Business Deductions Lost In 2022

Business Deductions Lost In 2022

For small businesses some of the expenses that are 100 percent deductible include the following. You will also need to register if you are employed ie. A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. You earn a salary and run a business on the side and your total income exceeds the tax threshold.

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Small businesses can elect to expense assets that cost less than 2500 per item in the year they are purchased.

Business Deductions Lost In 2022. Business Use of Your Home Including Use by Day-Care Providers. If your expenses are more than your income the difference is a net loss. 100 percent deductible meal expenses.

A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use. DEDUCTIONS AY 2022-23 Section. What you can claim.

Similarly interest paid on loans and the rent that you pay for your office are legitimate business expenses. Meals for the client must have a business purpose For the 2021 tax year which youll file a return in 2022 the above deductions will no longer have a 50 percent limit. Income or deduction business interest or business interest income net operating loss deductions under Code Section 172 and any deduction under Code Sec -.

Increased Business Meal Deductions For 2021 And 2022 Henssler Financial

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Itr Filing 10 Investments Expenses In Fy21 That Can Help Salaried Individuals Save Tax Business News

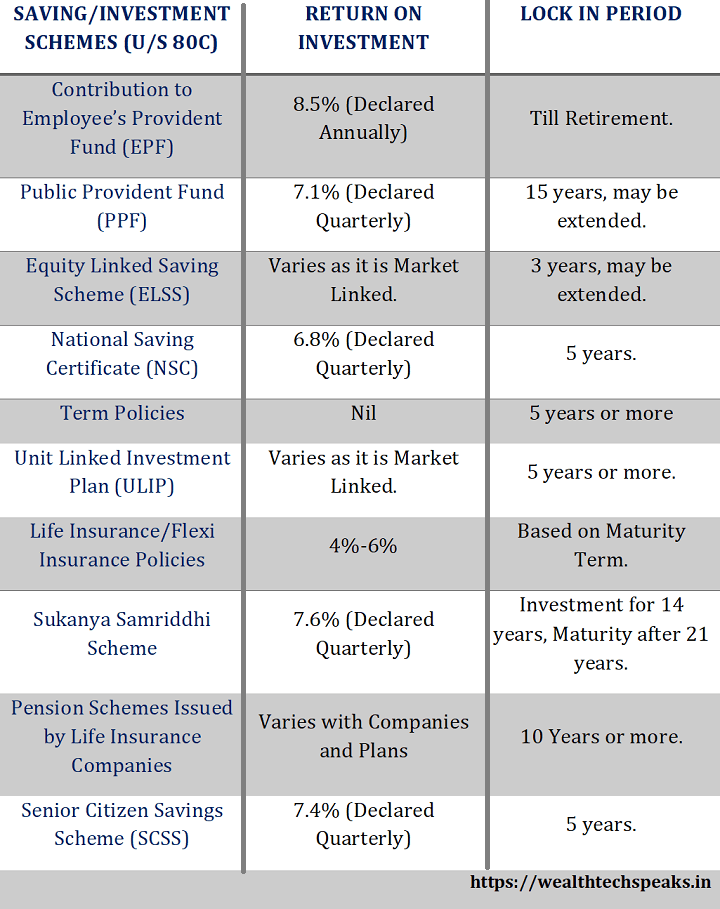

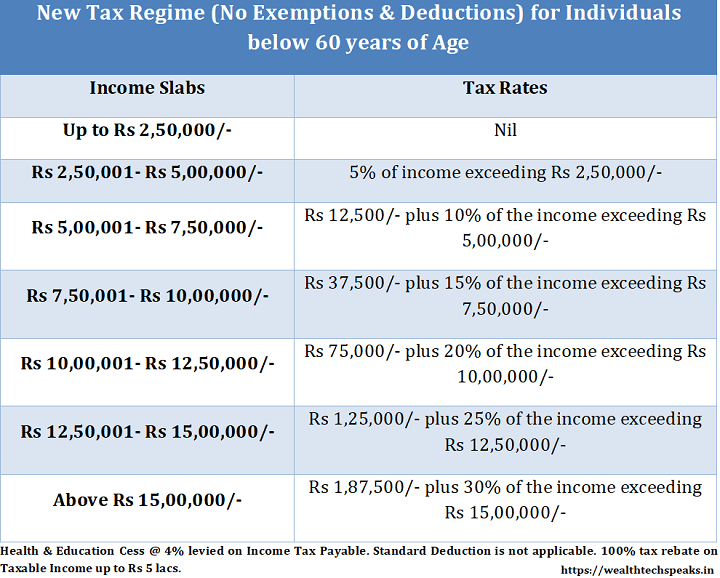

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Itr Filing All You Need To Know About Claiming Deductions For Covid 19 Related Expenses Hindustan Times

Union Budget 2021 Additional Deduction Of 1 5 Lakh On Home Loan Interest Extended Till March 2022 The Hindu

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Corporate Tax Planning Management Ay 2021 22 2022 23 M Com

Will The 2022 Income Tax Season Be Normal Cpa Practice Advisor

Budget 2021 Home Loan Interest Deduction Extended Till March 2022 Nirmala Sitharaman Announcement Business News India Tv

Three Martini Lunch Tax Break Could Fall Short For Vulnerable Eateries

Nikon S Q1 Fy2022 Results Revenue Operating Profit Up With 220k Ilc Units 390k Lens Units Sold Digital Photography Review

Business Interest Deduction Limitation Changes Coming After 12 31 2021 Wegner Cpas

Corporate Tax Planning Management Ay 2021 22 2022 23 M Com

Corporate Tax Planning Management Ay 2021 22 2022 23 M Com

Top 10 List Of Income Tax Deductions For Ay 2021 22 For Salaried Employees Tax Benefits On Payments Investments And Incomes The Financial Express

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Income Tax Slabs Rates Financial Year 2021 22 Wealthtech Speaks

Post a Comment for "Business Deductions Lost In 2022"