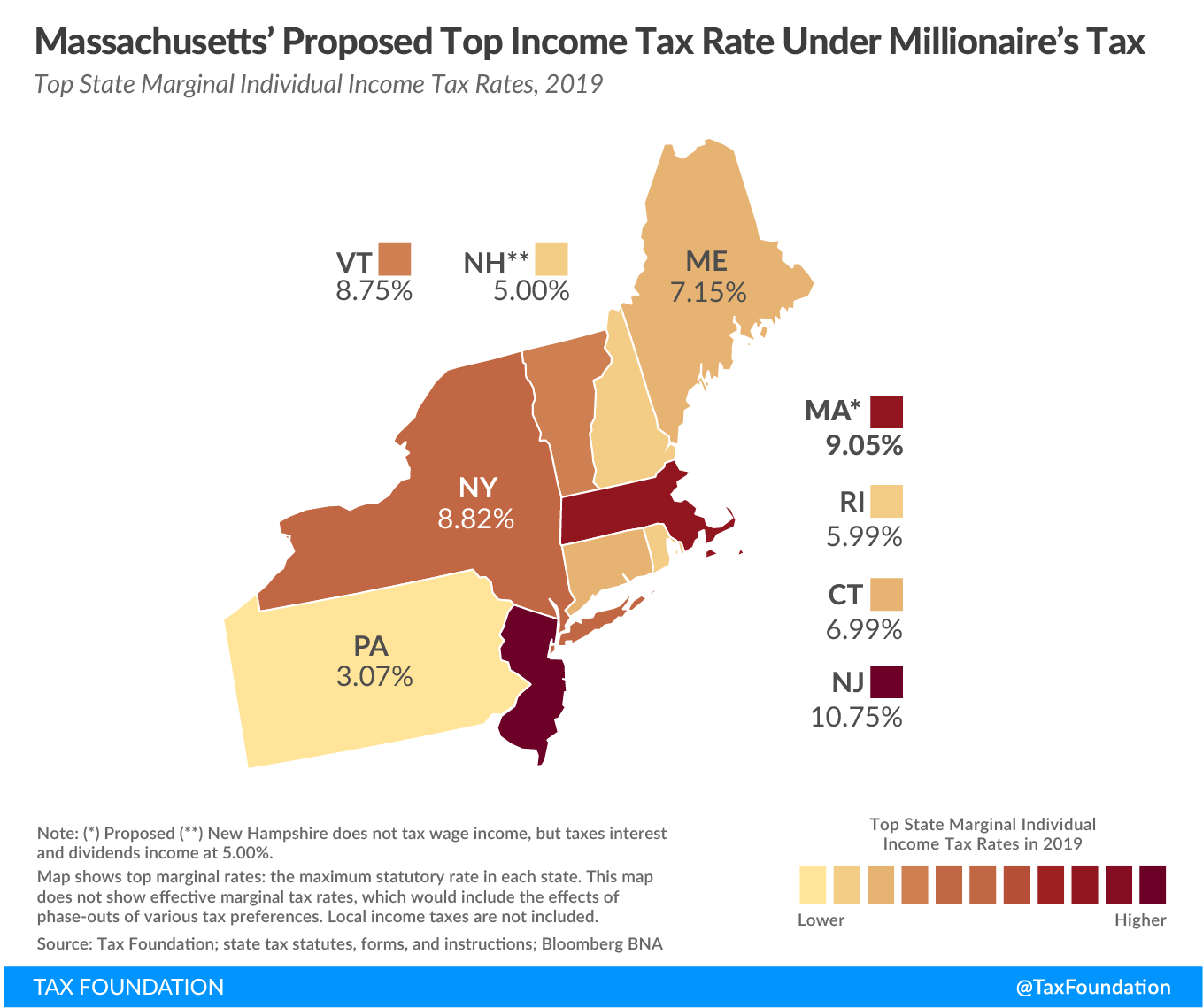

Massachusetts Legislature Moves Forward Millionaires Tax

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Some Changes That May Affect Next Year S Tax Return The New York Times

