Ohio Small Business Deduction 2022

Ohio Small Business Deduction 2022

Transcription service is all about converting oral speech files such as video or audio into the electronic or written text format. Who can claim 1 2 3 Against salaries. 11 to kill a portion of the state budget that eliminated the small-business income deduction exclusively for lawyers and lobbyists. Here is a list of the best small businesses to start in Ohio Columbus.

The Ohio 2022 2023 State Budget

Jamie has 300000 of business income and takes the maximum 250000 deduction on Ohio Schedule A.

Ohio Small Business Deduction 2022. Home-Based Online Business Ideas in Ohio 1. Eventbrite - Ohio Small Business Development Center presents Capital Crash Course 2022 - Friday December 10 2021 - Find event and registration information. Small Business Tax Deductions.

You can claim a deduction for most costs you incur in running your business for example staff wages marketing and business finance costs. How is business income defined. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors.

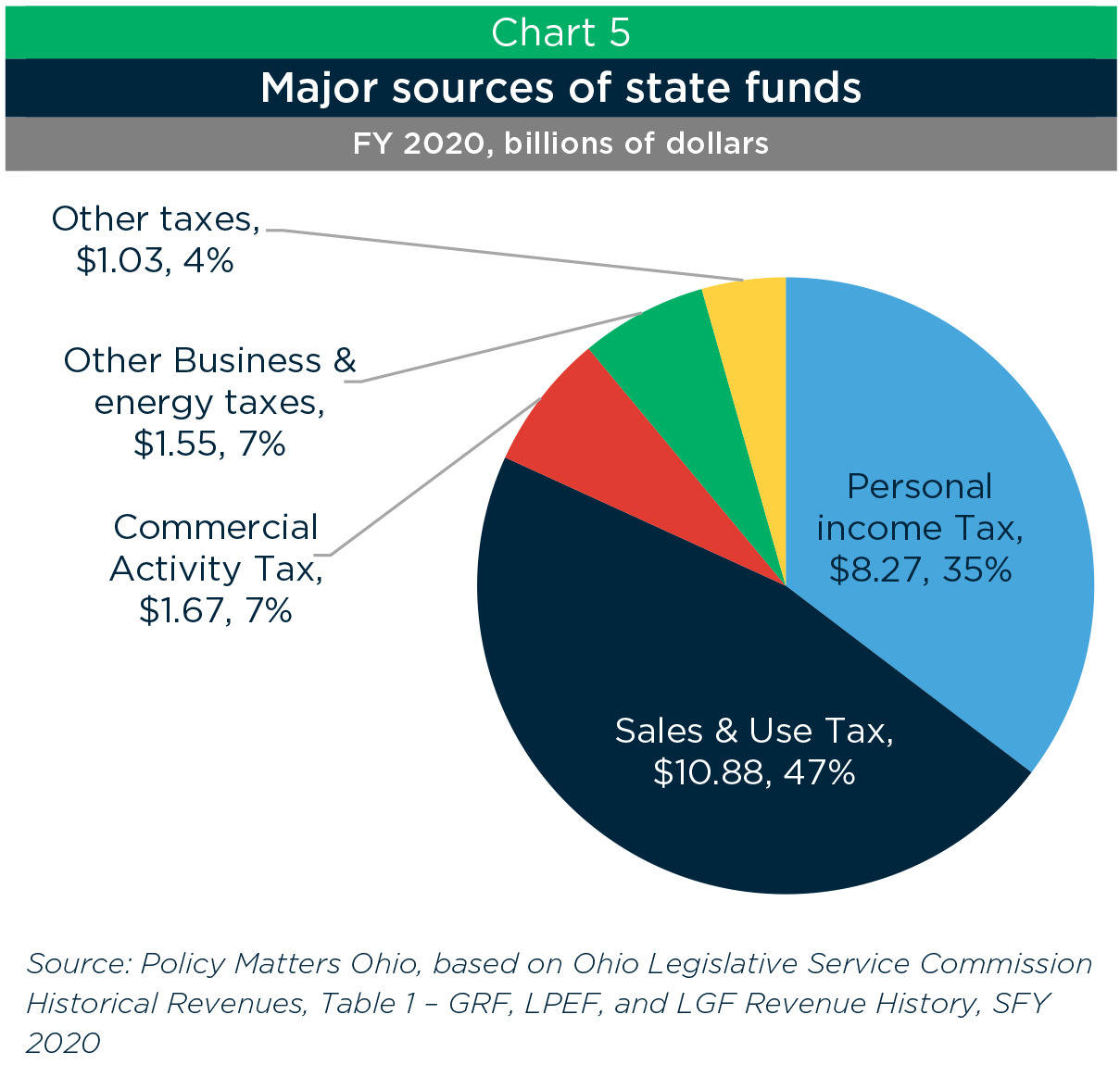

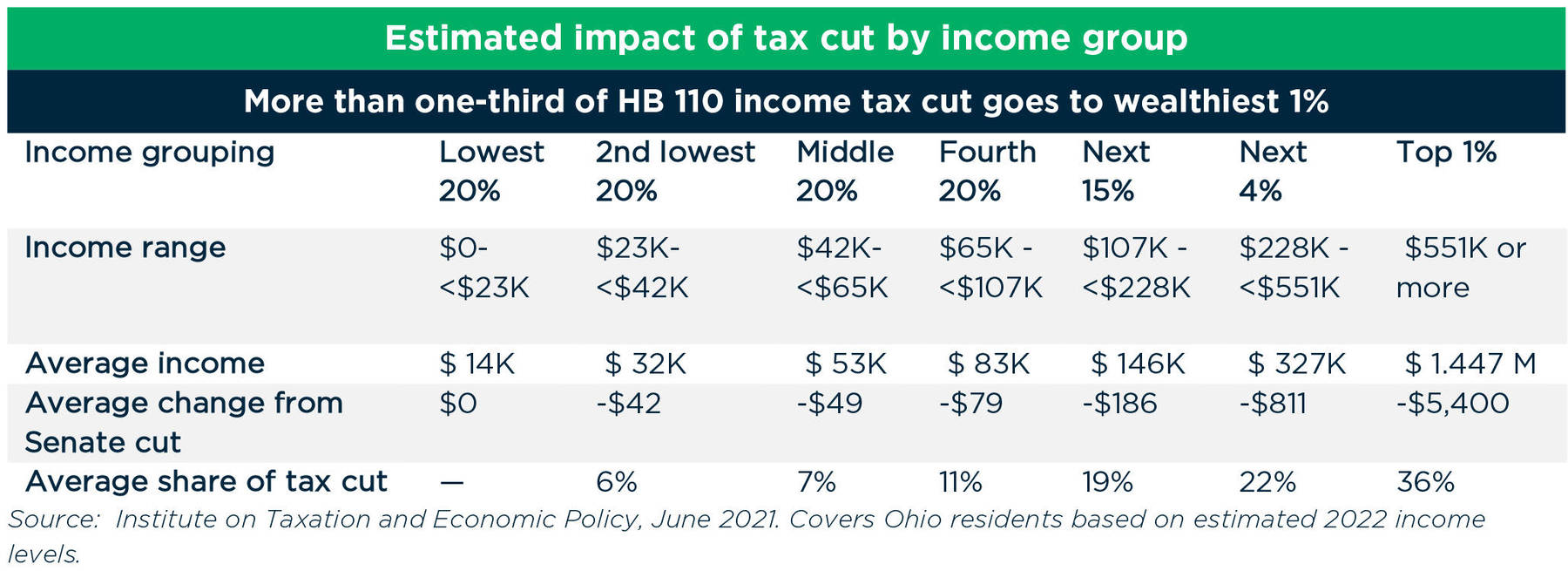

Business business income business income tax dayton ohio tax lawyer income tax liability jeff senney ohio small business Ohio Small Business. An individual business owner can deduct 75 of his or her first 250000 of business income up to 187500 reported on the Ohio individual income tax return and then apply a graduated tax rate capped at 3 on business income over the SBD amount. On June 30 2021 Ohio Governor Mike DeWine signed Amended Substitute House Bill 110 the state operating budget for fiscal years 2022-2023.

