Limit Business Expense Vs Depreciate Assets 2022

Limit Business Expense Vs Depreciate Assets 2022

These are capital expenses or capital fixed assets. Any business interest income or business interest expense Any net operating loss deduction The deduction for up to 20 of qualified business income from a pass-through business entity Any allowable depreciation amortization or depletion deductions for tax years beginning before 2022 and. Items under that 2500 threshold are expenses. The tax detriment of lower depreciation deductions under the ADS.

Rates Of Depreciation For Income Tax For Ay 2022 23

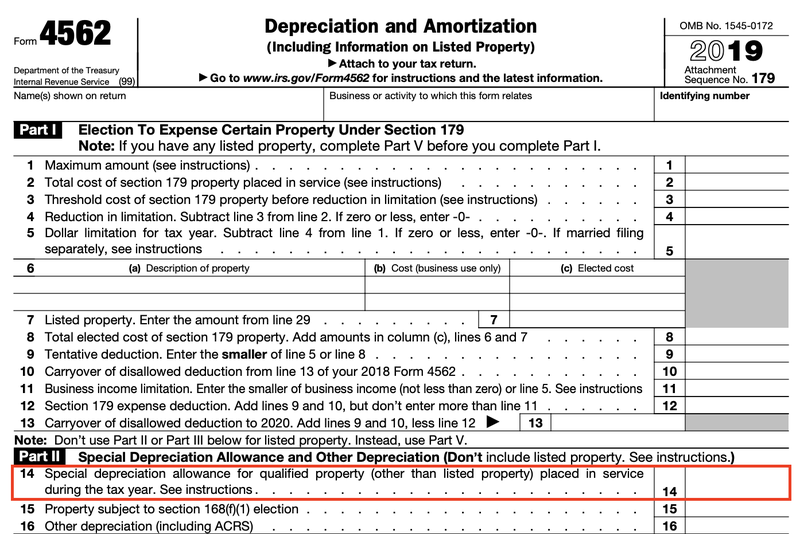

Finally its important to understand that if your business elects out first-year bonus depreciation that would otherwise be.

Limit Business Expense Vs Depreciate Assets 2022. Anything that costs more than 2500 is considered an asset. Income year Low value assets. There are some limitations and qualifications that apply.

The second election deals with deducting. When items are purchased for a business a decision is made whether its an expense that you deduct all of the cost now or you deduct the cost over multiple years depreciation. After 2026 there is no further bonus depreciation.

The business cant claim the excess cost of the car under any other depreciation rules. You must claim depreciation on assets kept in your business for longer than a year. The new law changed depreciation limits for passenger vehicles placed in.

Ato Depreciation Atotaxrates Info

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Depreciation Rate As Per Income Tax Act For Ay 2022 23 New Tax Route

