Where Do You Report Business Expenses On Form 1040 For 2022

Where Do You Report Business Expenses On Form 1040 For 2022

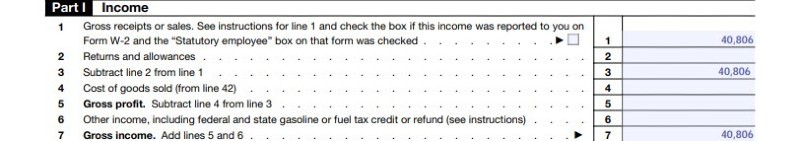

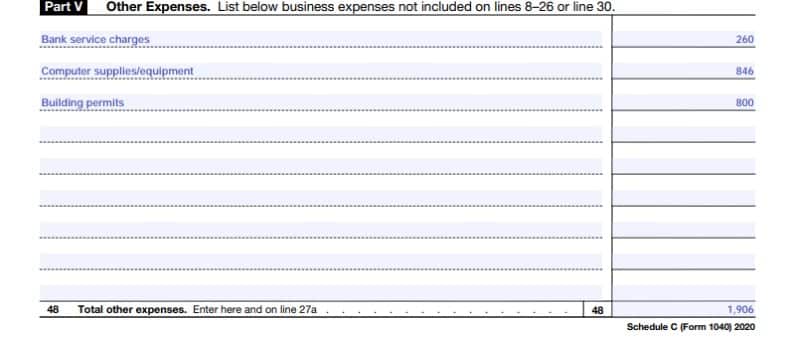

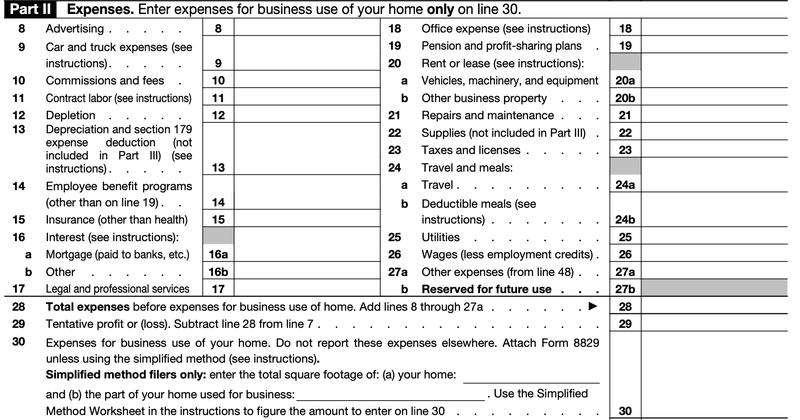

2019 IRS Form 1040 Black Lung Benefits etc List sources. Each year sole proprietors have the chore of preparing and filing Schedule C with their 1040 to show the IRS whether their business had a taxable profit or a deductible loss. Form 1040 Schedule EIC Earned Income Tax Credit. Business expenses are those that are ordinary and necessary to operate run the business.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

