Can A Business Deduct Contributions To An Employee Benefit Plan 2022

Can A Business Deduct Contributions To An Employee Benefit Plan 2022

100 HSA catch-up contributions age 55 or older 1000. An embedded individual deductible can be no less than the minimum family deductible. Page 2 of 3. The plan must specifically state that contributions or benefits cannot exceed certain limits.

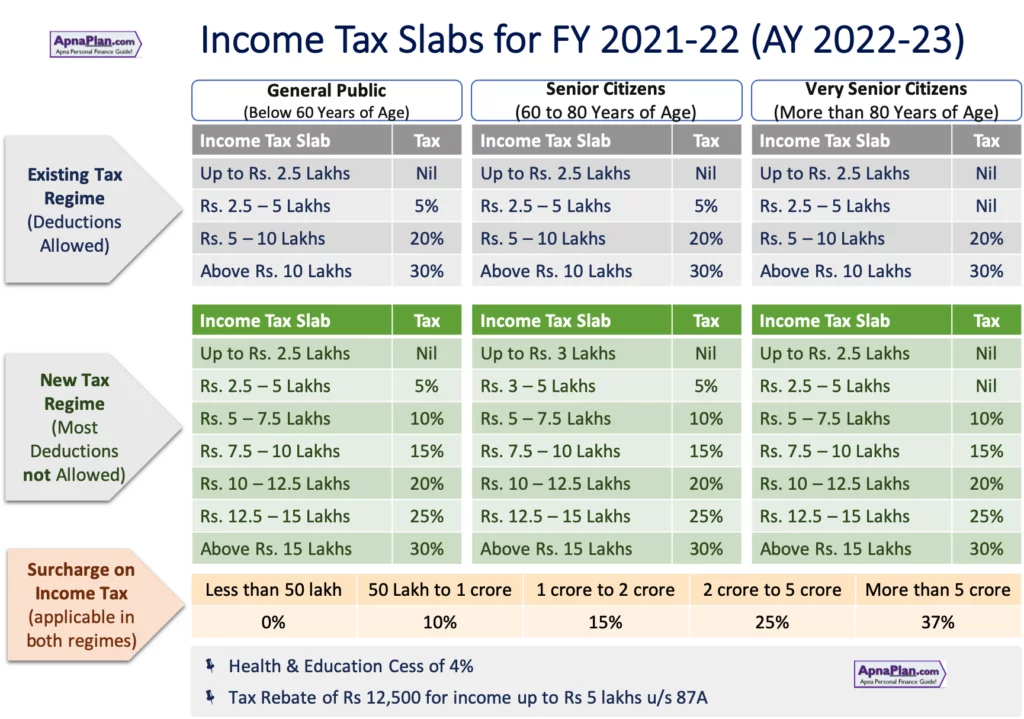

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

This can be an easy supplemental benefit that costs the employer nothing but provides the convenience for employees to make payroll contributions towards the cost of college for their children which is viewed very favorably as an employee incentive.

Can A Business Deduct Contributions To An Employee Benefit Plan 2022. Annual HSA Contribution Limit employer and employee Self-only. The Limits and Plan Design Maximums are as follows. Well you can make it just as easy for college costs by offering payroll deduction for your states 529 College Savings Plan.

The High Deductible plan may be a great option for you. Change Annual HSA Contribution Limit employer and employee Self-only. Annual Catch-Up Contribution limit age 55 to 65 1000.

