Are Business Miles Driven In 2022 Deductible

Are Business Miles Driven In 2022 Deductible

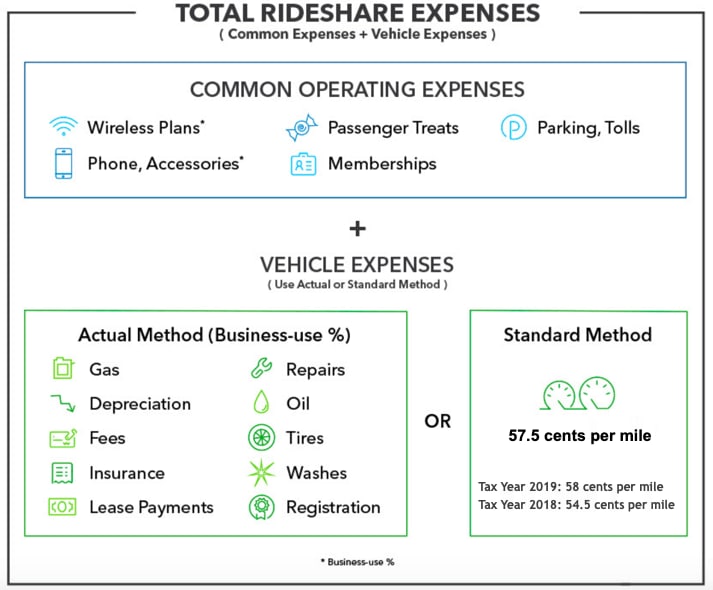

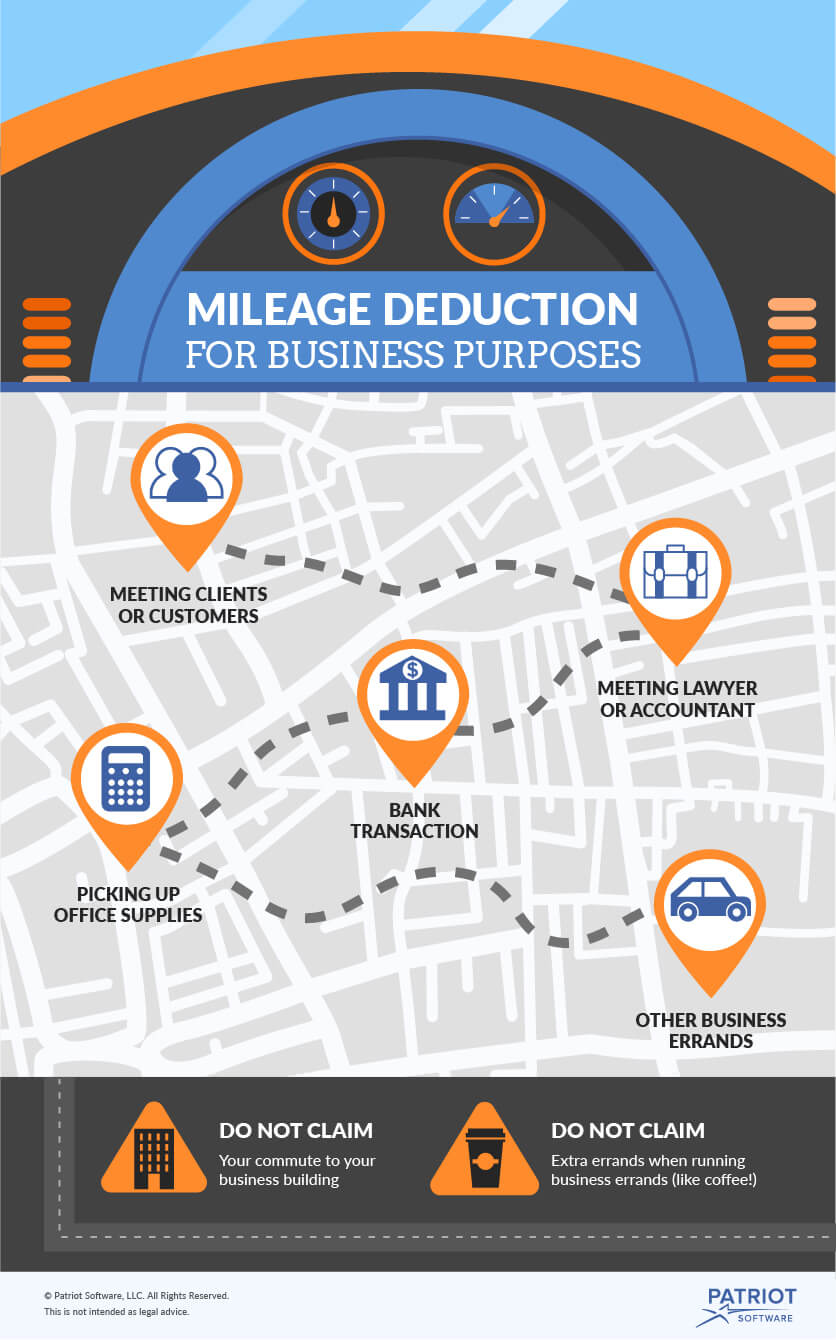

For 2021 and 2022 you can deduct 100 of your meal cost from a restaurant if you are out of town for work purposes. The standard federal mileage rate in 2020-2022 are. If your home office is your main business location then trips from home to other business locations are deductible. Include gas oil repairs tires insurance registration fees licenses and depreciation or lease payments attributable to the portion of the total miles driven that are business miles.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

The IRS is very clear on this saying You cant deduct amounts that you approximate or estimate Heres an example of what can happen if you estimate.

Are Business Miles Driven In 2022 Deductible. For example depositing or cashing checks. Mileage expenses for certain employees. Discussing work with an existing or prospective client.

If you work from your home all your miles are typically deductible anytime you get in your car and drive for any purpose related to your business. We will add the 2022 mileage rates when the IRS releases them. Rates in cents per mile.

565 cents per mile for business miles driven down 5 cents from 2020 rates. With the standard mileage rate you take the deduction of a specified number of cents for every business mile you drive. 56 cents per mile.

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

Irs Mileage Rate 2022 Irs Taxuni

2021 Standard Irs Mileage Rates For Automobile Operation

Irs Raises Mileage Rates For 2019 Accounting Today

The Deductible Mileage Rate For Business Driving Decreases For 2020

What Business Mileage Is Deductible

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

How To Calculate Mileage Deductions On Your Tax Return

Your Beater Car Can Make You A Lot Of Money In Reimbursements

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

Standard Mileage Vs Actual Expenses Pros And Cons Financially Simple

The Cents Per Mile Rate For Business Miles Decreases Again For 2021 Mlr

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How To Calculate Your 2021 Income For Health Insurance Stride Blog

How To Calculate Your 2021 Income For Health Insurance Stride Blog

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc Travis Raml Cpa Associates Llc

How To Obtain Small Business Tax Deductions

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

2021 Standard Irs Mileage Rates For Automobile Operation

Post a Comment for "Are Business Miles Driven In 2022 Deductible"