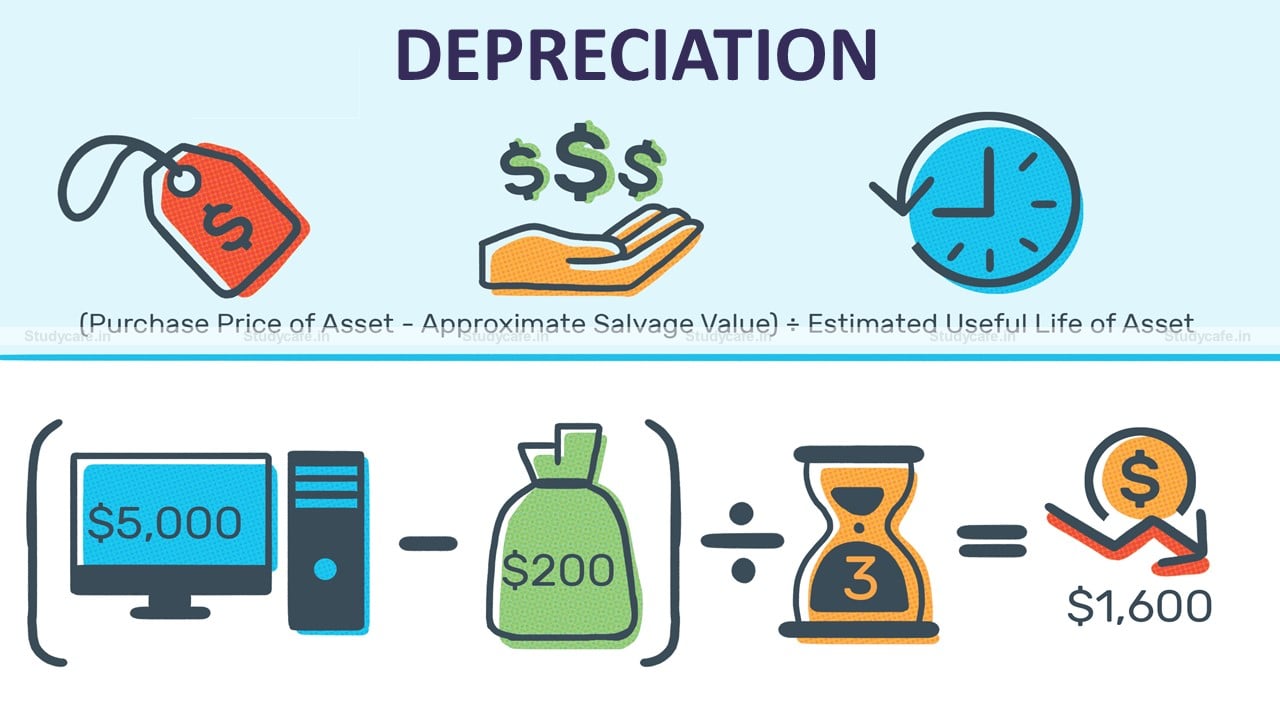

How To Calculate Depreciation Expense For Business

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

What Is Bonus Depreciation A Small Business Guide The Blueprint

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

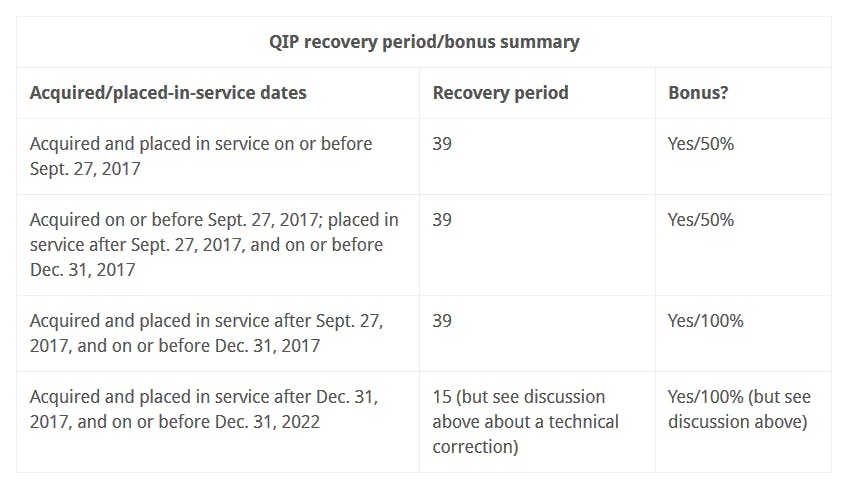

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Depreciation Rate Formula Examples How To Calculate

