Expenses For Business Use Of Your Home 2022

Expenses For Business Use Of Your Home 2022

There are 3 ways to do this keeping a logbook claiming 25 of the vehicles running costs or adding up the actual. Companies claiming expenses for the use of your home. Then you sell your home and your overall gain from the sale of that home minus original cost was 10000. Access the Home office expenses calculator.

Claiming Home Office Expenses In 2022 Ceebeks

Change expense categories or add new ones to fit your business.

Expenses For Business Use Of Your Home 2022. If your business turnover is less than 85000 for 20212022 youll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. For more information see Using the Simplified Method under Figuring the Deduction later. You use the space only to earn your business income and you use it on a regular and ongoing basis to meet your clients customers or patients.

In addition youll need to keep records to support the amount of your home office deduction. The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children NCMEC. You can claim all your business expenses but there are specific requirements for claiming a deduction for occupying a portion of your home for the purposes of trade.

And is working from home due to the. Additional Vehicle Use Deductions. A Direct expenses b.

Deducting Home Office Expenses Journal Of Accountancy

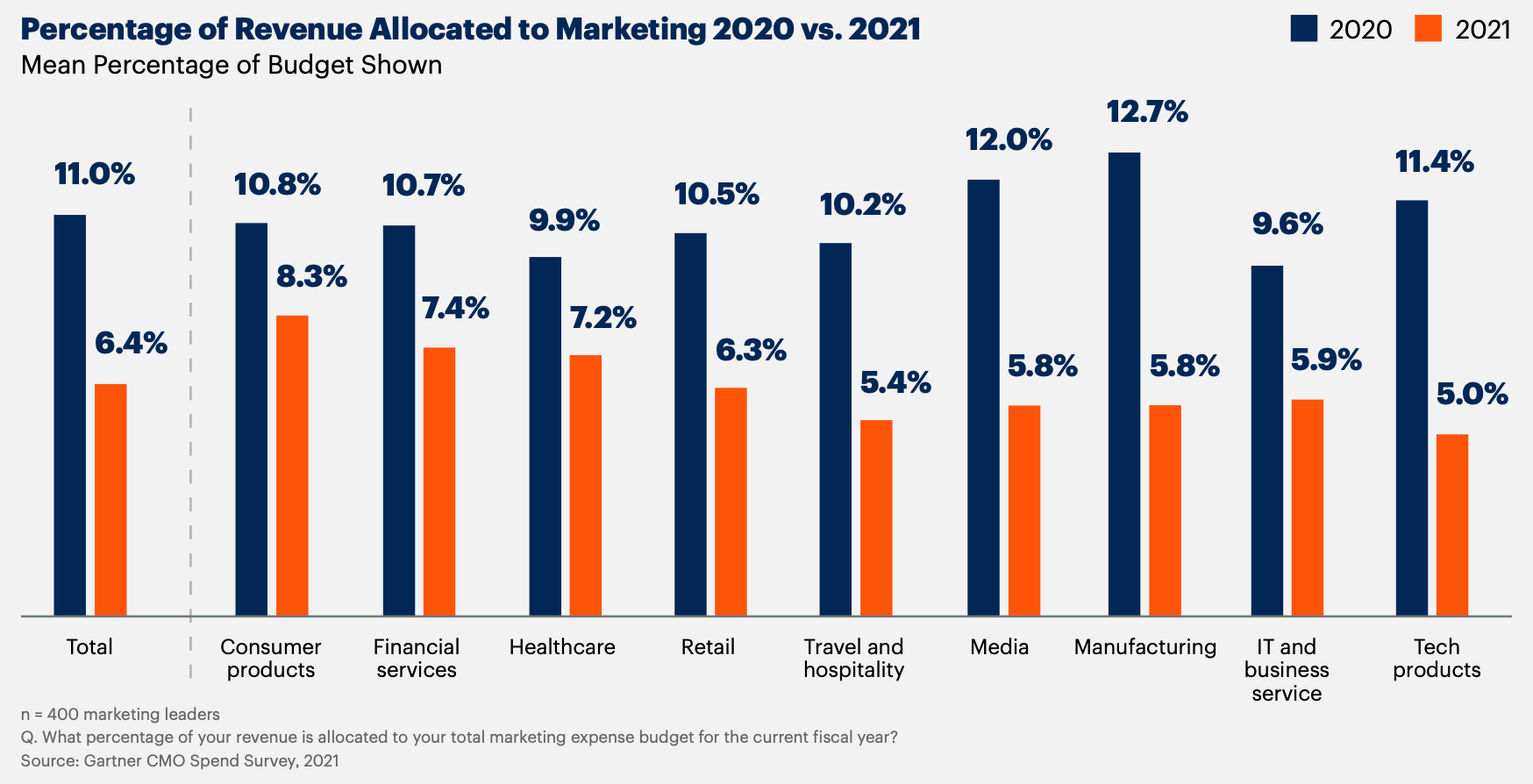

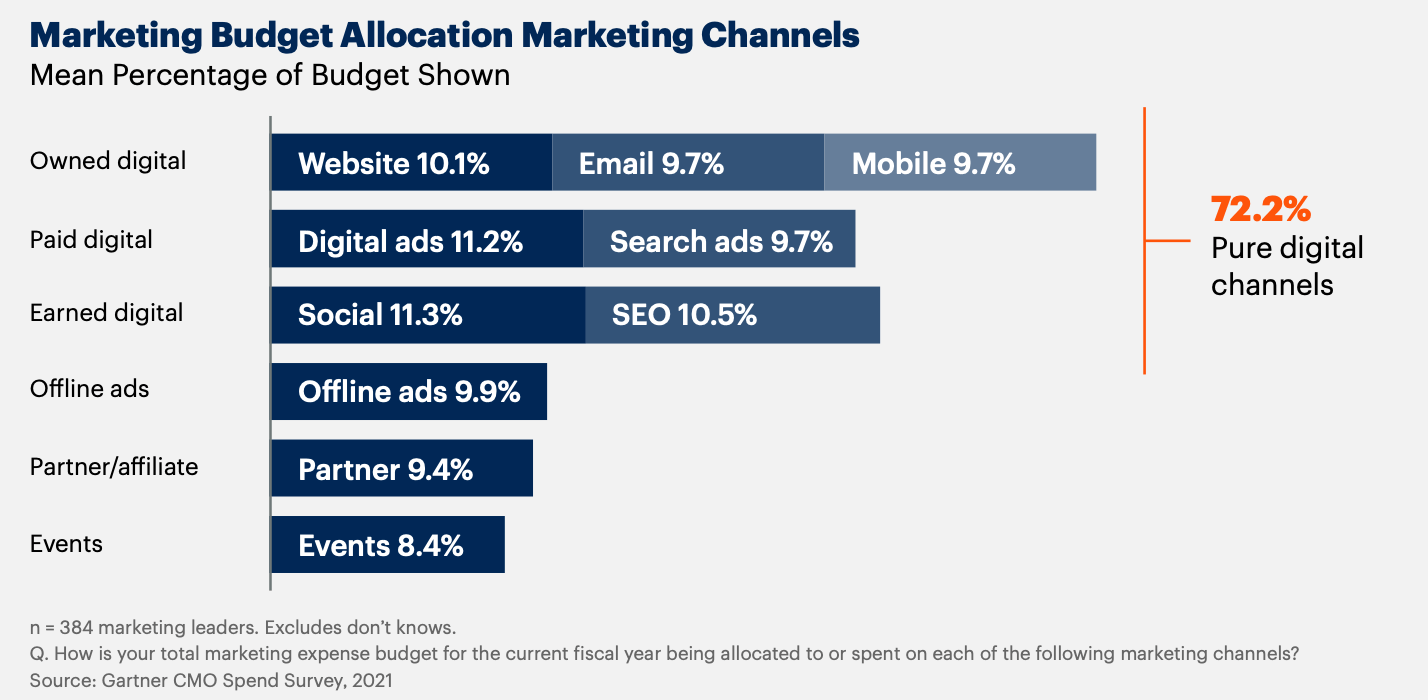

Digital Marketing Trends 2022 25 Practical Recommendations To Implement

