Does Mississippi Still Allow Employee Business Expenses On 2022 State Tax Return

Does Mississippi Still Allow Employee Business Expenses On 2022 State Tax Return

But dont toss those receipts just yet. The American Rescue Plan was signed into law on March 11 2021. Employees file this form to deduct ordinary and necessary expenses for their job. The Public Employees Retirement System of Mississippi PERS p roudly serves the state of Mississippi by providing retirement benefits for individuals working in state government public schools universities community colleges municipalities counties the Legislature highway patrol and other such public entities.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

They must complete Form 2106 Employee Business.

Does Mississippi Still Allow Employee Business Expenses On 2022 State Tax Return. If the revenue targets above are met in years 2023 through 2025 the Iowa deduction will be 100 percent of the federal QBI deduction. Taxpayers must elect to deduct the sales and use tax on their federal return to make this choice on their state return. An ordinary expense is one that is common and accepted in your field of trade business or profession.

Update March 15 2021. Even if you cannot deduct your unreimbursed business expenses for your federal return you may still be able to deduct them for your state return. The Kentucky General Assembly would have to adopt this amendment to the Internal Revenue Code by amending KRS Chapter 141 to enact the particular provision at issue before Kentucky taxpayers could increase their business interest expense deduction in calculating their Kentucky income taxes.

A necessary expense is one that is helpful and appropriate for your business. Estimate your current 2020 January 1 - December 31 2020 Taxes - due April 15 2021 - with this 2020 Tax Calculator and Refund Estimator. State Employees Teachers.

State Conformity To Cares Act American Rescue Plan Tax Foundation

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

2021 State Business Tax Climate Index Tax Foundation

/ScreenShot2021-02-11at4.25.46PM-efc1304fa898450db5381a052fb0fcfe.png)

Form 4868 Application For Extension Definition

What Are The Largest Tax Expenditures Tax Policy Center

Highlights Of The Green Book Tax Proposals Advisor Education Nuveen

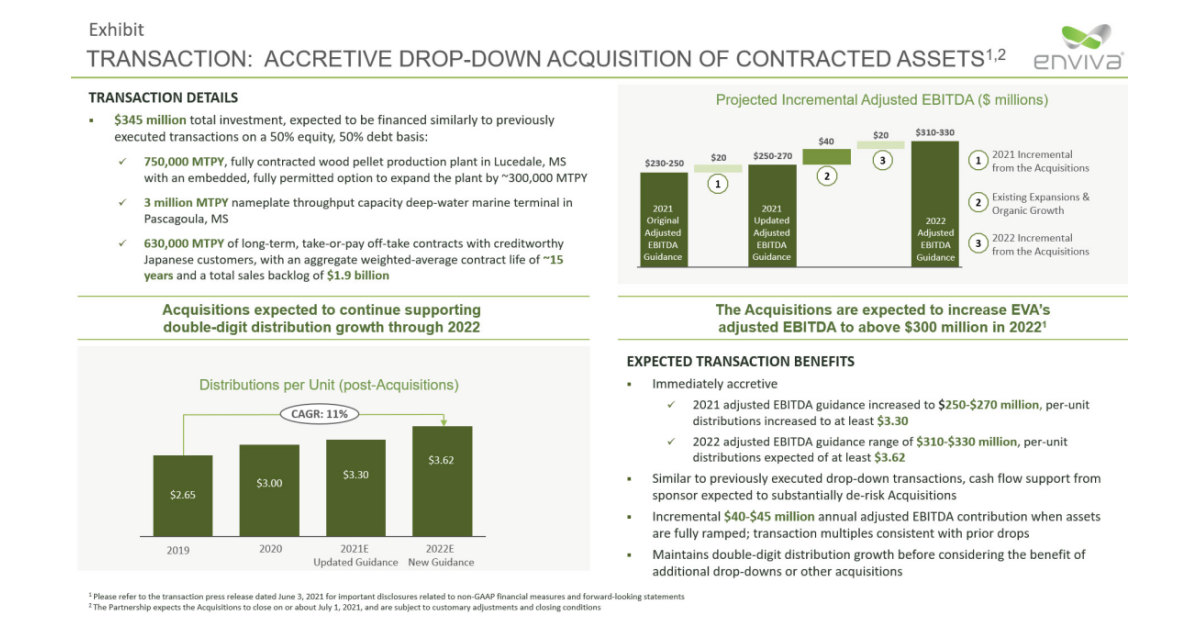

Enviva Partners Lp Announces Accretive Drop Down Transactions Increases 2021 Guidance And Provides 2022 Guidance Business Wire

Tax Newsletter April 2021 Part 2 Basics Beyond

State Income Tax Rates And Brackets 2021 Tax Foundation

The Best Online Tax Prep Software For 2021 Money Com

2020 Instructions For Schedule H 2020 Internal Revenue Service

Top 10 Taxes And Fees Qsr Magazine

:max_bytes(150000):strip_icc()/04April2021revise-f4e687bce7694a64a11abe152e0bef82.jpg)

2021 Personal Finance Calendar

Post a Comment for "Does Mississippi Still Allow Employee Business Expenses On 2022 State Tax Return"