Irs Business And Promotion Gifts 2022

Irs Business And Promotion Gifts 2022

The decrease in the estate and gift tax exemption amounts will be effective at the beginning of 2022. Unlike with business losses though taxpayers can generally only deduct applicable expenses up to the amount of the hobby income. So if you give a set of five promotional coffee mugs that cost 600 each to a client or prospect the cost of the collection is 30. 334 Tax Guide for Small Business.

One such area is an IRS notice.

Irs Business And Promotion Gifts 2022. Gift Cost Limits. Reduce the estate tax exemption amount to 3500000 minus past reportable gifts a steep decrease from the current 2021 exemption amount of 11700000 per person. First the basics what are business gifts under the tax law.

IRS Publication Number. A gift to a company that is intended for the eventual personal use or benefit of a particular person or a limited class of people will be considered an indirect gift to that particular person or to the individuals within that class of people who receive the gift. Any property held in trust on January 1 2022 that has been continuously held in trust for more than 30 years as of such date shall be treated as transferred pursuant to subsection a on such date.

15000 per person per. Potentially limited to 50 Percent per October 2020 final IRS regulations formerly 100 deductible. The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children.

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Table Of Experts Tax Outlook For 2021 San Antonio Business Journal

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

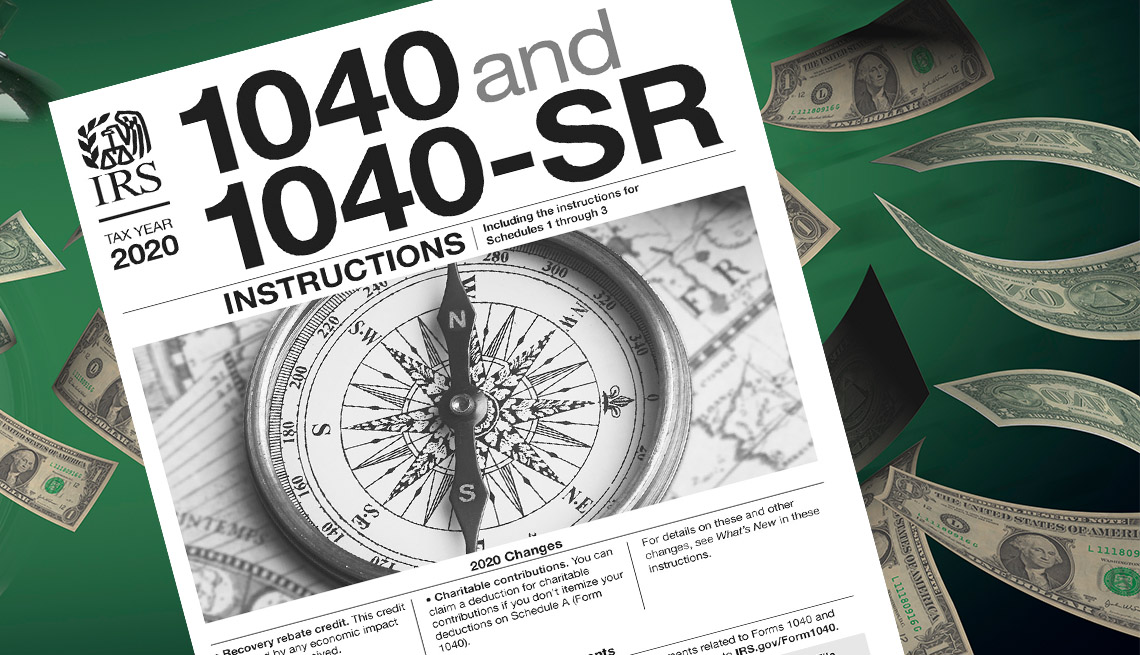

Publication 463 2020 Travel Gift And Car Expenses Internal Revenue Service

Sba Aca Irs What Qualifies As A Small Business Workest

Oscar Gift Bags 2021 A History Of Distinctive Assets

Amazon Com Funny Tax Preparer Mug Coffee Cup Cpa Certified Public Accountant Secretary Tax Season Irs Business Preparation Gift For Colleagues Mugs Coworker Employee Home Kitchen

Internal Revenue Service Irs U S Government Bookstore

When Can I Deduct Business Meal And Entertainment Expenses Under Current Tax Rules Marketwatch