A Guide To Depreciation Rates As Per Income Tax For Ay 2020 21

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

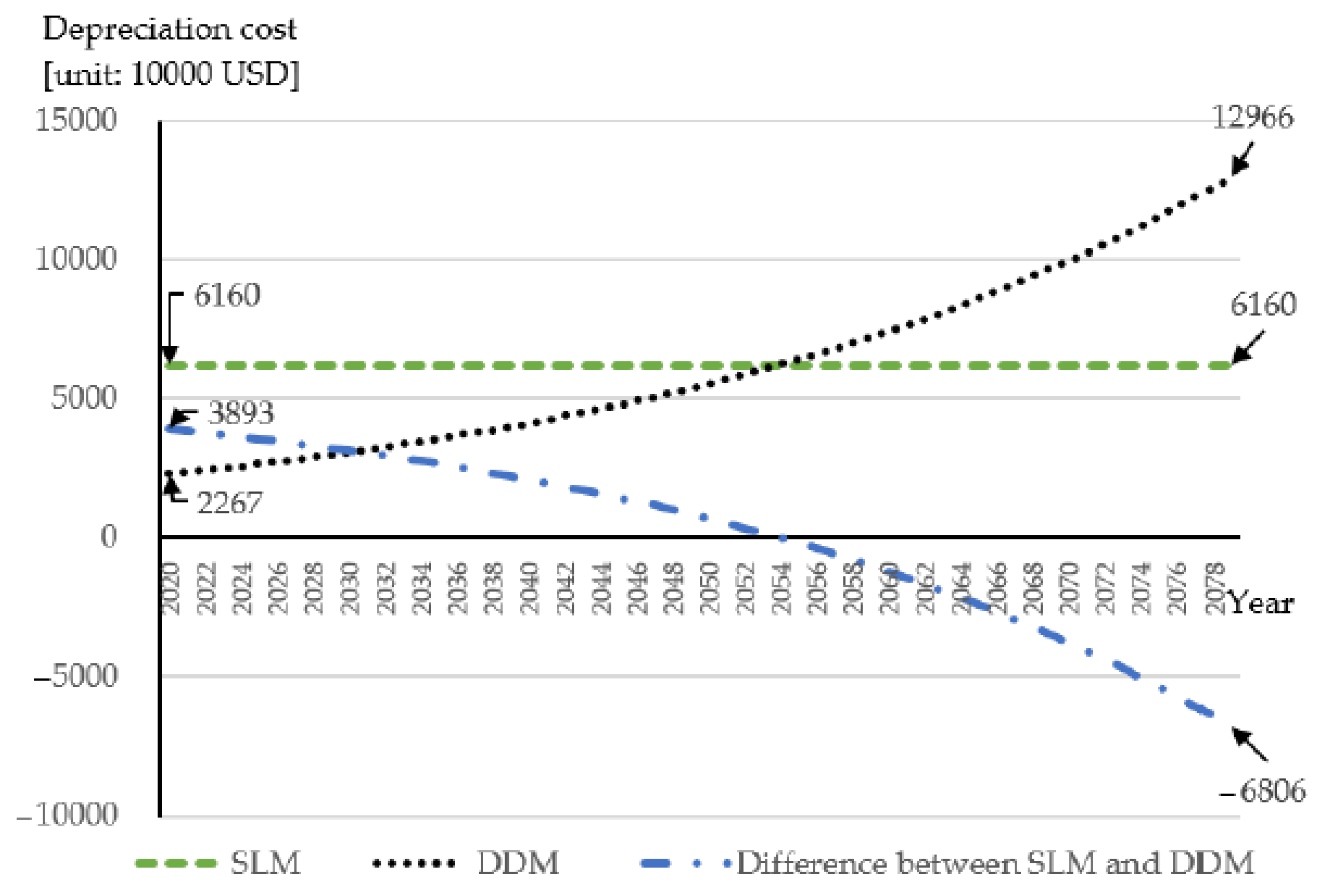

Sustainability Free Full Text Effect Of Depreciation Method For Long Term Tangible Assets On Sustainable Management From A Nuclear Power Generation Cost Perspective Under The Nuclear Phase Out Policy Html

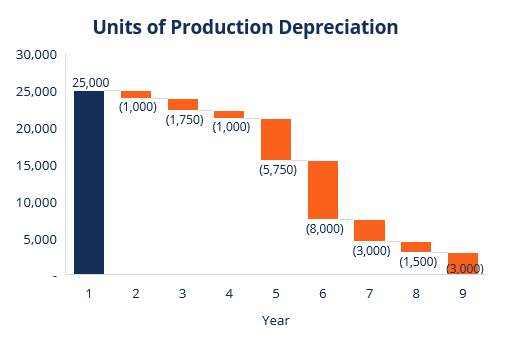

Depreciation Methods 4 Types Of Depreciation You Must Know

Ato Depreciation Atotaxrates Info

Depreciation Definition Types Example Tally Solutions

Straight Line Depreciation Accountingcoach

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Depreciation Rate As Per Income Tax Act For Fy 2021 22 New Tax Route

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Post a Comment for "Limit Business Expense Vs Depreciate Assets 2022"