Irc 2022 Business Mileage

Irc 2022 Business Mileage

056 per mile for commercial purposes. Since the IRS increases or decreases the standard mileage rates with no significance you can expect a comparable business rate in 2021. The new altered GSA Mileage Rate 2022 formally applies as of Jan 1 2021. From 2019 to 2020 the medical mileage rate was reduced by 2 cents.

This makes calculating business mileage fairly simple.

Irc 2022 Business Mileage. Depreciation Generally the Modified Accelerated Cost Recovery System MACRS is the only depreciation method that can be used by car owners to depreciate any car placed in service. On the other hand the current IRS mileage rates for business is 575 cents. If the employer reimburses you more than 56 cents per mile the excess amount is going to be taxable.

EXAMExam While the federal government do the math and try to get the approval of projects still in 2021 to enable new robust actions for the election year such as the reformulation of Bolsa Família the states will reach 2022 with a better fiscal situation. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for. Rates per business mile.

They are the details for GSA Mileage Rate 2022. It was produced community in Notice 2021-02 Dec 22 2020. Tax Year Business Medical Move.

Irs Mileage Rate 2022 Irs Taxuni

Triple I Blog Auto Damage Claims Growing Twice As Fast As Inflation Irc Study

Business Tax Provisions Expiring In 2020 2021 And 2022 Tax Extenders Everycrsreport Com