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

There S A Tax Deduction For People Working From Home But It Won T Apply To Most Remote Workers During The Pandemic Business Insider India

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png)

How To File Your Taxes As Head Of Household

100 Success Rate Business Ideas That Can Be Started With 1 Lakh In 2022

App Development Cost 2021 Business Of Apps

Amazon In Buy Tax Year Diary 2021 2022 For Small Business Accounts Book Self Employed Record Income And Expense For Small Home Businesses 7 X 10 Inch Book Online At Low Prices In India Tax

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

Amazon Com Tax Year Diary 2021 2022 For Small Business Accounts Book Self Employed Record Income And Expense For Small Home Businesses 7 X 10 Inch 9798690811389 Independent Publishing Ethan Books

House Prices Will Even Out In 2022 Economists Say

Medical Cost Trend Behind The Numbers 2022 Pwc

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Digital Marketing Trends 2022 25 Practical Recommendations To Implement

Influencer Marketing Costs 2021 Business Of Apps

2022 Accounting Ledger Book Track Your Income And Expenses For Personal Small Business Or Home Based Businesses 100 Pages 8 5 X 11 Baillaprint Amazon Com Au Books

Healthcare Industry In India Indian Healthcare Sector Services

Supercharge Business Processes Like Expense Tracking With Hybrid Low Code Lansa

2021 2022 Home Office Tax Deductions Cpa Practice Advisor

Post a Comment for "Expenses For Business Use Of Your Home 2022"