Business Use Of The Home 2022 Depreciation Percentage

Business Use Of The Home 2022 Depreciation Percentage

The new rules allow for 100 bonus expensing of assets that are new or used. In general the bonus depreciation percentage is reduced for property placed in service after 2022. Beginning with assets purchased after September 27 2017 the bonus depreciation percentage is increased from 50 to 100. Open the desired client and if necessary click an activity folder.

Rates Of Depreciation For Income Tax For Ay 2022 23

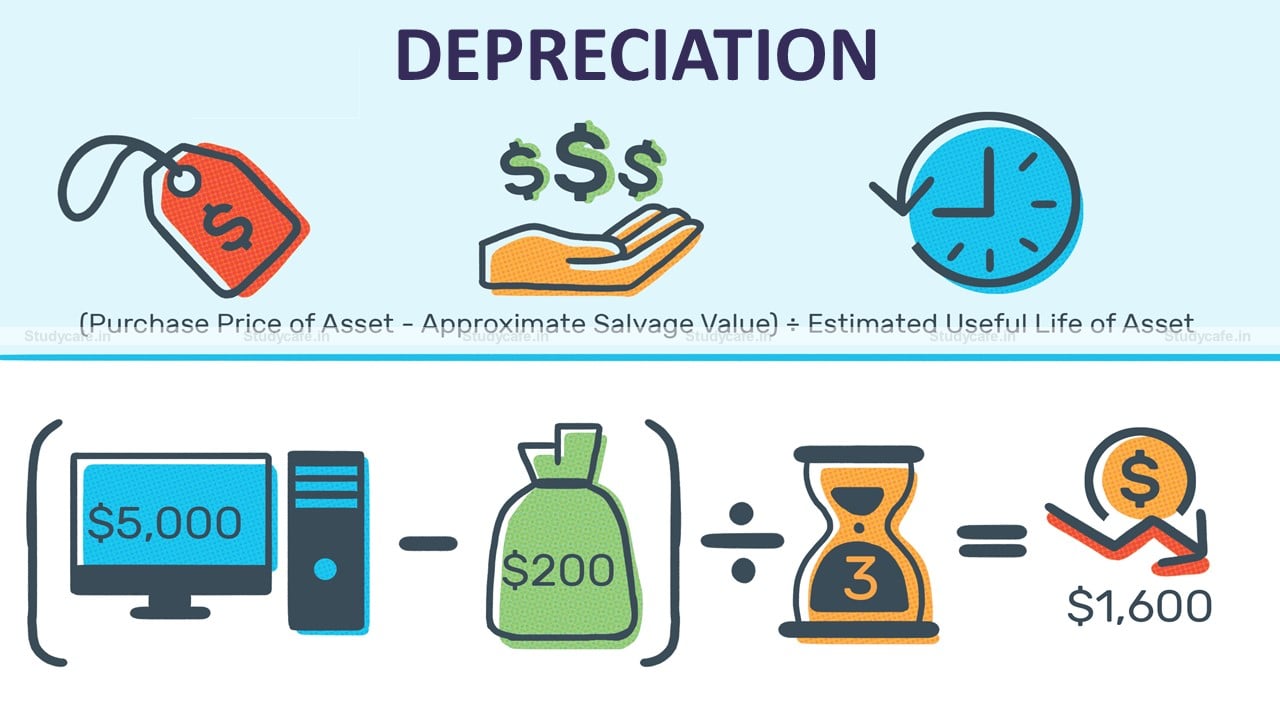

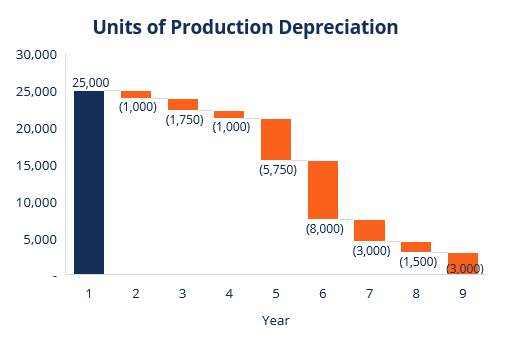

Of 20000 and a useful life of 5 years.

Business Use Of The Home 2022 Depreciation Percentage. In the Prior Depreciation Comparison dialog enter the prior-year business use percentages in the Assets business use percentages group box. Telephone costs If you run your business from home you can claim a deduction of 50 of the rental of a telephone landline if this is also your private line. Useful life of the asset.

The deduction applies to business property acquired after Sept. Home Record Keeping Taxes Checklist for Form 8829 Expenses for Business Use of Your Home 2019. Also the vehicle must be bought new from a dealer.

Checklist for Form 8829 Expenses for Business Use of Your Home 2019 March 4 2020. Sole Trader uses a Landcruiser in his maintenance business 90 Business. Take that percentage of the sale price and add that back into the pool or include as income.

Depreciation Rate As Per Companies Act For Ay 2022 23 New Tax Route

Depreciation Rate As Per Income Tax Act For Ay 2022 23 New Tax Route

Depreciation Rate As Per Companies Act For Ay 2021 22 New Tax Route

Depreciation For Ay 2021 2022 Under Income Tax Act 1961

Depreciation Rate Formula Examples How To Calculate

Ato Depreciation Atotaxrates Info

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Pdf Download Depreciation Rate As Per Companies Act For Ay 2020 21 Pdf New Tax Route

A Guide To Depreciation Rates As Per Income Tax For Ay 2020 21

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Depreciation On Furniture Definition Rates How To Calculate

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Depreciation Rates As Per I T Act For Most Commonly Used Assets Taxadda

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Depreciation Definition Types Example Tally Solutions

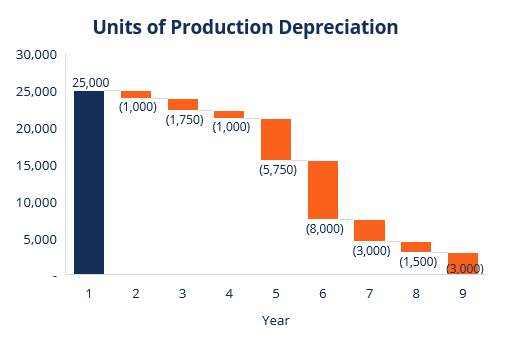

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Schedules A Beginner S Guide The Blueprint

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Post a Comment for "Business Use Of The Home 2022 Depreciation Percentage"