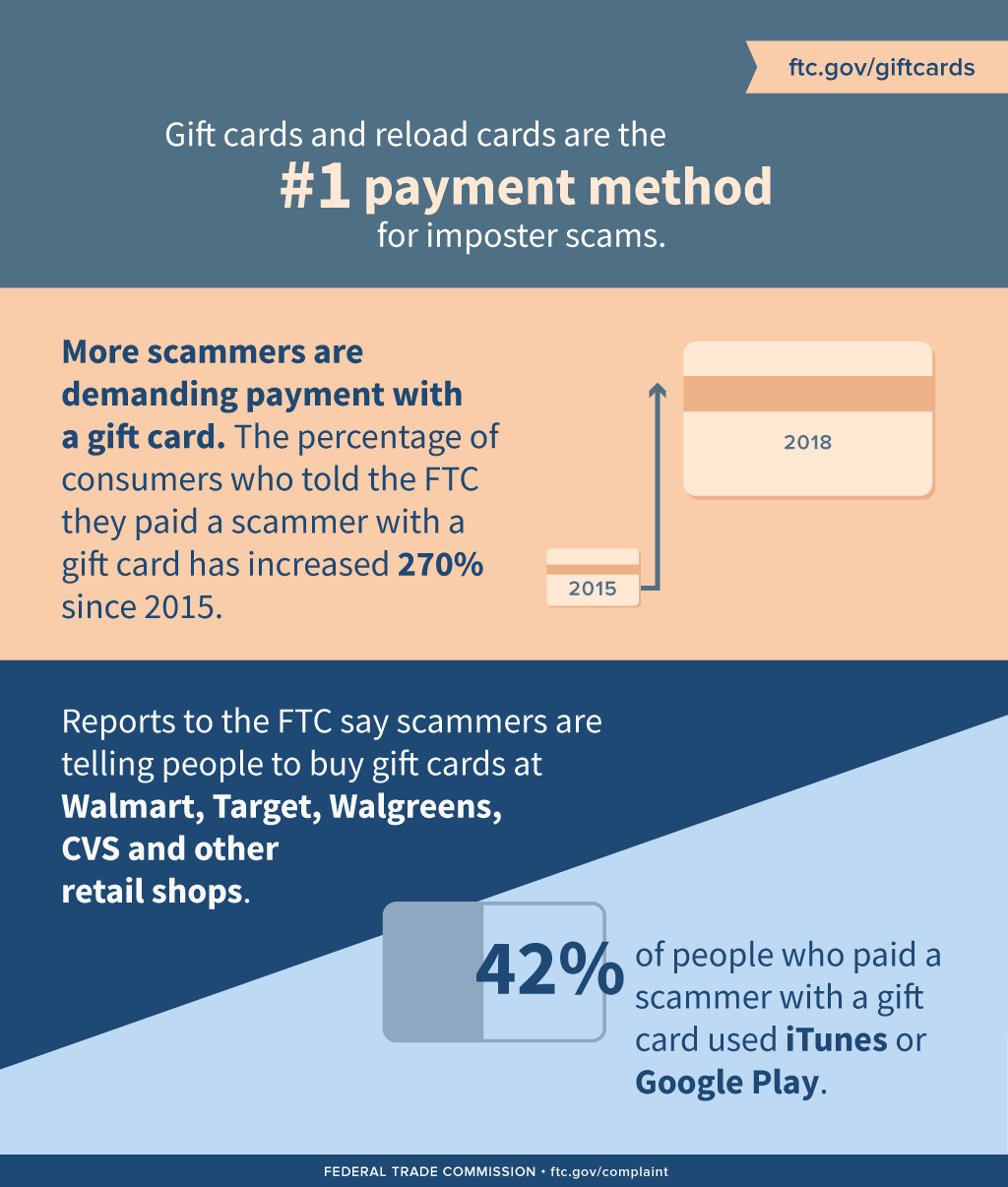

Scammers Demand Gift Cards Ftc Consumer Information

Talk To The Irs Here S How To Make Your Voice Heard On Tax Issues

Small Business Tax Tips For 2021 Hp Tech Takes

Internal Revenue Service Irs U S Government Bookstore

Stimulus Check Scams Irs Says Fraud Attempts At Record High Money

How To Claim Missing Stimulus Money On Your 2020 Tax Return

Uncovering Bribes Hidden In Books And Records Journal Of Accountancy

Those Not Really Irs Calls Ftc Consumer Information

Post a Comment for "Irs Business And Promotion Gifts 2022"