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

Helicopter View Of Meals And Entertainment Barron Co Cpas

What Are The Largest Tax Expenditures Tax Policy Center

15 Tax Deductions And Benefits For The Self Employed

Biden Corporate Tax Increase Details Analysis Tax Foundation

Cms Releases 2022 Medicare Part D Benefit Parameters Buck Buck

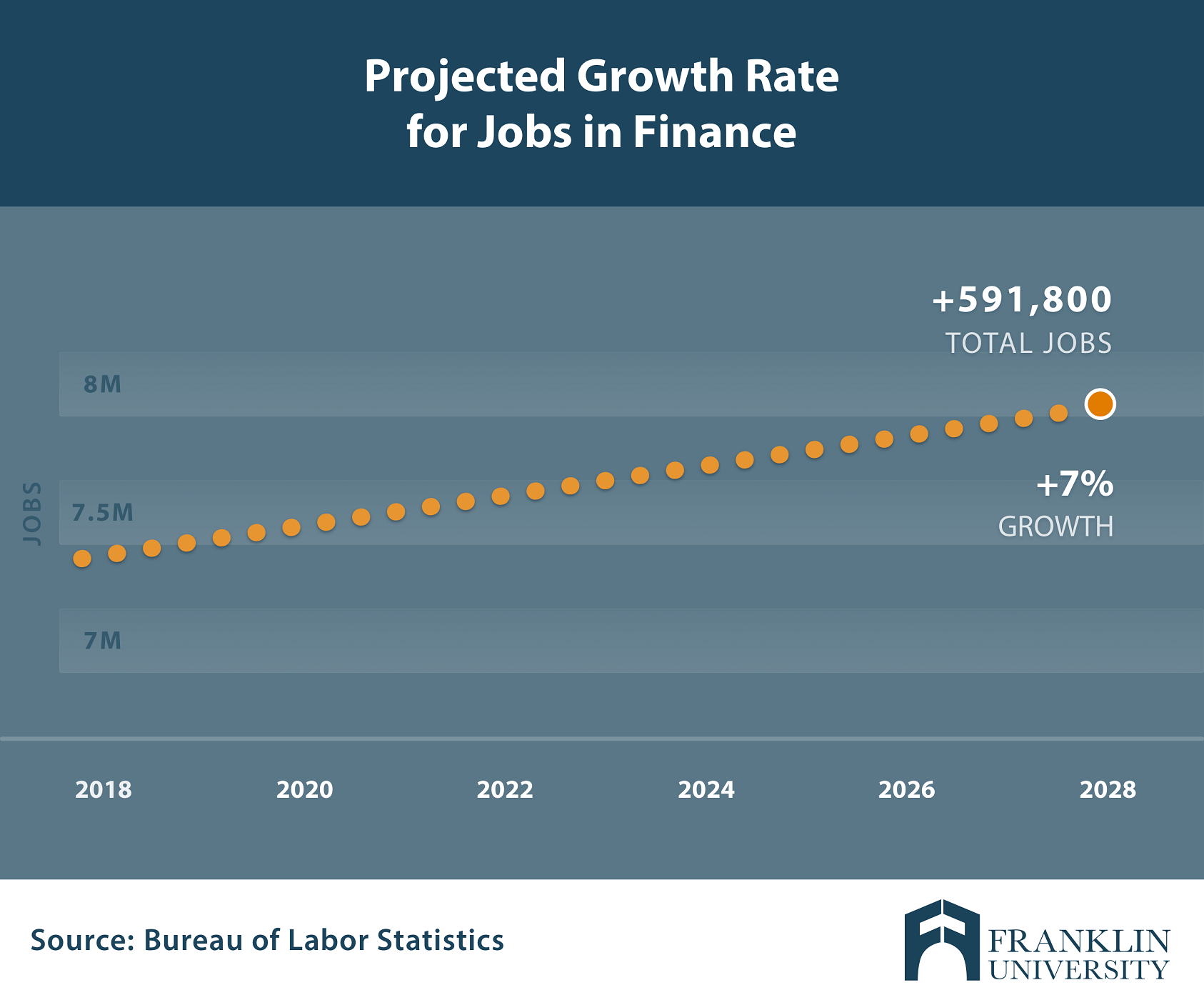

Is An Online Finance Degree Worth It Franklin Edu

Post a Comment for "2022 Massachusetts Employee Business Expense Deduction"