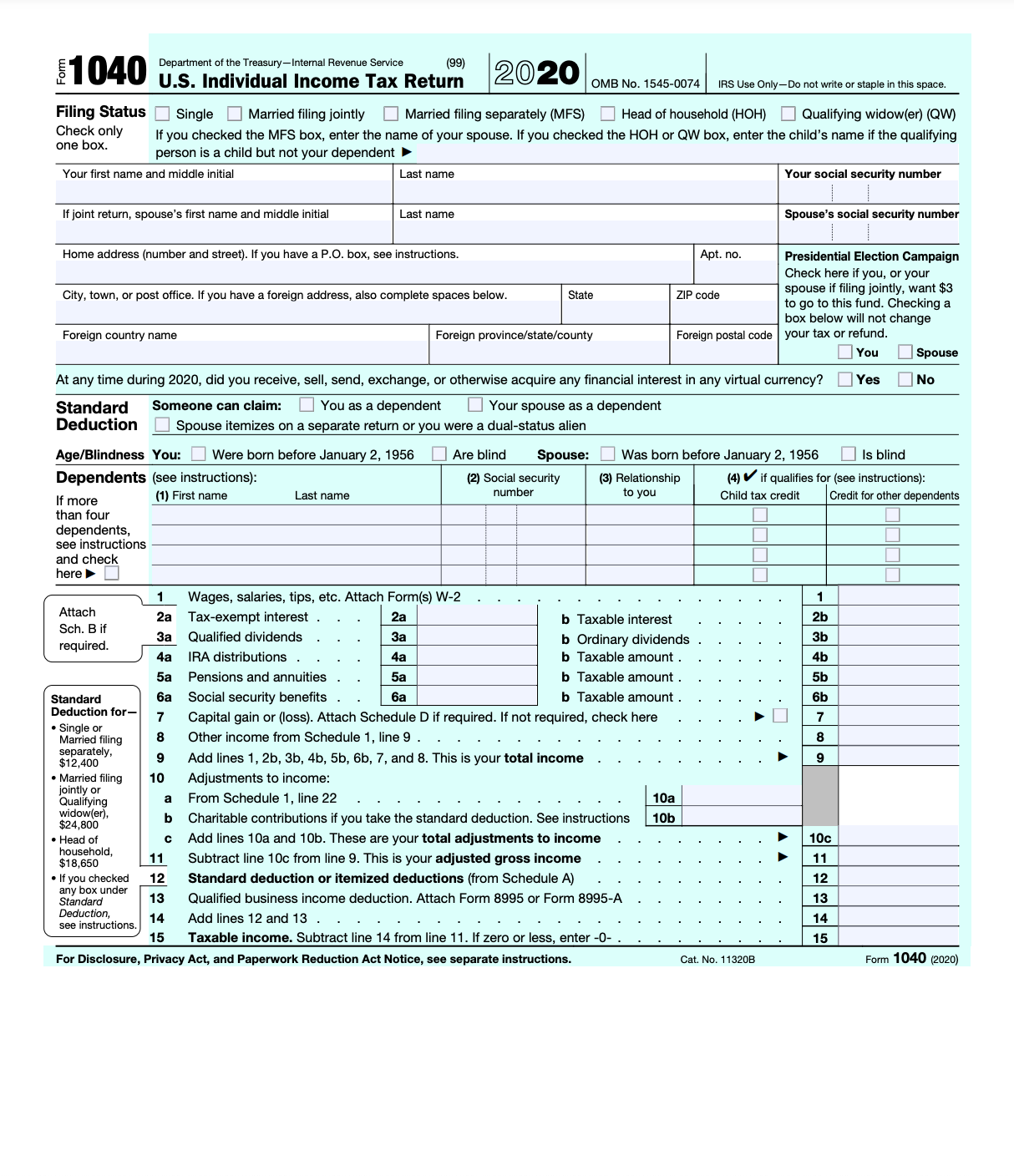

Form 1040 U S Individual Tax Return Definition

Like other types of businesses partnerships have a number of deductible expenses.

Where Do You Report Business Expenses On Form 1040 For 2022. Form 6251 Alternative Minimum Tax. Helps determine your business profit by subtracting business expenses from your income. Instead the profits pass through the businesses to their owners who report business income or losses on their personal tax returns.

You can pay tax estimates online at the IRS site thus you do not have to file this Form 1040-ES. Updated April 15 2021. Youll use the typical IRS Form 1040 to report your earnings.

Business 1065K-1 preparation Recipient of Artnership K-1 entries into Personal 1040 interview Personal 040 entry of. When you should file your taxes. _____ _____ Total Income in 2019 MUST include values from previous page PO.