The Ohio 2022 2023 State Budget

Tax Changes Under The Ohio Fiscal Year 2022 23 Budget Bill

Ohio Budget 2021 2022 Key Changes

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

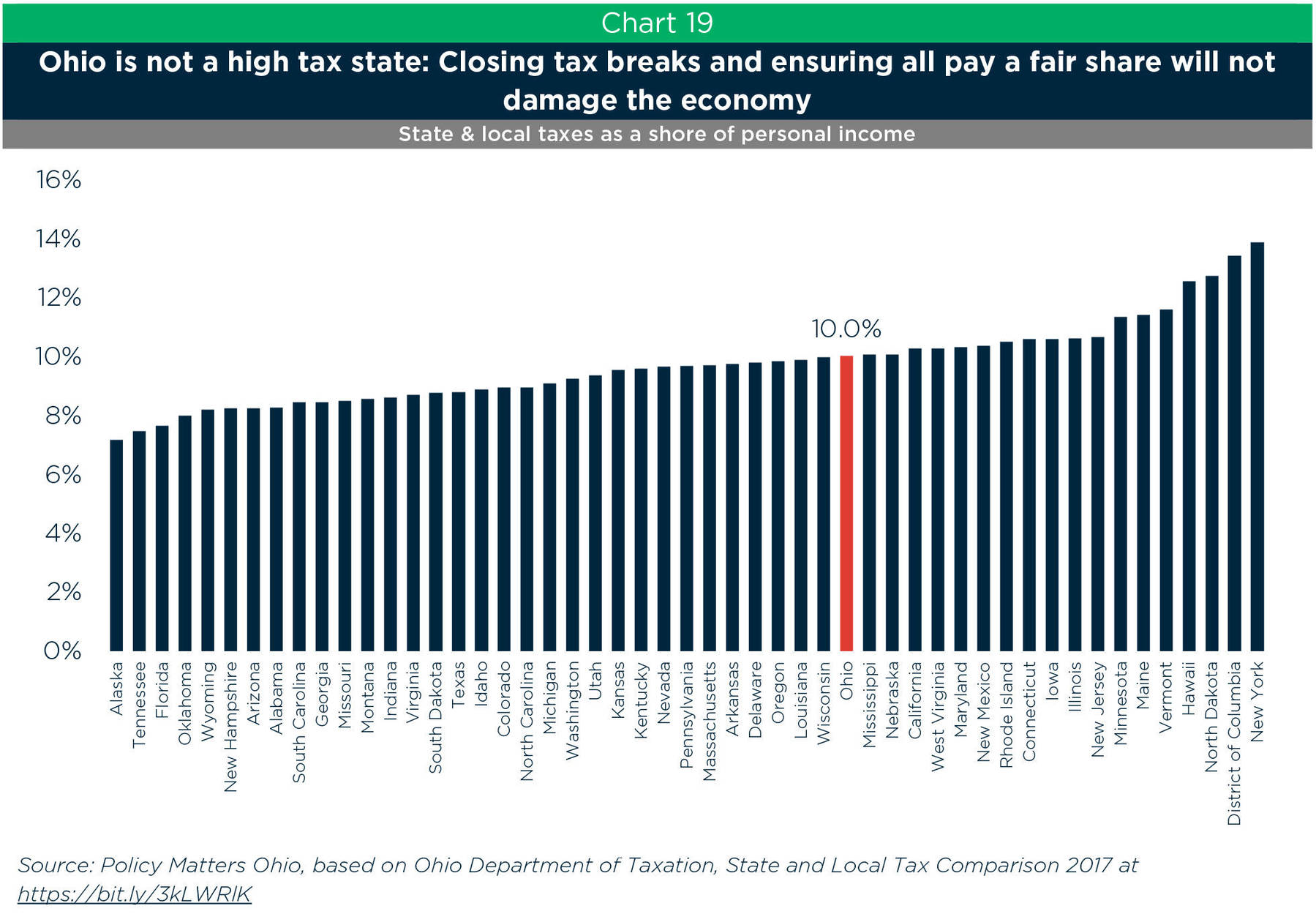

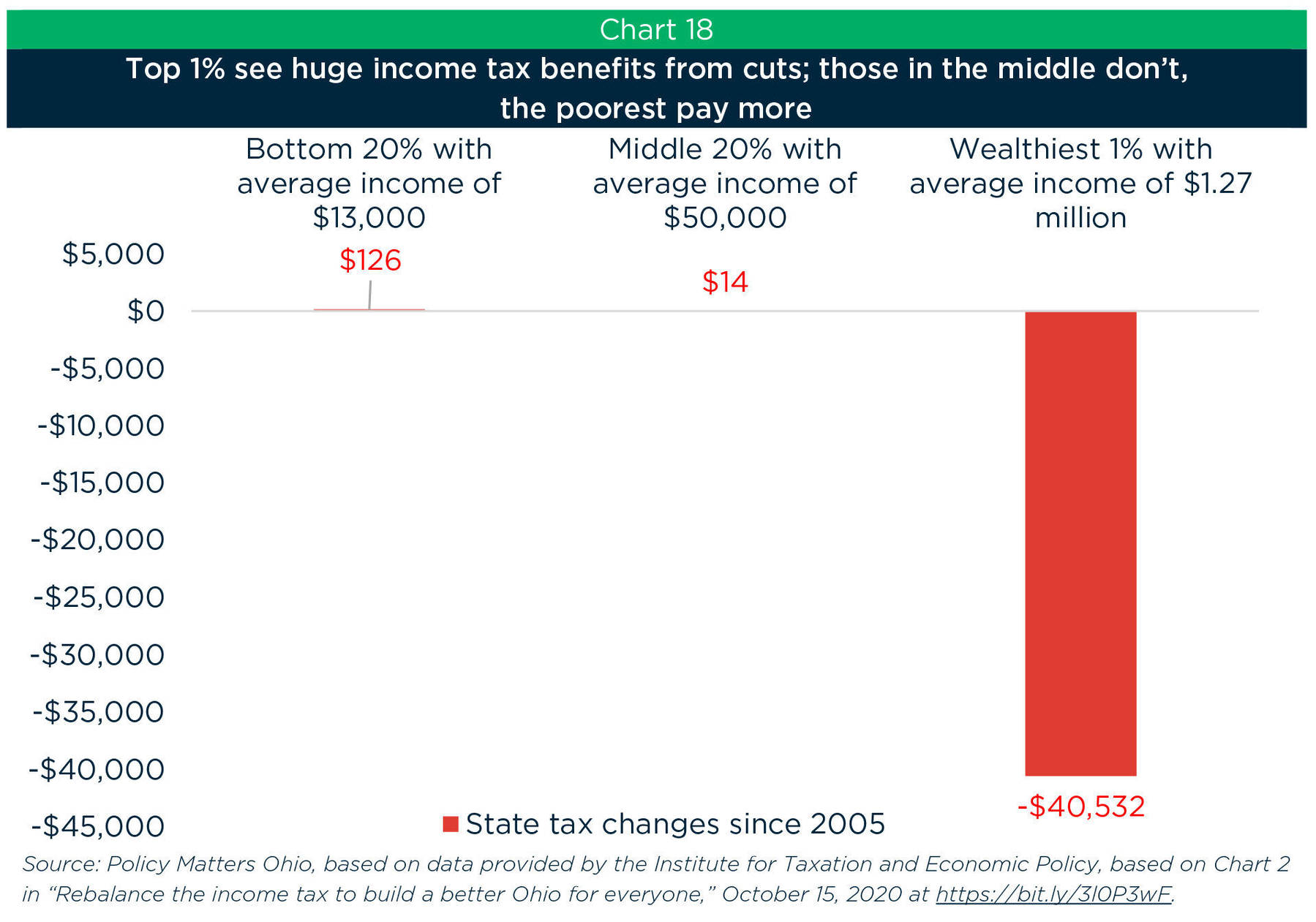