All types of businesses can set it up however a prudent decision needs to be made based on the goals and the profitability of the business. Also employers that allow employees to make pre-tax HSA contributions should update their plan communications for the increased contribution limits. Minimum Annual HDHP Deductible.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Nps Income Tax Benefits Fy 2020 21 Old New Tax Regimes

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Top 10 List Of Income Tax Deductions For Ay 2021 22 For Salaried Employees Tax Benefits On Payments Investments And Incomes The Financial Express

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

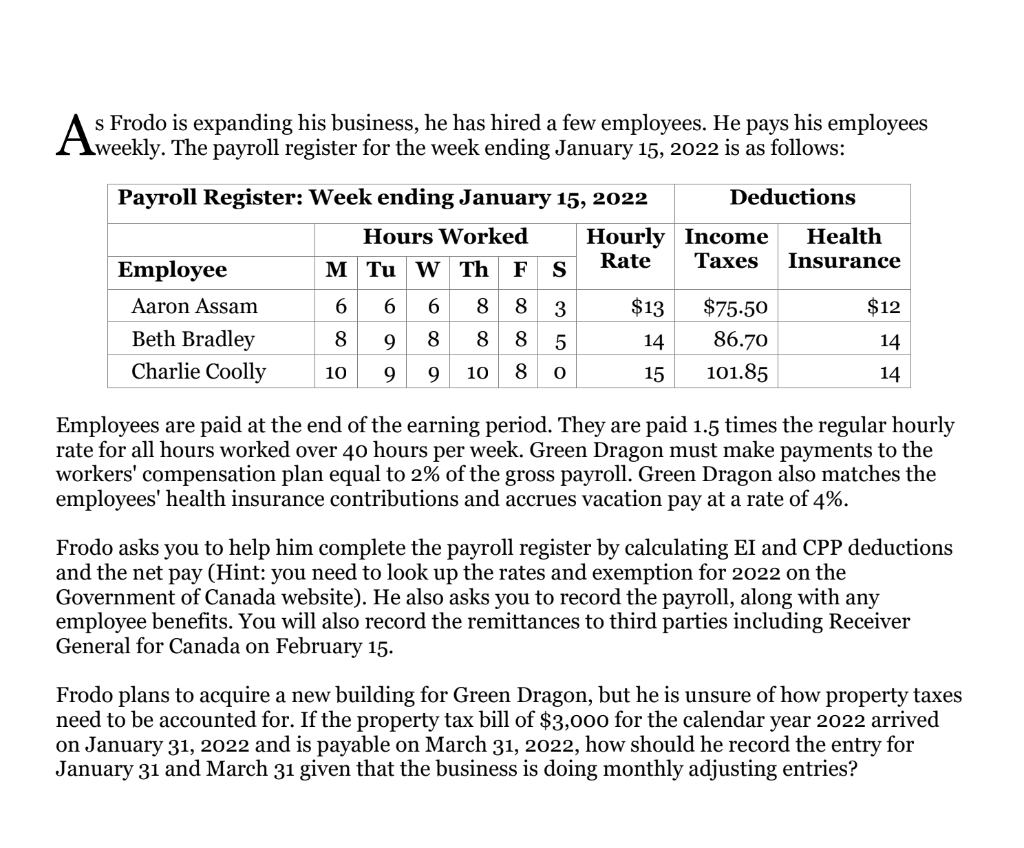

Requirements The Payroll Register For The Week Chegg Com