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

State Conformity To Cares Act American Rescue Plan Tax Foundation

Biden Corporate Tax Increase Details Analysis Tax Foundation

Registration Statement On Form S 1

2022 Ford E Series Cutaway The Muscle To Power Your Business

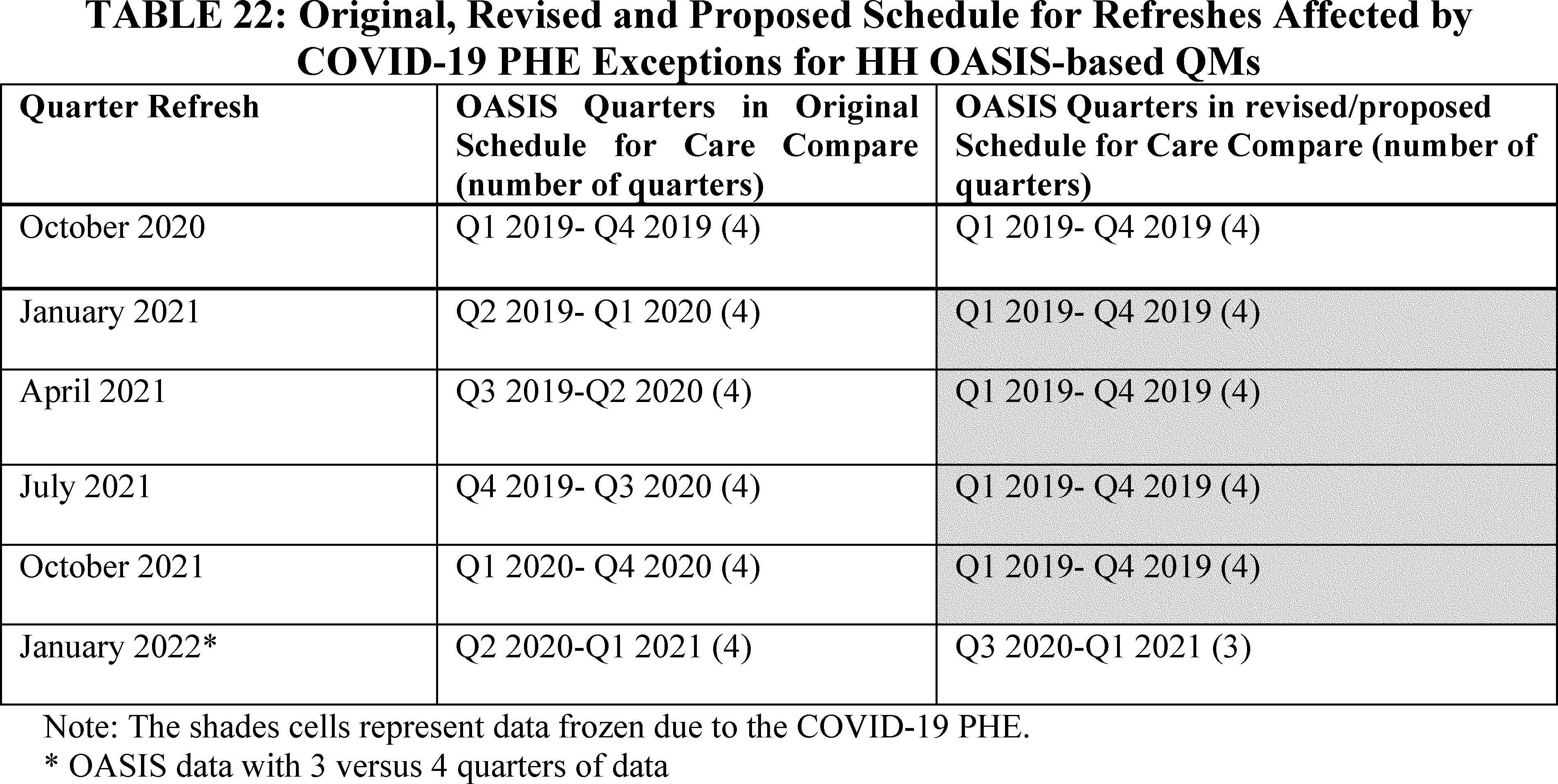

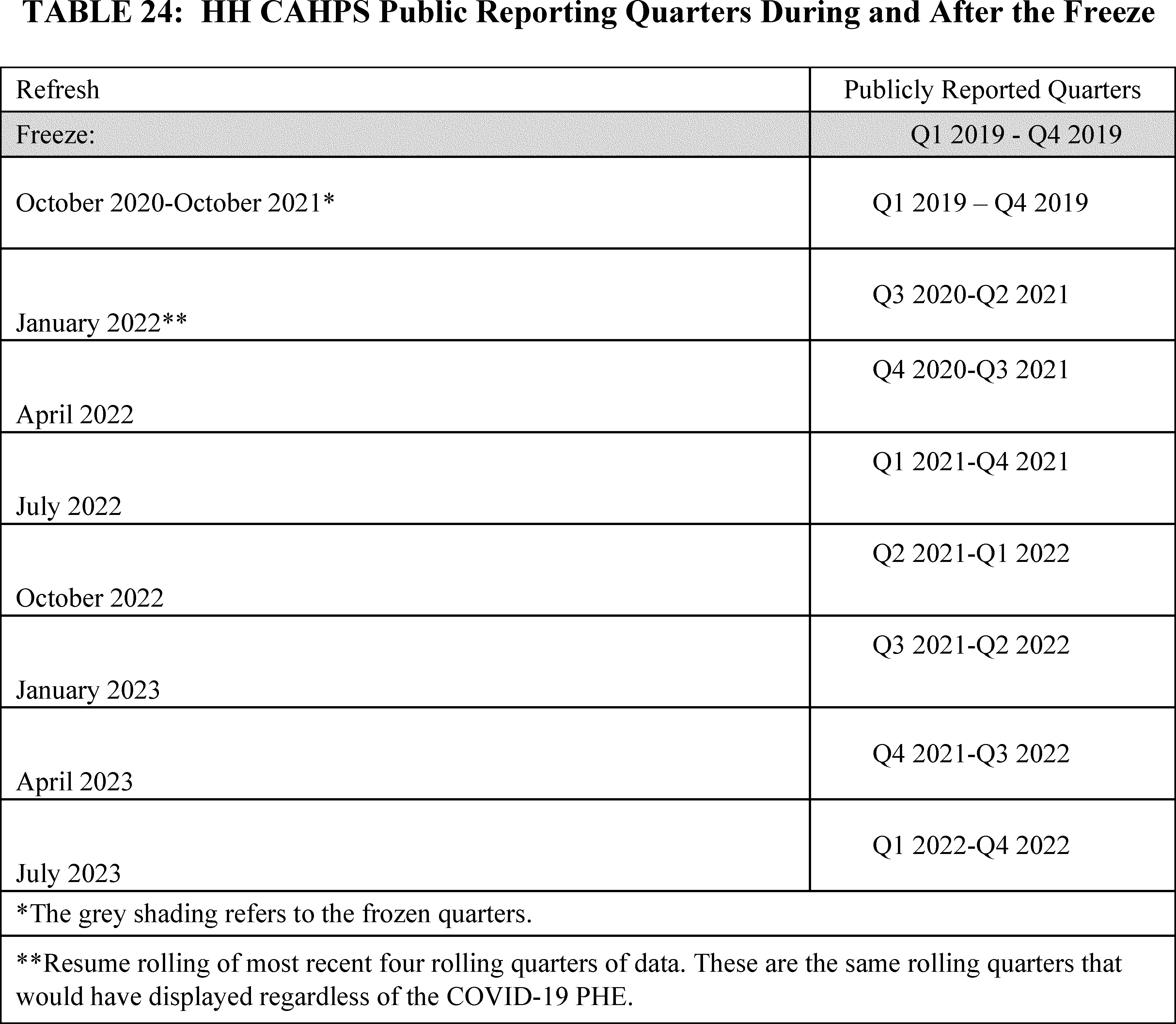

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

Highways Construction Highways Construction Has Seen Sharp Rise During Pandemic Period Gadkari Auto News Et Auto

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

Biden Corporate Tax Increase Details Analysis Tax Foundation

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

Federal Register Medicare Program Fy 2022 Hospice Wage Index And Payment Rate Update Hospice Conditions Of Participation Updates Hospice And Home Health Quality Reporting Program Requirements

2022 Ford E Series Cutaway The Muscle To Power Your Business

Post a Comment for "Irc 2022 Business Mileage"