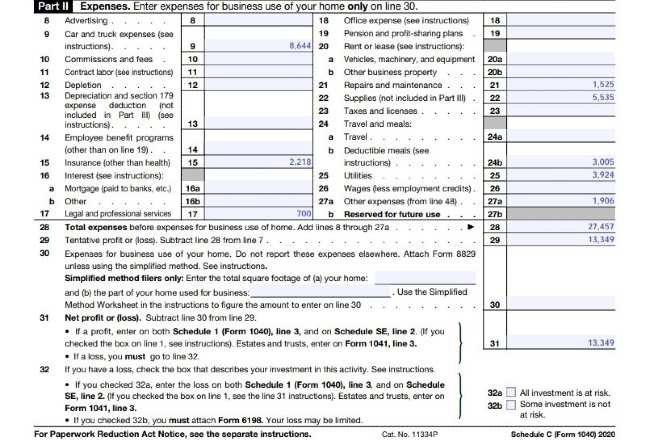

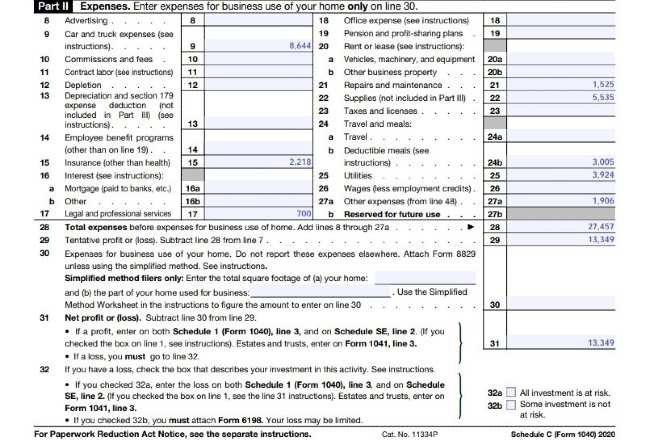

Step By Step Instructions To Fill Out Schedule C For 2020

1040 2020 Internal Revenue Service

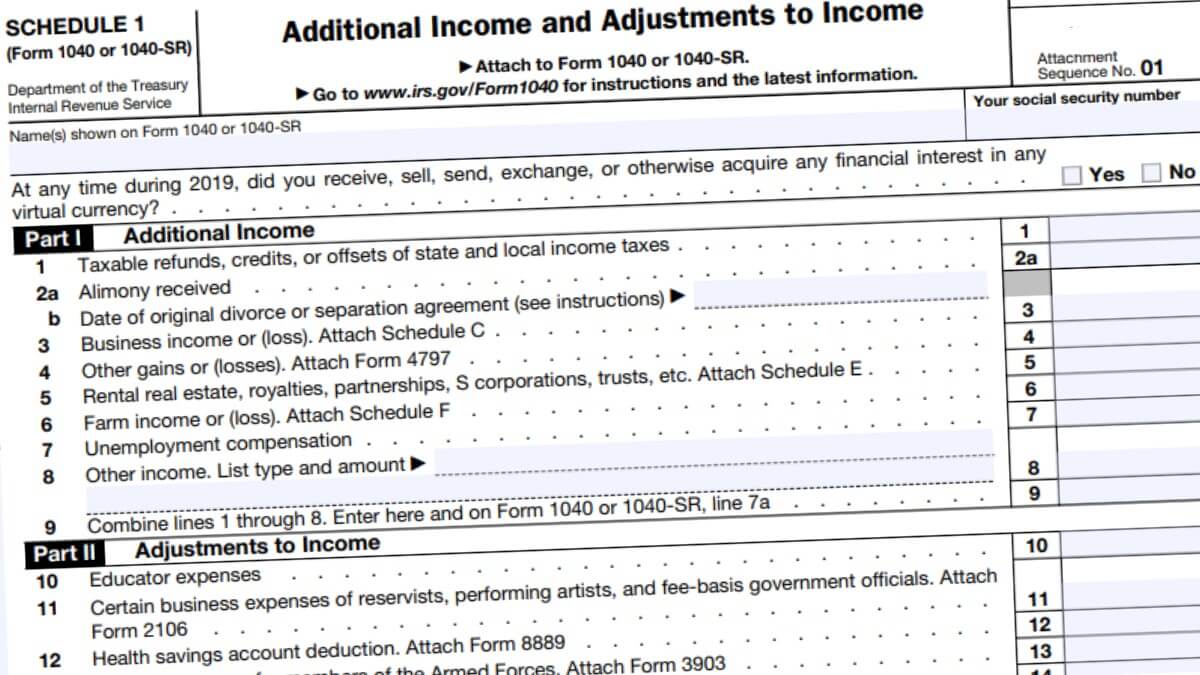

Schedule 1 2022 Irs Forms Zrivo

Step By Step Instructions To Fill Out Schedule C For 2020

Step By Step Instructions To Fill Out Schedule C For 2020

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Step By Step Instructions To Fill Out Schedule C For 2020

Form 1040 U S Individual Tax Return Definition

What Is Irs Form 1040 Overview And Instructions Bench Accounting

Step By Step Instructions To Fill Out Schedule C For 2020

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Everything You Need To Know About Filing 2020 Taxes For 2021

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

:max_bytes(150000):strip_icc()/ScheduleEp1-ac9417bba517452f8c66af4a5780fc16.png)

Form 1040 Schedule E What Is It

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

When Is The Earliest You Can File Your Tax Return

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Post a Comment for "Where Do You Report Business Expenses On Form 1040 For 2022"