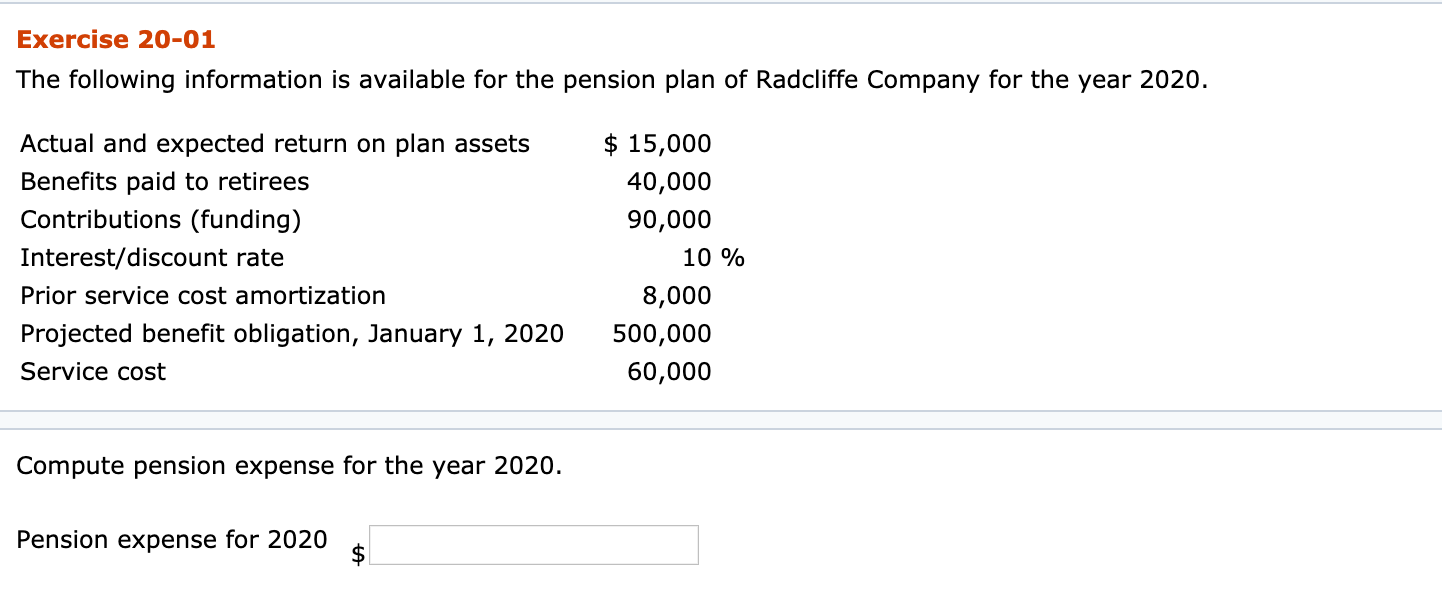

Solved Exercise 20 01 The Following Information Is Available Chegg Com

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

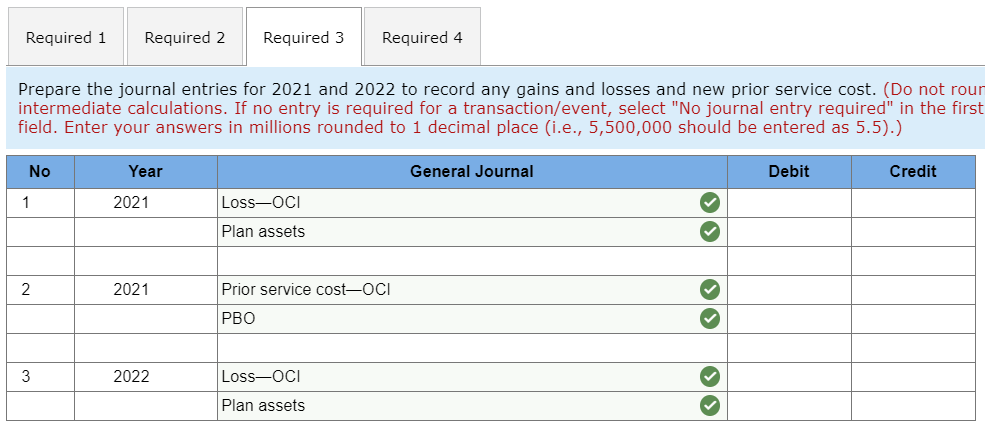

Solved The Kollar Company Has A Defined Benefit Pension Chegg Com

Income Tax Benefits Available To Salaried Persons For A Y 2022 23

Mercer Projects 2022 Ira And Saver S Credit Limits Mercer

Govt To Pay 24 Of Wages Towards Epf Till March 31 2022 Will You Be Eligible For This Benefit Business News

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Irs Announces 2022 Limits For Hsas And High Deductible Health Plans

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Post a Comment for "Can A Business Deduct Contributions To An Employee Benefit Plan 2022"