Can I Deduct Self Employed Business Expenses In 2022

Can I Deduct Self Employed Business Expenses In 2022

There are several exceptions to this 50 rule. However self-employed individuals have a greater control over their tax rate because they are the primary decision makers. Talking shop with them over a meal is bound to help you learn about your industry and catch up on best practices. If you use the cash method of reporting income and expenses you can only deduct expenses you paid in the year.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

If your employee spent his own money for your business the reimbursements can also be your business expense if its related to your business activities.

Can I Deduct Self Employed Business Expenses In 2022. Self-employed business owners can deduct costs for their own education subject to certain limitations in the same way as individual taxpayers. Before business meal deductions were capped at 50. If you use your car for both business purposes and personal reasons you must separate the business driving and personal driving.

Businesses can deduct 100 percent of business meals for 2021 and 2022 but not for 2020 instead of the usual 50 percent. Tuition books supplies lab fees and similar items. You should also have digital breadcrumbs proving your meals were actual business expenses.

What business expenses can I deduct. Yes self-employed individuals and business owners have to pay taxes just like any other salaried employees. For a self-employed person this can be anyone in your line of work.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

2021 Tax Deductions For Self Employed Business Vehicles Cpa Practice Advisor

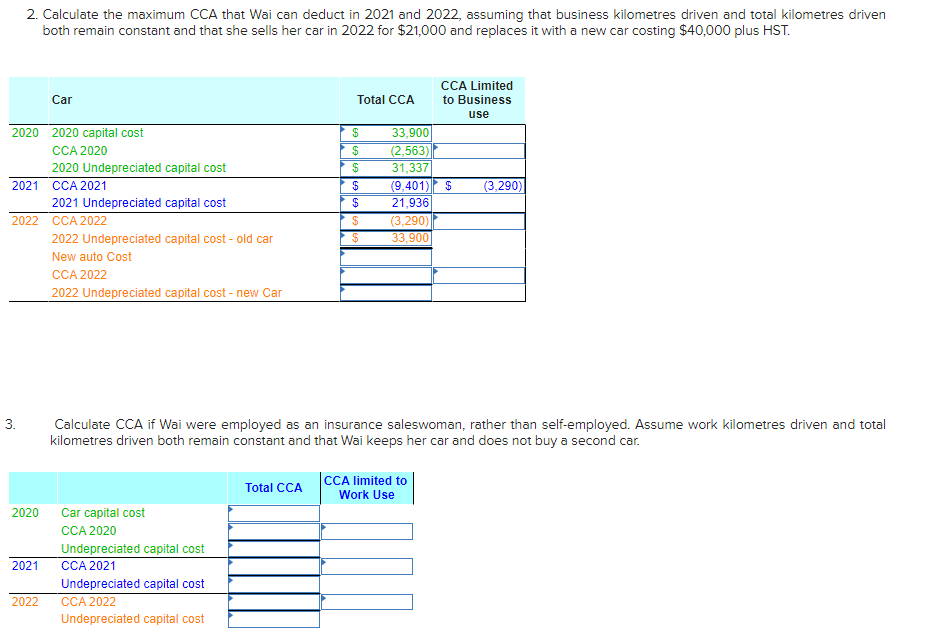

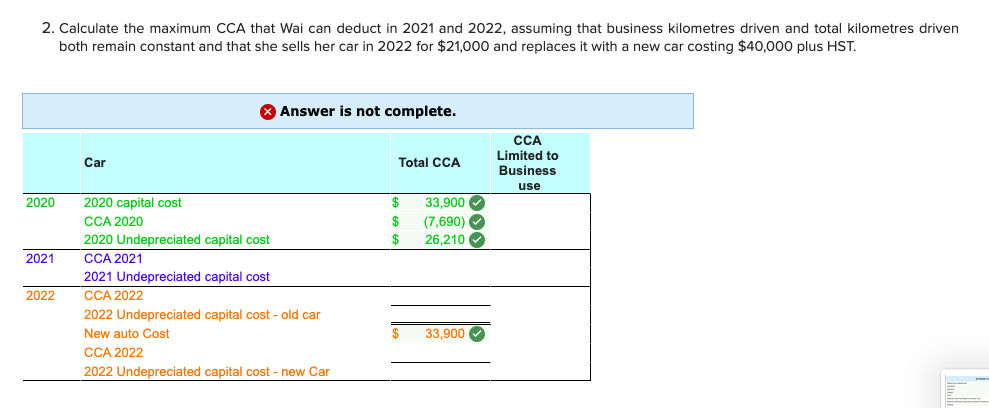

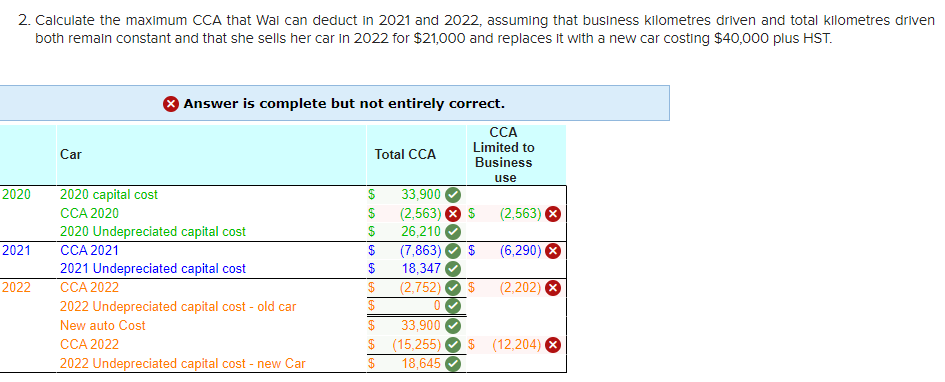

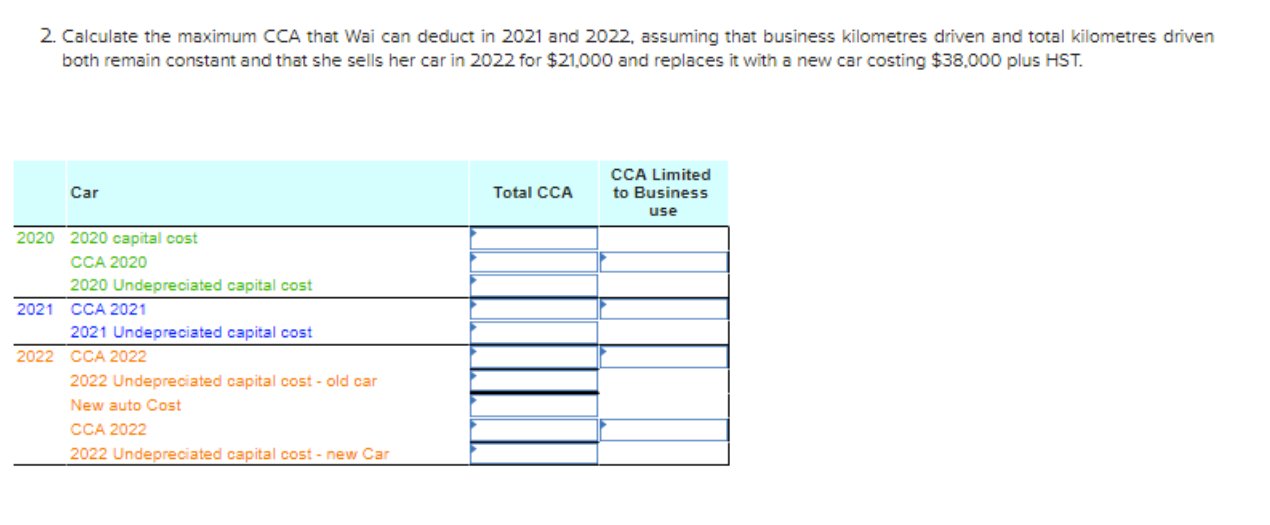

Wai Yeung Is A Self Employed Insurance Saleswoman Chegg Com

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Solved Wai Yeung Is A Self Employed Insurance Saleswoman Chegg Com

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

Wai Yeung Is A Self Employed Insurance Saleswoman Chegg Com

Nps Income Tax Benefits Fy 2020 21 Old New Tax Regimes

Solved Wai Yeung Is A Self Employed Insurance Saleswoman Chegg Com

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Your 2021 Income For Health Insurance Stride Blog

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

2021 2022 Home Office Tax Deductions Cpa Practice Advisor

How To Deduct Meals And Entertainment In 2021 Bench Accounting

Post a Comment for "Can I Deduct Self Employed Business Expenses In 2022"