Ohio Tax Cuts Would Go Mostly To The Very Affluent

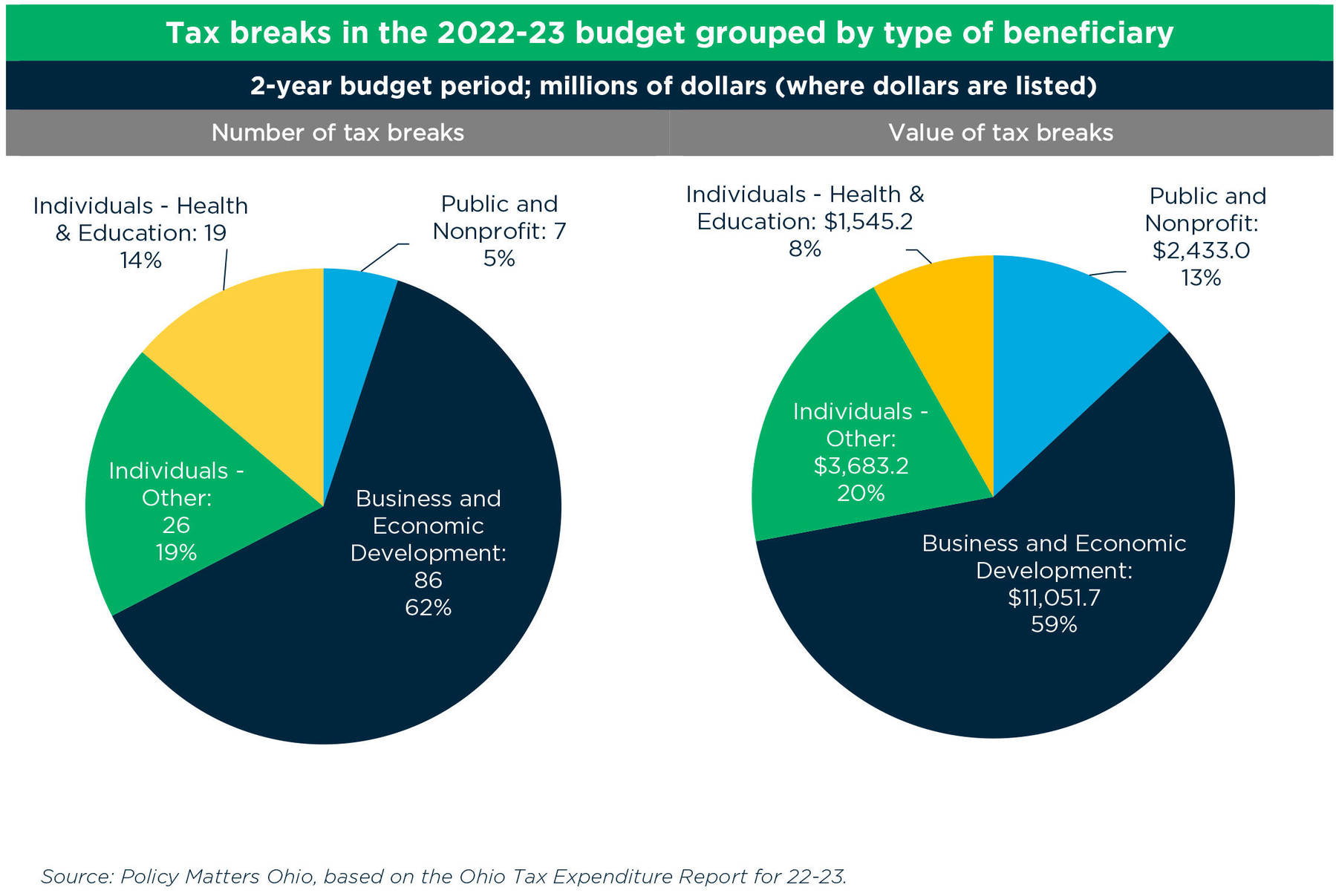

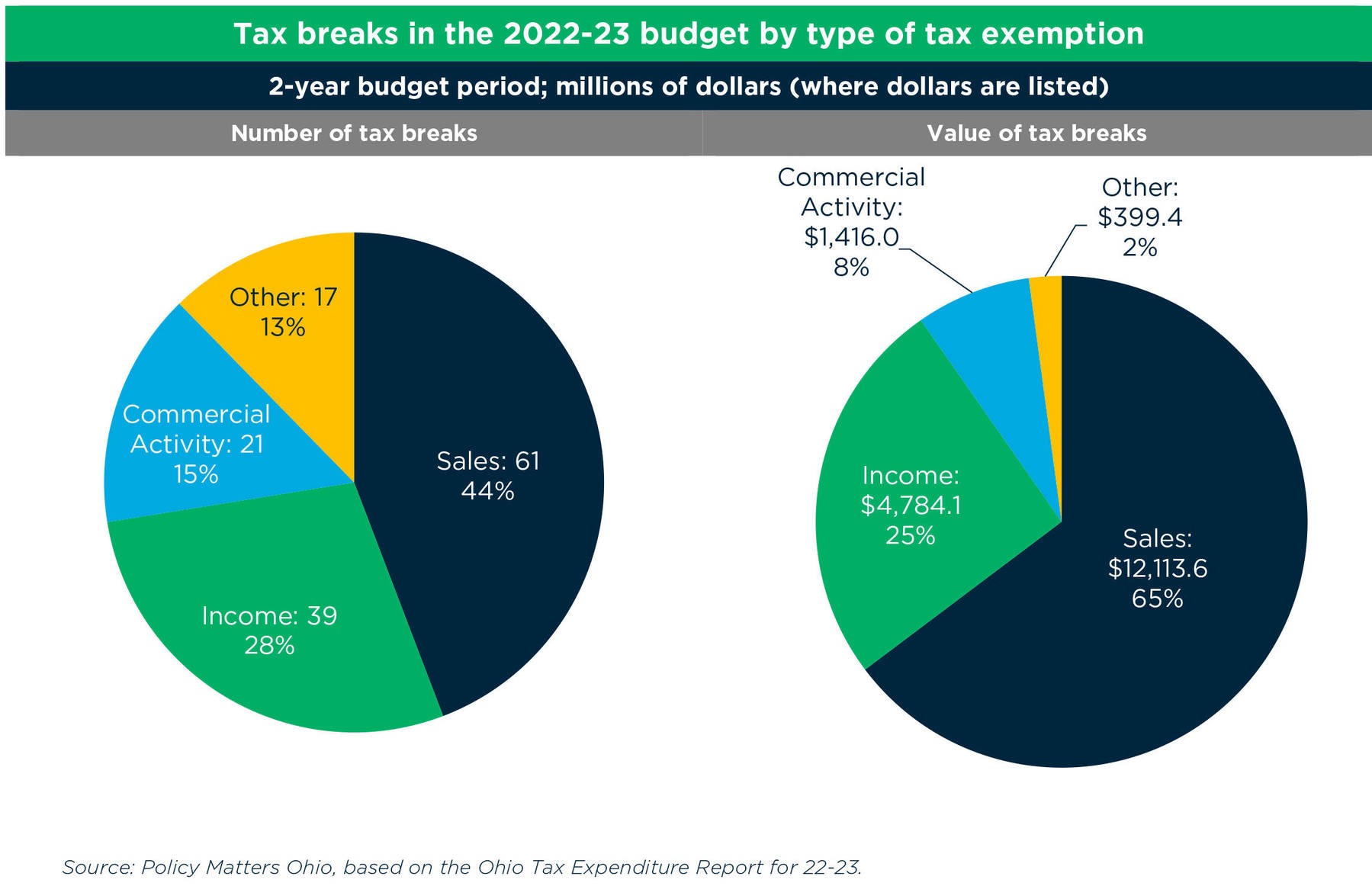

More Public Money To Private Interests

Ohio Minimum Wage To Increase Effective January 1 2022

Ohio State And Local Tax Update Budget Bill 2021 2022

2021 State Corporate Tax Rates And Brackets Tax Foundation

More Public Money To Private Interests

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

House Democrats Tax On Corporate Income Third Highest In Oecd

27 Common Small Business Tax Deductions And Write Offs

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Biden Tax Plan Gives 620 Tax Cut To Middle Class New Study Says

Governor Dewine Signs Biennial State Operating Budget

Post a Comment for "Ohio Small Business Deduction 2022"