Business Meals Deduction 2022 Employee Events

Business Meals Deduction 2022 Employee Events

In previous years deductions for business meals at restaurants were limited to only 50 of the cost. Since people must eat irrespective of the tax code however some portion of fully deductible. WASHINGTON The Internal Revenue Service issued final regulations on the business expense deduction for meals and entertainment following changes made by the Tax Cuts and Jobs Act TCJA. Keep all business meal receipts.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

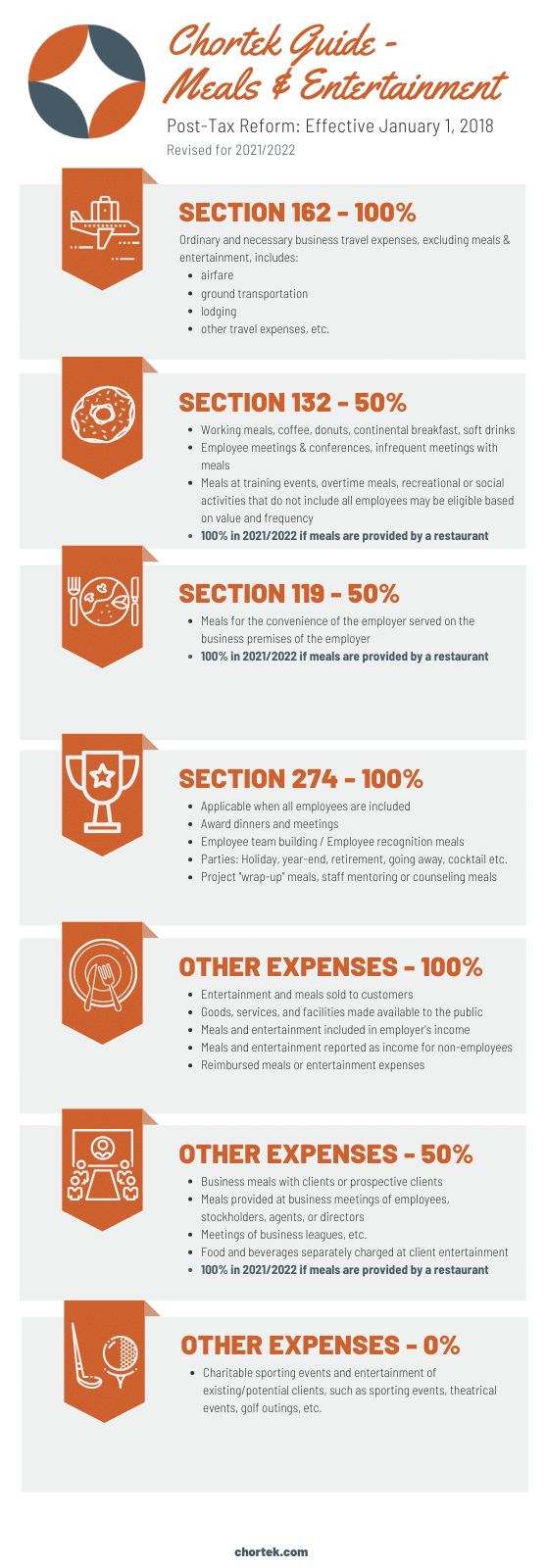

As part of the Consolidated Appropriations Act 2021 the deductibility of business meals is changing.

Business Meals Deduction 2022 Employee Events. New Exception for Food or Beverage Expenses in 2021 and 2022. The facility must prepare and sell food or beverages to retail customers for dining in or take-out meals and the business owner or an employee must be present. Under current law businesses may deduct 50 percent of the cost of business-related meals.

This relief enacted as part of the Consolidated Appropriations Act 2021 comes in the form of an increase in the deductibility of business meal expenses from 50 percent to 100 percent if purchased from a restaurant during calendar years 2021 and 2022. You can deduct 100 of business meals in 2021 and 2022. The temporary exception allows a 100 deduction for food or beverages from restaurants.

Starting in 2018 the rules changed only meals were allowed the 50 deduction. When Congress hands out extra deductions the IRS will surely audit it in a few years so be sure to have all your receipts and notes together. One of the biggest changes is that deductions are no longer allowed for entertainment expenses except for certain employee events.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

Irs Guidance Clarifies Business Meal Deductions For 2021 And 2022

Meals And Entertainment Deduction 2021 Updated Information Chortek

Business Meals Are 100 Deductible Through 2022 Bsb

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Increased Business Meal Deductions For 2021 And 2022 Tax Mam Inc

Business Meals And Parties Full Vs Partial Deductions

Some Business Meals 100 Deductible In 2021 And 2022 Councilor Buchanan Mitchell Cbm

Certain Meals Will Be 100 Tax Deductible For Businesses In 2021 And 2022 Chugh

Business Meals Temporarily Qualify For 100 Tax Deduction Marks Paneth

Increased Business Meal Deductions For 2021 And 2022 Henssler Financial

Business Meals And Entertainment Expenses What S Deductable

Know Which Business Meals Are Deductible Under New Tax Code

Deducting Business Meals In 2021 And 2022

Oregon Business Meals And Entertainment Expenses Under The Consolidated Appropriations Act

Meals And Entertainment Deduction Tax Reform Doeren Mayhew Cpas

How To Deduct Meals And Entertainment In 2021 Bench Accounting

New Law Doubles Business Meal Deductions And Makes Favorable Ppp Loan Changes

Post a Comment for "Business Meals Deduction 2022 Employee Events"